Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — May 18, 2023

By Jingyi Pan

The following is an excerpt from the May S&P Global Monthly Global Trade Monitor, produced withGTAS Forecasting. Read the latest onConnect™ by S&P Global.

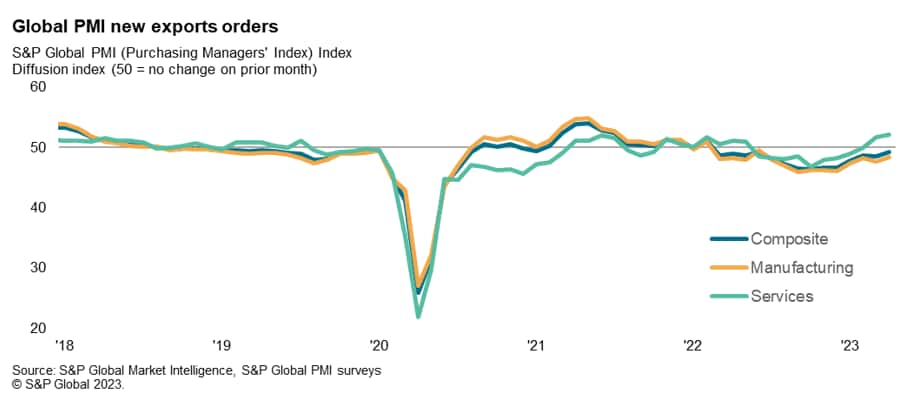

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a fourteenth successive monthly fall in export orders for goods and services at the start of the second quarter. At 49.3, up from 48.6 in March, the seasonally adjusted New Export Orders Index reflected a sustained deterioration in export conditions globally. That said, the extent to which trade flows declined eased from March to the slightest in the current sequence.

The divergence in performance between goods and services exports remained marked in April. Despite both the manufacturing and services New Export Orders Indices having climbed from March, the volume of goods trade remained in contraction whereas global services trade improved at the fastest rate since new export orders data were first computed for the global index (September 2014).

Falling orders for goods continued to contrast with improved demand for services, especially consumer services, according to the April PMI survey sub-indices and anecdotal evidence. Although global manufacturing supply chain conditions improved markedly, healing at the fastest rate since 2009, the lack of demand continued to constrain output growth. This was more pronounced in the US and Europe compared to Asia. By sectors, primary manufacturing industries such as paper & timber products and metals & mining bore the brunt of deteriorating exports conditions. Foods and beverage manufacturers were the only ones reporting growth in overseas trade.

On the other hand, global services trade expanded for a second straight month, supported by more robust tourism & recreation and transportation activities. This was most prominent in Asia, especially mainland China, as the region continued to enjoy the boom in service sector performance post the easing of COVID-19 restrictions in mainland China. Solid improvements in services exports were nevertheless also observed in the UK and eurozone while the US registered only a mild contraction. Over and above the revival in confidence to travel, unseasonably favourable weather aided in the surge in services consumption, though it remains to be seen how persistent this can be as we approach the summer months for the Northern hemisphere.

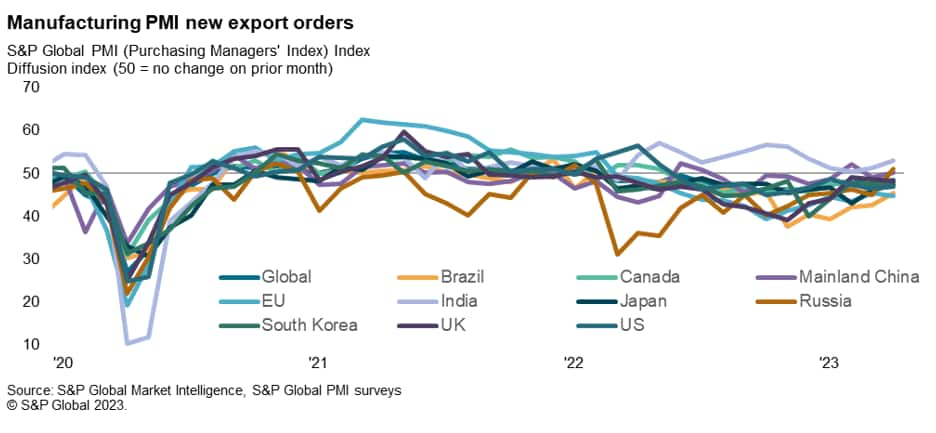

Assessing the major economies tracked by the S&P Global PMI surveys, India led the expansion in composite new export orders among the top 10 economies. This was followed by mild growth in Russia, mainland China and the UK. Brazil registered the steepest decline once again while the EU, US and Japan saw overseas demand contract to smaller extents.

Manufacturers in the top 10 economies shouldered the bulk of new export orders decline, though there remained bright spots, mainly in the East, with India, Russia and mainland China seeing growth. The sharpest downturn in goods trade took place across the EU, Brazil and the US. That said, the pace of decline moderated across all but the EU and UK in April.

Comparatively, services trade remained in growth across the majority of top 10 economies at the start of the second quarter. The strongest increase in services export orders took place in Japan, followed by mainland China and the EU. Brazil saw the sharpest declines, though this had likewise moderated from March.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.