Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JUNE 03, 2025

By Iuri Struta

| EU Commission Executive Vice President for Tech Sovereignty, Security and Democracy Henna Virkkunen discusses the AI Continent Action Plan. Source: Thierry Monasse/Getty Images News via Getty Images. |

As the EU mobilizes a €200 billion investment designed to spur new AI datacenters and supercomputers, experts warn that it will take more than funding for Europe to catch up in the global AI race.

In April, the European Commission outlined the details of its AI Continent Action Plan, which aims to make the EU a "global leader in AI." The plan calls for the construction of AI factories and gigafactories, aiming to triple the EU's datacenter capacity in the next five to seven years. Under the plan, the EU wants to increase access to high-quality data for training AI models.

Coupled with deregulatory efforts, this strategy marks a significant shift for a region traditionally skeptical of technology companies and inclined toward regulation. Given that long history, experts say the EU's AI efforts will require more than just spending. More profound reforms — including immigration policies and power generation — may be required to enhance Europe's competitiveness.

"There is an entire civil service structure that requires reform, and it needs to be empowered by innovation," said Alexandru Voica, head of corporate affairs and policy at Synthesia Ltd., a leading European AI startup. "You need to send signals from the top and encourage people to experiment with new technologies."

AI gigafactories

In building the AI infrastructure, the EU aims to mirror the success of past government initiatives such as the European Organization for Nuclear Research, an intergovernmental organization operating the largest particle physics laboratory in the world.

"This unique public-private partnership, akin to a CERN [European Organization for Nuclear Research] for AI, will enable all our scientists and companies — not just the biggest — to develop the most advanced very large models needed to make Europe an AI continent,” European Commission President Ursula von der Leyen said in the press release announcing the €200 billion investment. The EU will allocate €20 billion, with the remainder coming from private investors.

The EU plans to establish five "AI gigafactories," each anticipated to house about 100,000 state-of-the-art AI chips like those from NVIDIA Corp. This is four times more than the current seven AI factories that are being built in countries including Italy, Germany and Spain. All told, the EU will have 13 supercomputers for AI companies and computer scientists to use.

Thomas Regnier, European Commission spokesperson for tech sovereignty, defence, space and research, told S&P Global Market Intelligence that access to the AI infrastructure will be free-of-charge for startups that use it for "innovation purposes." Commercial access will be allowed on a pay-per-use basis.

"AI Factories will bring together the key ingredients that are needed for success in AI: computing power, data and talent," Regnier said.

This time is different

Unlike nuclear research, AI development is moving at breakneck speed. This could present a challenge for European consortia that include collaborative groups formed by EU member states, research institutions and technology hubs.

"Consortia are very good at getting money, but not very good at achieving results," Bert Hubert, the founder of network solutions company PowerDNS.COM BV and a former regulator in the Netherlands, said in an interview with Market Intelligence.

For every European Organization for Nuclear Research success story, there is a Gaia-X. Gaia-X is an initiative to create a "cloud ecosystem," believed to be the European answer to US hyperscalers, Microsoft Corp.'s Azure and Alphabet Inc.'s Google Cloud Platform.

Gaia-X has failed to deliver meaningful results so far. Experts still struggle to understand what the initiative does exactly. The organization repeatedly denied that it is a European hyperscaler, claiming instead that it aims to create a data-sharing environment. Hubert has called for the Gaia-X project to be abandoned, and he is not alone.

"Gaia-X has been an unmitigated disaster," said Johan Vermij, an analyst at Market Intelligence 451 Research.

The fear now is that history will repeat itself with the AI initiative. AI technology is developing much faster than previous technology shifts like mobile and software as a service. And US cloud hyperscalers have a software advantage that is not easy to replicate. On the public cloud, developers can gain quick access to all the chips and software necessary to build AI applications.

Synthesia, a GenAI video generator for enterprise use cases that recently closed a $180 million funding round at a post-money valuation of $2.1 billion, is building its applications on Amazon.com Inc.'s Amazon Web Services and Google Cloud Platform.

