Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 21 Nov, 2022

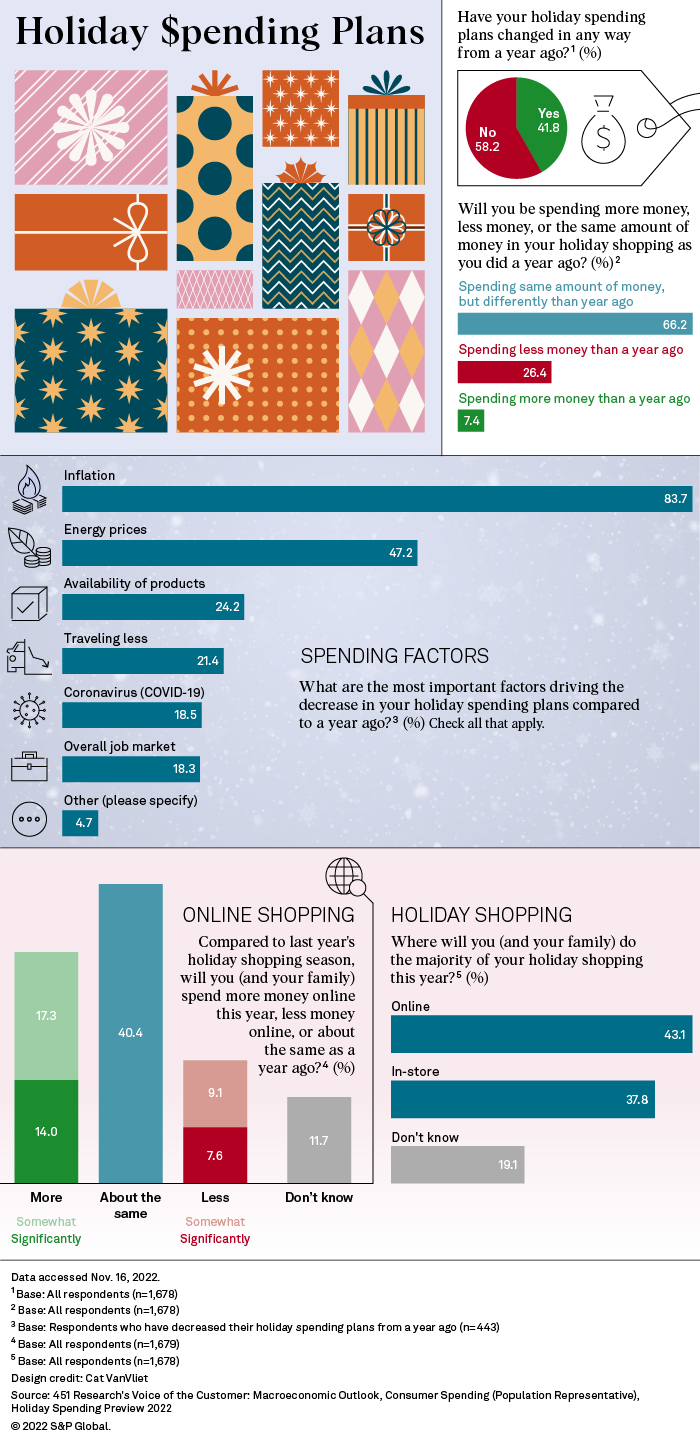

Consumer holiday spending is showing a pullback this year, after a huge surge in pent-up demand and revenge spending, combined with pandemic-era government assistance programs, lifted spending through the 2021 holiday season, new data from S&P Global Market Intelligence finds.

The survey of 1,678 U.S. consumers shows 7% of respondents planning to spend more for the holidays year over year, versus 26% saying they will spend less and 66% saying they will spend roughly the same amount. 451 Research’s Macroeconomic Outlook: Consumer Spending, Holiday Spending Preview shows a disparity between lower-income households (making less than $50K per year), and higher-income households that bring in more than $100K per year. Higher-income households (net +6) are showing a positive outlook while lower-income households (net -29) are showing a big pullback this holiday.

Since much of holiday spending is discretionary, these results, in particular, showcase contrasts as lower-income households — in the face of pandemic-era assistance programs ending and rises in cost of living — were already making tough choices about discretionary purchases before the holiday season added more pressure to already tight household budgets.

When asked specifically about why they were planning to spend less during the holidays, respondents cited inflation and energy costs as the biggest drags on their plans. These were far ahead of holiday-related responses like availability of products and traveling less, highlighting how the overall macro environment is weighing on holiday spending this year.

Lower-income households hit hardest

An increased cost of living is affecting everyone, but it has a disproportionate impact on lower-income households. Respondents rank inflation and energy prices as the top economic threats to personal finances overall, with greater concern among lower-income households (57% said inflation, 33% energy prices) than higher-income ones (38% said inflation, 26% energy prices).

The full impact can be seen when we look back one year. Inflation and energy prices were among the top concerns, along with the COVID-19. As concern over COVID-19 waned in the last 12 months, inflation and energy prices surged. Lower-income households have taken the brunt, as the threat of inflation among this group jumped 24 points and energy prices 11 points. For higher-income households, the increases are only 2 points and 5 points, respectively.

To keep up with rising costs, lower-income households plan to increase spending on nondiscretionary items (net +36), with groceries, energy/utilities and housing taking the largest chunks of their budgets. To afford the rising cost of necessities, lower-income households plan to decrease spending on discretionary items (net -12), with travel/vacation, movie theaters and restaurants taking the biggest cuts. Higher-income households plan to increase spending on both nondiscretionary (net +27) and discretionary (net +6) items. Importantly, nondiscretionary items take up less of their household budgets, allowing them to spend more on travel, restaurants, and consumer electronics, in addition to groceries and energy/utilities.

Consumers plan more online shopping

The adoption of online shopping channels looks to continue this holiday season as 43% of respondents say it is their preferred way to shop. Furthermore, 31% of respondents indicate they plan to spend more online than in 2021, with Gen Z (52%) and Millennials (46%) leading the charge.

Interestingly, 17% say they plan to spend more in-store. While Baby Boomers (22%) stand out as the most likely to return to in-store shopping, all other generational groups are hovering at 14%-15%, showing there is a consistent segment of consumers returning to in-store shopping that cuts across age groups.

451 Research’s Macroeconomic Outlook, Consumer Spending, Holiday Spending Preview survey uses our Population Representative sample of 1,678 U.S. consumers to get an advance look at consumer sentiment toward the upcoming holiday season. The survey was fielded October 7-26, 2022.

Blog