Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 14, 2023

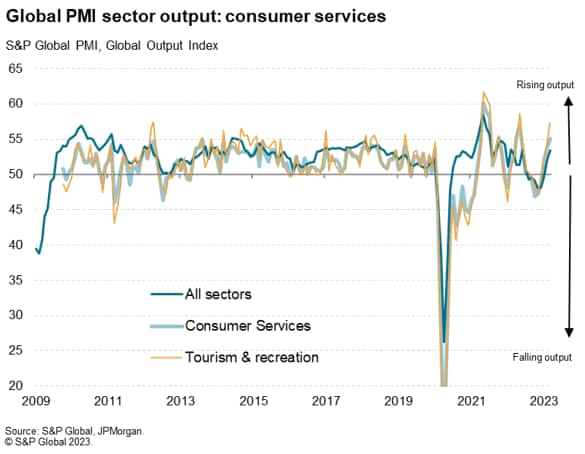

Detailed sector Purchasing Managers' Index (PMI) from S&P Global reveal how faster than anticipated economic growth in March can be traced to a boost from resurgent spending by consumers on services such as travel and tourism. Especially strong growth of which is evident in Asia following the recent loosening of COVID-19 health precautions in mainland China, though a broader loosening of travel restrictions globally has also helped so far in 2023 compared to prior years. The concern is that, like prior spending waves following loosened COVID-19 restrictions in 2021 and 2022, this latest fillip to growth could prove short-lived.

Consumer services drive global expansion

Global business activity rose in March at the fastest rate for nine months. At 53.4, up from 52.1 in February, the Global PMI - compiled by S&P Global across over 40 economies and sponsored by JPMorgan - has now signalled two months of accelerating economic growth after a six month period of contraction up to January. The latest reading is broadly indicative of worldwide GDP rising at a robust quarterly annualized rate of approximately 3.0%, helping to further allay worries of the global economy being in recession.

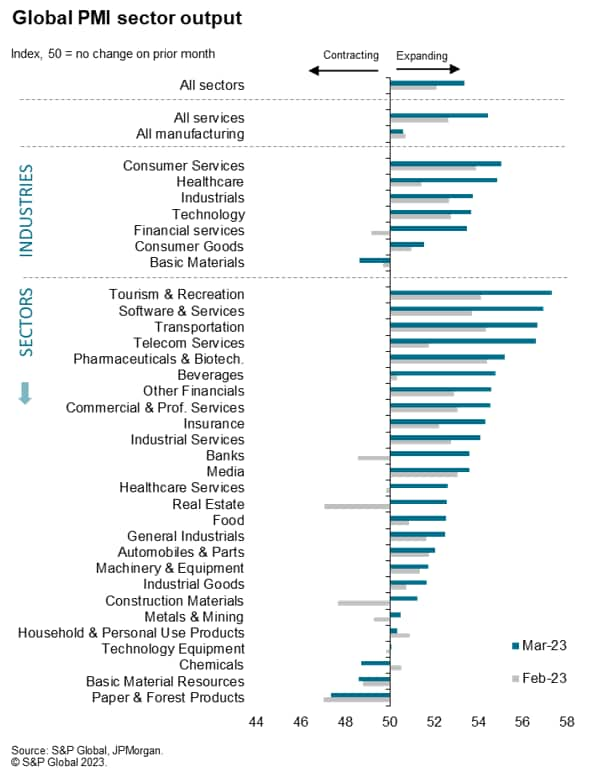

Digging deeper into sector trends, the detailed PMI data highlight how the global expansion was led in particular by accelerating consumer services activity, in turn fuelled by resurgent spending on tourism & recreation, which was the fastest growing of all 26 PMI sectors.

The tourism & recreation expansion was in fact the fastest since April 2012, barring only two spells in 2021 and 2022.

Travel surge

It is not uncoincidental that the last two peaks in both consumer services activity and travel & tourism activity were associated with economies reopening from pandemic waves. The consumer-led expansion so far this year is also likely to be being driven by a post-COVID-19 reopening - this time of mainland China.

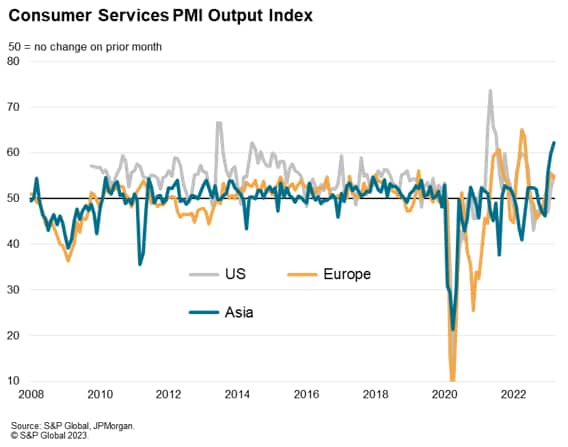

This is supported by a regional breakdown of the PMI data showing the surge in consumer services activity in Asia, dominated by China of course, to have risen at the fastest pace in the survey's 16-year history by a striking margin.

However, the upsurge in consumer spending is not just confined to Asia. Europe and the US are both seeing historically strong growth for consumer services in March. This in part also reflects the more general shift towards uninhibited global travel compared to prior years: 2023 is the first year in which we are free to travel across borders without worrying about COVID-19 testing and quarantining. However, unseasonably clement weather both in the US and Europe is also likely to have helped (something which is slowly being corroborated by official data, such as the improvement in consumer spending on services in the monthly UK GDP data for February).

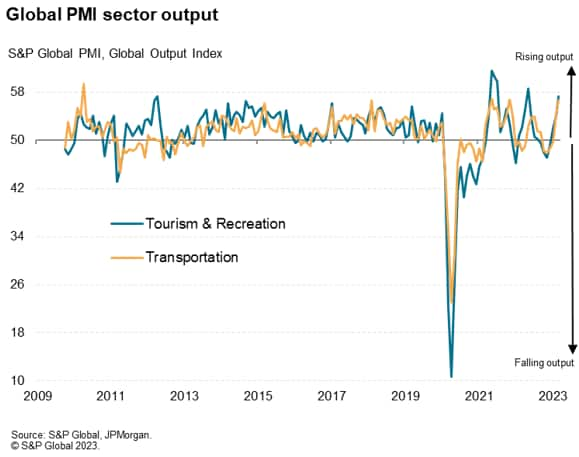

Not surprisingly, global transportation activity likewise grew at one of the fastest rates on record in March, reflecting the surge in travel and tourism. This likewise matches similar spikes in demand for transport in 2021 and 2002 after pandemic re-openings.

Short-lived boom?

While the revival of consumer spending and upturn in travel is of course welcome news and has provided a much needed fillip to the global economy. However, if the upturn is indeed being driven by the further post-covid re-opening of activities such as international travel, then past experience warns us that this boost will be short-lived. Once an initial travel wave fades, we are left with a global economy which continues to face the headwinds of the rising cost of living, higher interest rates and tightened financial conditions in the wake of recent banking sector stress.

Read the accompanying press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location