Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan 16, 2025

The past year saw many of our predictions become reality. Notable developments include the increase in the monthly cost of streaming video subscriptions following the rollout of ad-supported tiers, the rise in the number of free ad-supported streaming TV (FAST) channels by broadcasters and studios, and the proliferation of deals such as the spinoff of Canal+ SA from Vivendi SE as well as the acquisition of All3Media Ltd. by investment management firm RedBird IMI.

In 2025, we expect to see media industry stakeholders working together through new distribution deals and content licensing partnerships. Combining an ad-funded with a premium paid business model should prevail in 2025, with many players expanding their ad inventory capabilities into additional markets. As competition intensifies and consumer budgets tighten, streaming platforms are expected to keep prices at similar levels to mitigate the risk of customer churn. Additionally, as interest rates are expected to decline, media companies may pursue acquisitions in high-growth markets while also considering divestitures to optimize the value of specific assets.

Bundling, partnerships and third-party licensing to continue

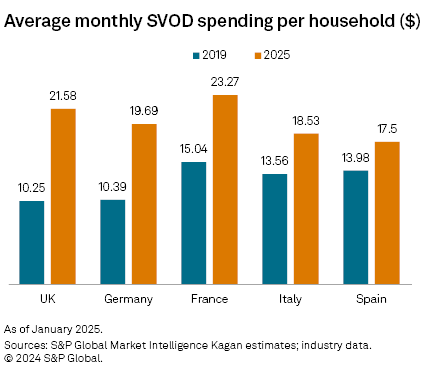

The rapid proliferation of streaming services, encompassing both subscription video on demand (SVOD) and ad-supported video on demand (AVOD) or FAST, has created a landscape where consumers often feel overwhelmed. This abundance of options complicates the process of content discovery and raises challenges regarding where to watch specific content. As a result, many consumers find themselves juggling multiple subscriptions, making it increasingly difficult to track expenses and manage their budgets effectively. S&P Global Market Intelligence Kagan estimates that the average monthly expenditure for SVOD services in the five largest by revenue European markets could rise from anywhere between 25% and 110% between 2019 and 2025.

In response to consumer frustrations, streaming providers, in collaboration with telcos/pay TV operators, are exploring various strategies. These include hard and soft bundling of services, offering incentives such as discounts for long-term commitments, and deploying segments of their content libraries to third parties such as ITV PLC on Alphabet Inc.'s YouTube and Channel Four Television Corp. and Channel 5 Broadcasting Ltd. on Netflix Inc., all aimed at enhancing user experience and streamlining access to content.

Read our report "Western Europe: Operators go from integrating OTT apps to super apps."

Hybrid revenue models to drive subscriber growth

As the growth of paid subscriptions is anticipated to slow to 3.9% in 2024, down from 9.7% the previous year, service providers are increasingly turning to advertising. Major streaming platforms, including Netflix, Amazon.com Inc., Walt Disney Co. and Paramount Global, and local broadcasters have introduced ad-supported subscription models in key European markets. Additionally, Warner Bros. Discovery Inc. plans to launch a more affordable ad-supported tier with the debut of Max in 2026. These ad-supported options are gaining popularity, with Netflix indicating that in the third quarter of 2024, 50% of its new subscribers had opted for the Standard with Ads plan, resulting in a 35% quarterly increase in its ad-supported subscriber base. This trend gives price-sensitive consumers more choices and the flexibility to maintain multiple subscriptions while enabling streaming services to manage subscriber turnover more effectively and enhance their operational performance.

Read our European OTT subscription video outlook through 2028.

The cost of SVOD should stabilize in the short term

In the past year, subscribers to Netflix and Disney+ in various European markets saw the costs of their ad-free plans going up by anywhere from 8% to 18%. These price adjustments coincided with Disney's expansion of its ad-supported service into three new markets to reach a total of 12, while Netflix bolstered its ad-supported subscriber base, with Kagan estimating nearly 15 million members in Europe by the third quarter of 2024. As the SVOD sector faces mounting pressure from an abundance of competing services, tighter consumer budgets, and the rise of FAST and broadcast video on demand (BVOD) options, we anticipate that streaming platforms will largely maintain their pricing structures in 2025 to avoid risking further customer churn.

Read our report on Disney+ raising prices in Europe and expanding its ad-supported plan to 12 markets.

Read our analysis of Netflix implementing price increases in major markets amid ad-tier growth.

More M&A deals could come to fruition

The need to ensure profitability and be cost-efficient could lead to more acquisitions and spinoffs, reinforcing the consolidation trend we have seen for half a decade. Italy-based MFE-Mediaforeurope NV has not been shy of its intention to raise its 30% stake in Germany's ProSiebenSat.1 Media SE (P7S1), which will make it the largest ad-revenue-generating broadcaster in Europe, in front of RTL Group SA. MFE has already asked a consortium of banks for a five-year €3.4 billion loan, according to Reuters.

Spinoffs such as Canal+ from its parent Vivendi and its listing on the London Stock Exchange are also on the horizon for 2025. Earlier in 2024, MFE's suggestion for P7S1 to spin off its dating and commerce & venture divisions fell short of the 75% voting threshold required to pass the proposal. We expect MFE to push further for the spinoff upon completion of the acquisition of the majority stake in P7S1.

The Saudi Public Investment Fund (PIF) has expressed interest in acquiring a potential 10% stake in London-based sports streamer DAZN, with the latter seeking a valuation of $10 billion to $12 billion. PIF already holds an 80% stake in Newcastle United through a consortium and has invested in key tennis tournaments, such as the ATP and WTA. Further investment in DAZN, which holds the rights to the Saudi Pro League and La Liga, Ligue 1 and Bundesliga, would make sense.

Read our article on DAZN exploring new revenue streams.

Studios are also under pressure, with the number of high-end TV shows produced in Europe down 2% in 2023 on a yearly basis, according to the "Audiovisual fiction production in Europe — 2023 figures" report by the European Audiovisual Observatory. As a result, one cannot rule out similar deals in other European markets such as the United Kingdom, where ITV Studios is rumored to be a possible takeover target.

Read more about ITV takeover talks.

Read our analysis of 2024 European advertising revival running out of steam.

Annual FAST revenue growth to halve to 14% in 2025

The adoption of Connected TV (CTV) and the growing availability of high-quality programming on FAST platforms are contributing positively to the sector. However, the comparatively lower user engagement levels relative to SVOD and BVOD may impede growth. Data from UK telecom regulator Ofcom indicates that only 3% to 4% of survey respondents utilized FAST services within a three-month period in 2024. Furthermore, Kagan's Consumer Insights surveys from 2024 revealed that usage rates for platforms like Samsung Electronics Co. Ltd.'s Samsung TV Plus, Pluto TV and LG Electronics Inc.'s LG Channels ranged from about 2% to 8% across the UK, France and Germany. Additionally, a challenging environment for acquiring advertising inventory and evaluating performance metrics could further restrict growth in 2025. Kagan projects revenue from FAST platforms in Europe to fall 14% in 2025, down from nearly 31% in 2024.

Read our report on European free ad-supported TV revenue, which could near $1B in 2028.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Wireless Investor is a regular feature from S&P Global Market Intelligence Kagan.