Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 21 Aug, 2023

By Milan Ringol

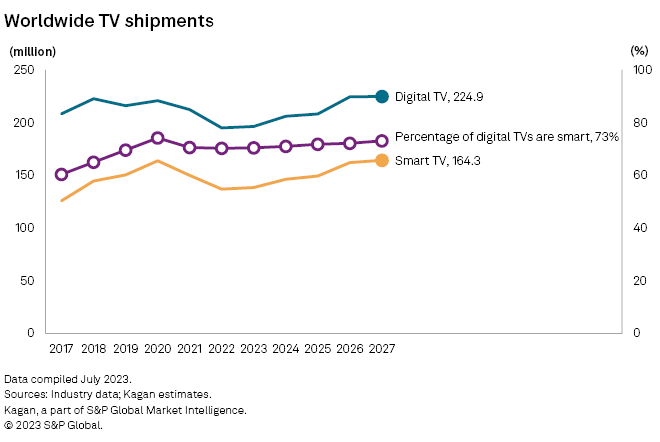

Smart TV shipments decreased 8.7% in 2022 as challenging global macroeconomic conditions reduced demand for new TV sets. Although inflation was already cooling in many markets as of July 2023, the cost of essential goods remains high and continues to dampen discretionary spending by consumers. However, with the momentum of the ongoing economic recovery and increasing smart TV penetration, Kagan expects declining global smart TV shipments to return to growth starting in 2023 with a forecast 3.7% CAGR from 2022 to 2027.

The severe inflationary effects of the pandemic exacerbated by the conflict between Russia and Ukraine is gradually dissipating and the prices of many consumer goods are trending downward. However, the costs of essentials like food, fuel, utilities and rent remain elevated in many markets across different economic levels, curtailing non-essential spending in the near term and reducing global demand for TVs.

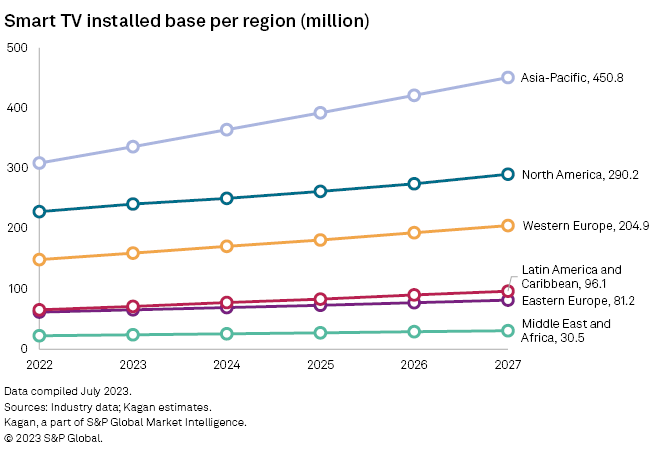

Emerging markets with rapidly expanding TV and broadband penetration are still far from achieving smart TV saturation, making them the growth engine of the global smart TV segment. This engine has stalled, however, as consumers in emerging markets have become extra cautious with discretionary spending during tough economic conditions. Once the costs of essentials go down as inflationary pressures ease, however, the smart TV growth engine is expected to drive demand back up in the coming years.

Two factors that are expected to facilitate the recovery of smart TV shipments over the course of the forecast period are low LCD display prices and upcoming sporting events.

Global smart TV installed base growth has slowed considerably since the boom in the 2010s but remains positive, with a forecast 6.7% CAGR through 2027, as smart TVs continue to replace traditional "dumb" TV sets on store shelves. Broadband infrastructure is a major limiting factor for adoption, especially in emerging markets where many underserved households remain. With lower unit prices, traditional TV sets without internet connectivity features are expected to remain on the market for years to come.

Kagan's global smart TV forecast is built upon analysis of publicly available industry reports and proprietary data models. Note that this analysis only covers TV sets used for home entertainment, excluding commercial TV sets used, for instance, in the hospitality industry and in public spaces and offices.

Research