Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 1 Jun, 2023

By Paul Bartholomew, Sylvia Cao, and Xinxin Hao

The largely supply-driven global steel price strength seen in the March quarter has run its course. Steel supply shortages in Europe and the US helped mask the lack of robust downstream demand. Now that production is being restored and buyers are turning more to steel imports, the onus is placed on the demand side of the equation. Macro headwinds have not disappeared and may bite ferrous markets harder in the coming months. Chinese demand seems to be deteriorating rather than improving, and the country has been producing too much steel. Weaker Asian steel prices will result in lower offers into Europe and other markets.

➤ Steel supply constraints are easing.

➤ Downstream demand is unconvincing.

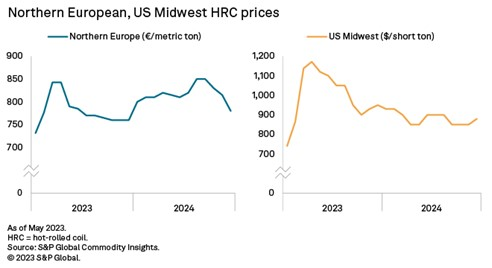

The positive sentiment that helped northern European hot-rolled coil (HRC) prices rise 25% over the first quarter of this year has evaporated. The northern European HRC price lost €50 per metric ton over the first half of May, averaging €802 per metric ton (t) ex-Ruhr, compared with an average of €843/t in April. The price decline is compounded by buyers holding off purchases and mills not offering in an uncertain market environment.

We have lowered our view for northern European HRC prices in the second quarter to €806/t ($865/t) ex-Ruhr from €845/t previously and now see the third quarter averaging €768/t from €820/t in last month's update.

US domestic HRC prices have ended their four-month rally as supply constraints have eased, allowing buyers to sit on the sidelines, awaiting clearer price direction signals. The Midwest HRC price averaged $1,171 per short ton in April before easing to $1,130 per short ton in the first half of May.

We have lowered our view for average Midwest HRC prices in the second quarter to $1,131 per short ton from $1,183 per short ton in our previous monthly report. We now see third-quarter prices easing to $1,017 per short ton from a previous forecast of $1,133 per short ton.

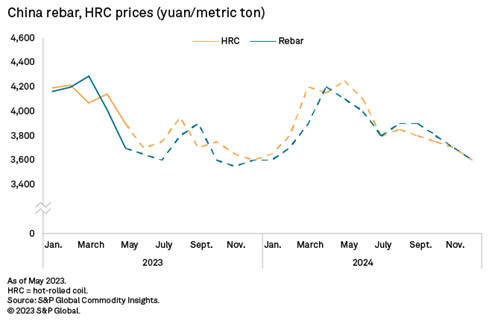

In China, weaker property construction demand and deteriorating sentiment resulted in domestic rebar prices falling to an average of 3,723 yuan per metric ton ($532/t) in the first half of May, down from 4,014 yuan/t in April. Consequently, we have lowered our price outlook for the second quarter to 3,788 yuan/t from 4,067 yuan/t. For the third quarter, we see an average of 3,767 yuan/t compared with our previous expectation of 3,900 yuan/t.

As measured by the two leading purchasing managers' indexes, Chinese manufacturing activity deteriorated in April, indicating that HRC prices will come under further pressure. China domestic HRC prices averaged 4,140 yuan/t ($600/t) in April, down 5% from March.

In the April issue of Ferrous Markets Analytics, we forecast that HRC prices will average 4,083 yuan/t in the second quarter and 3,950 yuan/t in the third quarter. We now see them at 3,914 yuan/t in the second quarter and 3,800 yuan/t in the third quarter.

S&P Global Commodity Insights analysts produce Ferrous Markets Analytics for distribution on Platts Dimensions Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.