Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 14 Mar, 2024

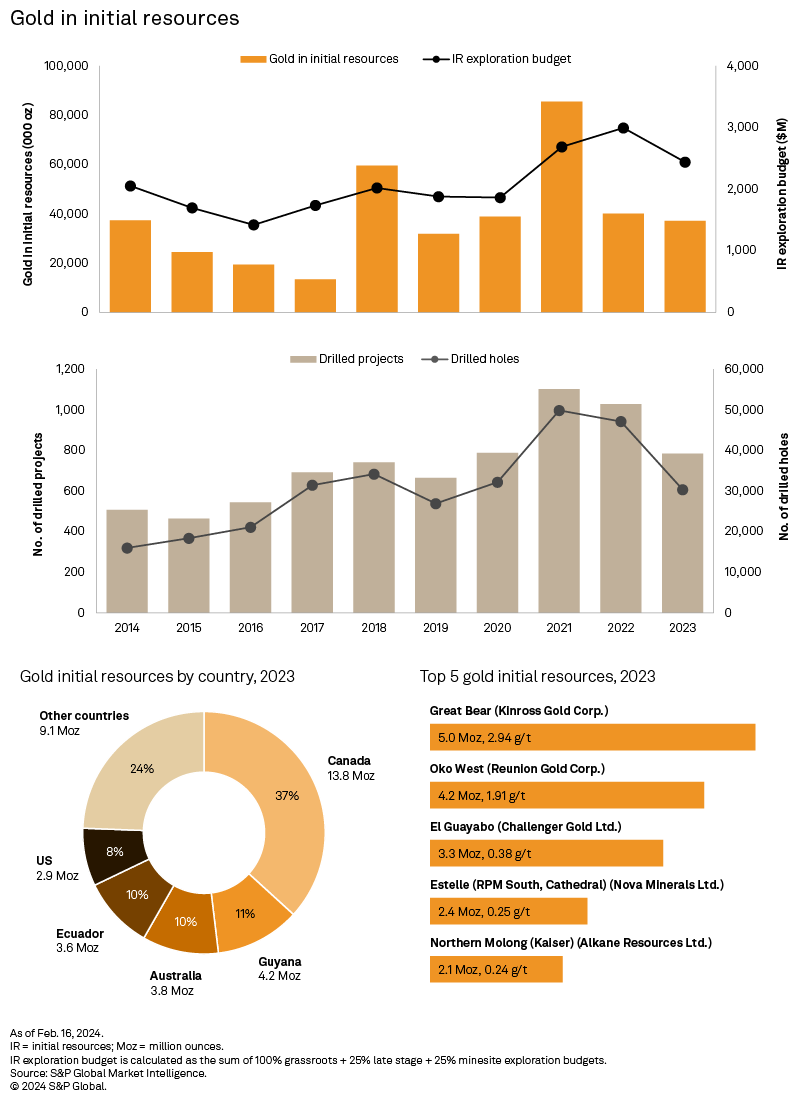

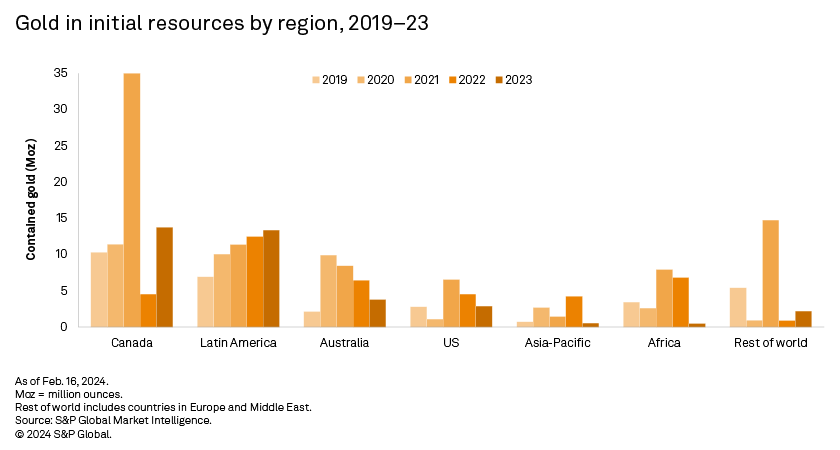

Total gold contained in initial resources declined in 2023 to a four-year low of 37.1 million ounces, 7% lower than the 40 Moz announced in 2022. The number of gold initial resource announcements increased to a five-year high of 56. Yet only 30% contained more than 500,000 ounces of gold, decreasing the average to 0.7 Moz from 0.8 Moz in 2022. This marks the second consecutive year of decline for gold in initial resources, weighed down by reduced financings, exploration budgets and drilling activity.