"The challenge you have with [EU] supercomputers is that they have specific software stacks. If you build commercial applications in the hyperscalers' cloud, it's much easier to move software workloads, while supercomputers get bottlenecked," Voica said.

The gigafactories can be more useful in solving deep research problems, such as drug discovery, which are not subject to commercial competition. Mistral AI SAS, the leading European provider of foundation models, built its early foundation model, Mistral 7B, on Leonardo, an EU supercomputer in Italy. Mistral complained about the lack of computing power in Europe. It is now reportedly building its own cloud infrastructure. Mistral did not reply to a request for comment.

Synthesia runs its workloads on hyperscalers' datacenters in Europe, but sometimes it needs to tap into the US datacenters due to a lack of capacity on the continent.

|

- Learn about S&P Global's coverage of GenAI funding trends:

|

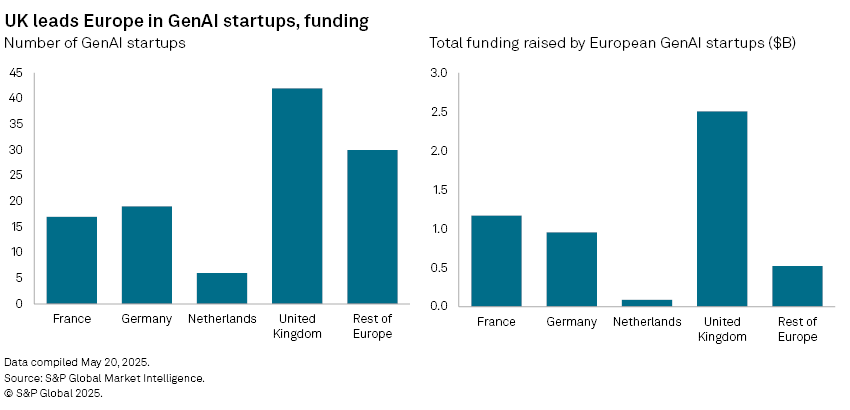

European GenAI startups

Market Intelligence counted more than 130 GenAI startups based in Europe. About a third of those are in the UK, and another third in France and Germany combined. Together, these companies have raised a total of more than $5 billion in venture capital since inception, according to Market Intelligence. "There are a couple of companies that are promising, but without government backing, they cannot compete with the US companies," Vermij said.

The EU numbers pale in comparison to the US, which has three times as many GenAI startups that have collectively raised $161 billion. Large multibillion-dollar funding rounds in the US have been closed by leading GenAI foundation model makers such as OpenAI LLC, Anthropic PBC and X.AI Corp.

|

Download the Excel file for the data in the infographic. |

Changed approach

Experts say the EU would need to make reforms that have little to do with technology itself to boost the GenAI startup scene. Specifically, the region needs more talent and datacenters.

To attract talent, startups say they need a better visa regime. An article by European computer scientists Nuria Oliver, Bernhard Schölkopf and Yann LeCun criticized the EU's approach as project-based rather than person-centered.

"Europe's most successful scientific organizations and programs … believe that the key to groundbreaking innovations lies in identifying and attracting the brightest minds," the trio wrote. "But in the EU, this principle is in danger."

To build more datacenters, a key constraint is the energy power and regulatory requirements. The Netherlands, for instance, imposed a moratorium on new datacenter construction due to a lack of energy. Germany imposed various restrictions on new and operating datacenters as part of the country's ambitious decarbonization goals.

"The EU needs to create the underlying infrastructure, such as the energy grid that allows datacenters to exist and scale," Synthesia's Voica said.