The total contained gold in initial resources is down 7% to a four-year low of 37.1 million ounces. The number of announcements is slightly higher year over year at 56 and the highest since 2018. Record-low funds raised for the precious metal affected allocations to its exploration. As half of these budgets in 2023 came from junior and intermediate sectors reliant on financings, the effect trickled down to drilling activity for gold, recording a second consecutive year of decline in the same year.

Lower drilling activity weighs down on initial resources

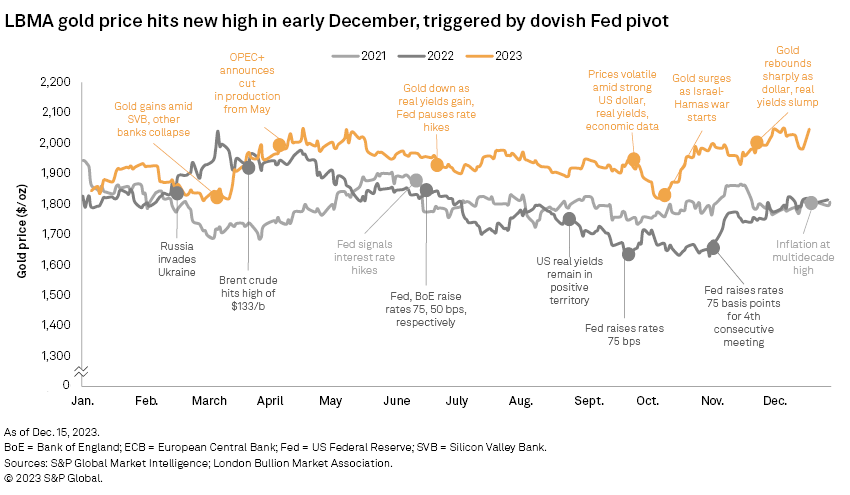

In 2020, gold recorded a strong price performance with an average of around $1,770 per ounce, up from $1,393/oz in 2019, owing to global economic uncertainty caused by the COVID-19 pandemic. Upon entering 2021, optimism on the prospect of a strong economic recovery after the development of vaccines weighed down on gold prices, resulting in them trading in a range until Russia started its invasion of Ukraine in early 2022.

With new uncertainties on the horizon, gold prices breached $2,000/oz in March 2022. However, toward the second half of the year, prices trended downward as the US Federal Reserve announced a series of interest rate hikes to combat inflation brought by geopolitical uncertainties and the lingering effects of the pandemic. With Treasurys now offering increasing returns due to higher interest rates, gold prices tempered in 2022. In 2023, gold prices were pushed to new highs on the back of the Israel-Hamas war and as the Russia-Ukraine war continued to drag on.

Among the key metrics impacting annual initial resources are exploration allocations, drilling activities and funds raised for gold. Trends for these metrics can be affected by a metal's market price. But even with the prices rising in 2023, funds raised by junior and intermediate companies for gold continued to decline for the second consecutive year. With elevated interest rates in the past couple of years, some investors may have opted for Treasurys rather than riskier financial instruments, such as equities or corporate bonds of smaller companies. Moreover, our financing data shows investors pivoting away from gold and being more interested in metals that are important in the decarbonization trend, such as copper, lithium, graphite, etc. Both factors could explain the slump in gold financings despite elevated prices.

Unlike major producers that have sufficient cashflows to support their expenditures, juniors and intermediates rely on financings to fund their exploration programs. In the past three years, junior and intermediate companies accounted for more than half of the gold exploration budgets. As such, lower financings for gold consequently reduced the total annual gold exploration budgets in 2023 to $5.91 billion, reflecting a 16% year-over-year decline. Initial resource-related exploration budget — which we assume is comprised of 100% of grassroots exploration allocations and 25% each of companies' late-stage and minesite exploration budgets — declined 19% to $2.48 billion, the lowest since 2020.

Fundraisings affect how much explorers are going to allocate to their activities; a more direct indicator of initial resources is the level of drilling activity. In 2023, both the total number of drilled projects and drilled holes for gold declined to three-year lows, with drilled projects decreasing 24% to 784 projects, and drilled holes down 36% to 30,345. Initial resources for gold followed this downward trend.

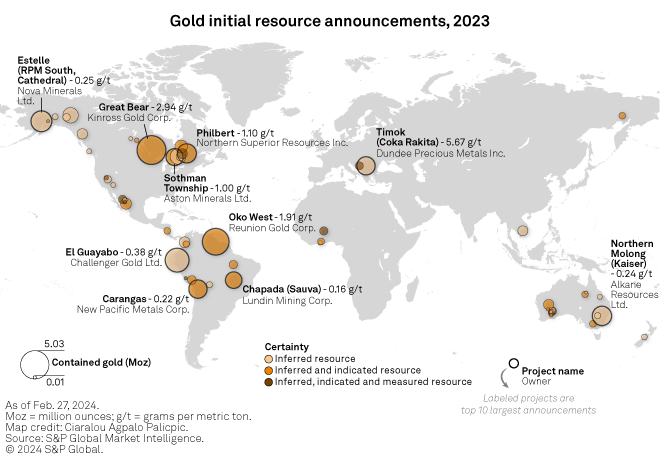

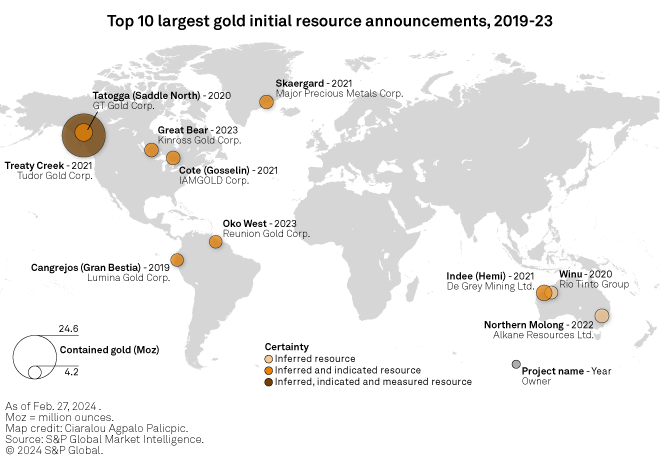

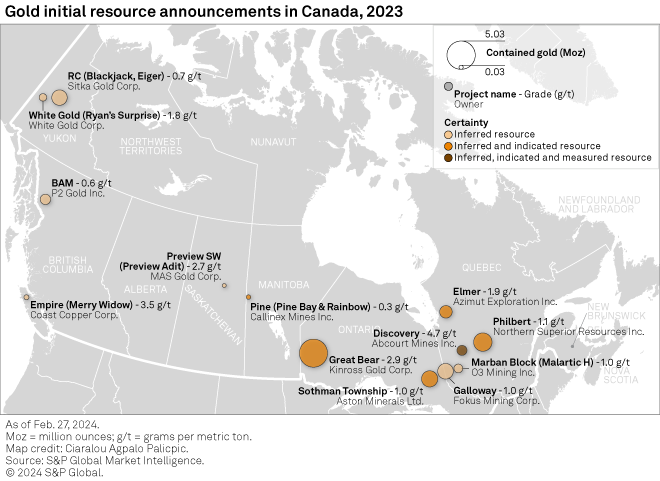

Two recent announcements enter the 5-year top-10 list

Two of 2023's largest gold initial resources entered the top-10 list of all announcements since 2019. Topping the year's list is Great Bear, a late-stage project in Ontario, owned by Toronto-based major producer Kinross Gold Corp. In February 2023, Kinross announced indicated and inferred resources in the project of 53.1 million metric tons grading 2.94 grams of gold per metric ton, containing 5.0 Moz gold. After Kinross completed its 2023 drilling program at Great Bear, it increased the project's measured, indicated and inferred resources to 7.2 Moz contained gold. The Great Bear initial resource accounted for 14% of the total contained gold in announcements in 2023, and 37% of gold initial resources in Canada the same year.