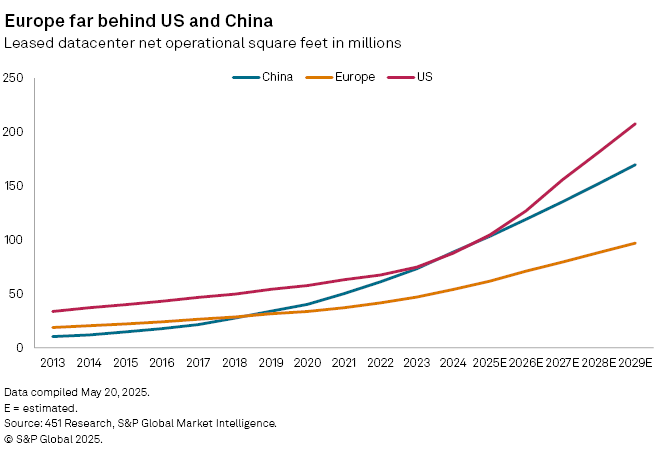

According to 451 Research's Datacenter KnowledgeBase, the European leased datacenter footprint is half that of the US and China.

Data demand

AI companies are also complaining about the lack of European data to train their models. According to Voica, this is where the EU could establish a modern and simplified regulatory framework that would encourage content creators to share data with AI companies without fearing their data will be misused.

Synthesia had to create its own training data by setting up a studio and hiring actors to talk on camera, largely because it was hard to source third-party data. The company recently signed a contract with US-based video and photo library Shutterstock, under which it will only pay for content it chooses to train on.

The EU was the first major jurisdiction to implement regulation of AI technologies under the EU AI Act. The European Commission is now looking to simplify the rules, with AI policy unit chief Kilian Gross recently expressing openness to "targeted changes," Politico reported.

Too much regulation often has unintended consequences. Instead of leveling the playing field between large corporations and small startups, it can advantage deeper-pocketed Big Tech companies who have the resources to hire compliance officers and to fight in courts, if necessary.

"Success will rely heavily on whether the EU can sustain its current momentum politically, especially when translating ambitious plans into concrete actions, particularly through clear policy signals and strategic communication that can attract and retain investment," Öykü Özfırat, a senior policy analyst at Access Partnership, told Market Intelligence.

France taking lead

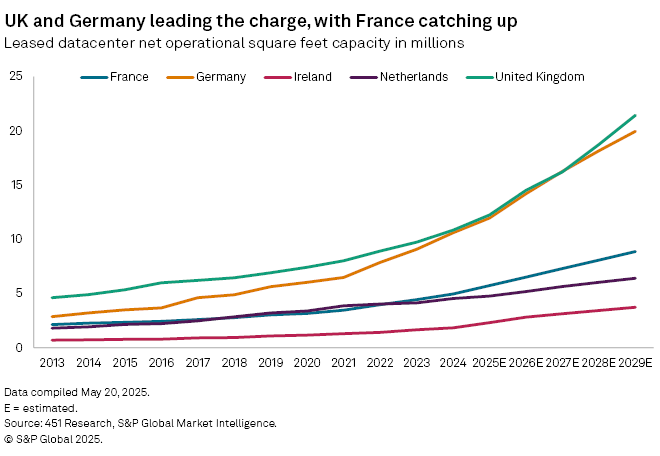

Separate governments in the EU are doing more. France, once a skeptic of datacenter construction, has now taken the lead in Europe. According to 451's Datacenter KnowledgeBaseGrowth, datacenter capacity growth in France is expected to rise 16% in 2025, the second-highest rate of growth after Ireland.

Mistral is building a massive 1.4 GW power datacenter cluster in Paris with the help of the French government and the United Arab Emirates' sovereign wealth fund MGX, in partnership with NVIDIA. It follows the footsteps of its American competitor OpenAI, which is building its 1.2 GW cluster in Texas to reduce reliance on its hyperscaler partner Microsoft.

"Given the high-energy demands of datacenters, France is well positioned to take the lead thanks to its extensive nuclear power infrastructure, which can provide a carbon-free energy source for AI datacenters," Vermij said.

|

451 Research Datacenter KnowledgeBase is now available on S&P Capital IQ Pro.

Key features include:

For more information, check May 2025 S&P Capital IQ Po Release Notes.

|

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is a technology research group within S&P Global Market Intelligence. For more about the group, please refer to the 451 Research overview and contact page.