TSX Venture Exchange-listed Reunion Gold Corp.'s Oko West project in Guyana was the second-largest gold initial resource in 2023, with indicated and inferred resources of 68.9 MMt grading 1.91 g/t containing 4.2 Moz gold, announced in June 2023. As of February 2024, Reunion Gold has completed 23,500 meters of a diamond drilling program and commenced another 20,000-meter infill drilling program at the project. Also in February, the company announced an updated 5.9 Moz mineral resource estimate for Oko West, which was the sole initial resource in Guyana in 2023 and represents the country's highest annual total in our records.

The third-largest gold initial resource for the year was at El Guayabo in Ecuador. In mid-June 2023, Australian Securities Exchange-listed junior company Challenger Gold Ltd. announced an inferred resource of 268.7 MMt grading 0.38 g/t gold, 0.07% copper, 2.59 g/t silver and 0.001% molybdenum at the project, containing 3.3 Moz gold, 189,000 metric tons copper, 22.3 Moz silver and almost 2,000 metric tons molybdenum. By the end of August 2023, Challenger Gold had conducted rock-saw channel sampling and surface mapping at the project. El Guayabo was the sole initial resource announcement in Ecuador in 2023.

Top gold exploration hubs record the most gold initial resources in 2023

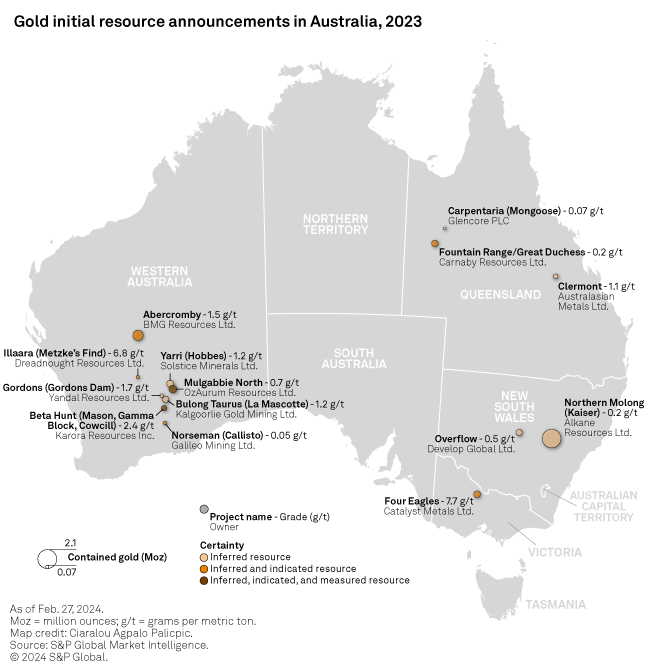

Geographically, Canada and Latin America maintained their rankings as the regions with the most contained gold in initial resources in 2023. This is unsurprising, given that both regions were the most explored for gold that year. On a country level, Canada recorded the largest total of contained gold in initial resources announced in 2023, with a total of 13.8 Moz in 13 projects. This is a rebound from the record-low 4.5 Moz across six projects in 2022, when gold drilling activity in the country posted a year-over-year decline, accounting for 37% of the total contained gold in initial resources for the year. Australia had the most announcements, with 14 projects totaling 3.8 Moz gold. Canada and Australia have been the top explored countries for gold since 2002 and accounted for 41% of the total gold exploration budget in 2023. Guyana came in second in terms of gold content, however, with its 4.2 Moz total coming solely from Oko West.

More exploration needed to lift initial resources, discoveries

Despite the brief recovery in 2020–2021, both the annual totals of gold contained in initial resources and the number of announcements have been generally sparse over the past decade. Our recent analysis of major gold discoveries revealed that only 350,000 ounces of gold in initial resources announced 2018–2022 could be newer discoveries, supporting the view that the number of recent major gold discoveries will remain weak. Additionally, our monthly gold Commodity Briefing Service expects mined gold supply to peak in 2026 and decline shortly after. As such, the industry needs to invest more in generative exploration programs for gold, which will in turn pull the numbers up for initial resources.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.