Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 15 Nov, 2023

By Jean Atelsek and Agatha Poon

Thanks in part to government initiatives, public cloud prices for general, compute and memory virtual machines in India are now the lowest among the 10 regions tracked by 451 Research's Cloud Price Index, while leased datacenter capacity in this market is expected to more than triple over the next five years. Overall, hyperscaler pricing rose for the third consecutive quarter in the third quarter of 2023, and Amazon Web Services, Microsoft Corp. (Azure) and Google Cloud continued to add generative AI products and services.

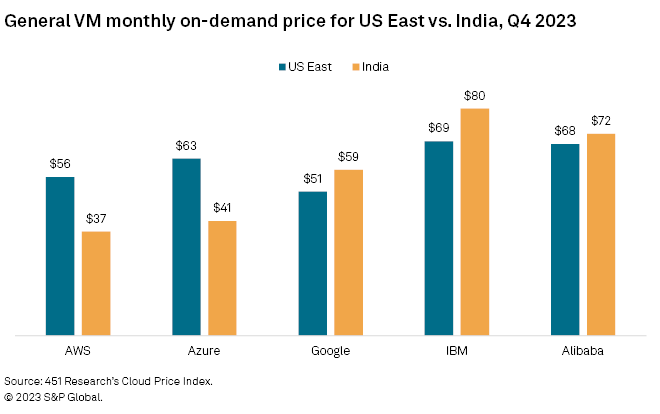

Cloud service pricing has remained remarkably steady amid broad macroeconomic inflation, although our CPI benchmarks have started inching up (after persistent declines) in recent quarters. With the US at the forefront of hyperscaler activity, it would be easy to miss the VM discounts prevailing in India. For a couple of years, general-purpose, compute and memory VMs in the market have been underselling (by as much as 28%) those in US East, which remains the cheapest region for most cloud services.

Contributing factors include an explosion of datacenter capacity in India, competition from local providers (prompted in part by government policy initiatives) and an abundance of cloud computing talent in the country, where enterprises, global systems integrators and hyperscalers have a growing footprint. Although the cut-rate regional cloud pricing doesn't yet extend to the accelerated instances (i.e., GPUs) needed to power compute-intensive workloads such as analytics, natural language processing and generative AI, India's commitment to extending its digital ecosystem into more advanced services could foreshadow a shift in supply.

India VM bargains amid silicon swaps, datacenter expansion

Four years ago — well into the cloud era but before the COVID-19 outbreak caused an abrupt shift in favor of remote work and online shopping — all of the hyperscalers tracked in our Cloud Price Index charged more for general-purpose VMs in India than in US East. Several developments since then have resulted in great deals for customers in the region.

AWS got the ball rolling in 2020 when it launched general-purpose, compute and memory instances based on its proprietary Graviton processors with a steep drop in price. While the reduction in US East general VM pricing that year was 20%, the price in India fell by half. Azure followed suit in 2022 with the launch of a new family of EPYC-based machines, resulting in a rate reduction of 10% in the US versus a 45% decline in India.

As we discussed in a recent report, government policy in India is stimulating investment, both domestically and internationally, and broadening IT's reach with more local content in native languages. Self-reliance is a national priority, as evidenced by the central government's program to train approximately 85,000 engineers with the goal of transforming the country from an importer of chips to a global center for semiconductor design and production. A pivotal moment in India's tech scene occurred in 2021, when technology investment came in and market spirits were up. Whether consulting with a physician via telemedicine or participating in a training program through videoconferencing, digital innovation seemed to touch every aspect of daily life.

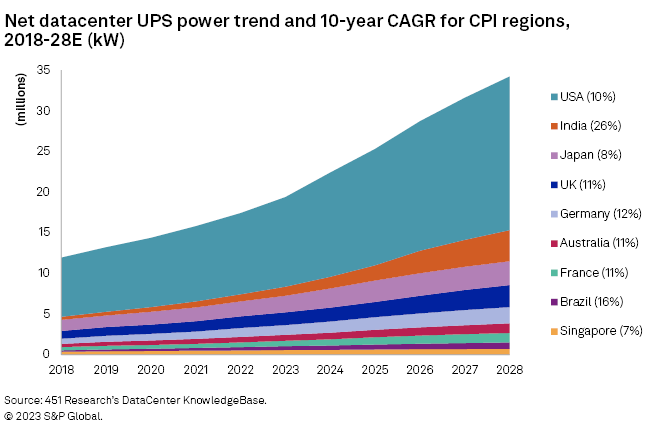

The hyperscalers we track in our CPI all have public cloud regions in India: AWS in Mumbai and Hyderabad; Azure in Pune, Mumbai and Chennai; Google Cloud in Mumbai and Delhi; International Business Machines Corp. in Chennai; and Alibaba Group Holding Ltd. in Mumbai. Thanks in part to government stimulus and collaborative efforts, buildouts of leased datacenters in the country have been and are expected to continue growing at a rapid pace, according to 451 Research's DataCenter KnowledgeBase.

When measuring capacity based on net uninterruptible power supply (UPS), India's 10-year growth rate to 2028 is projected to be 26%, moving it into second place among CPI regions (behind the US, whose capacity outstrips the other regions combined throughout the forecast period). In 2018, our DCKB had India as seventh on this basis, behind the US, Japan, the UK, Germany, Australia and France. Given the increase in overall supply, we can expect competition in the country to remain intense and prices to remain low.

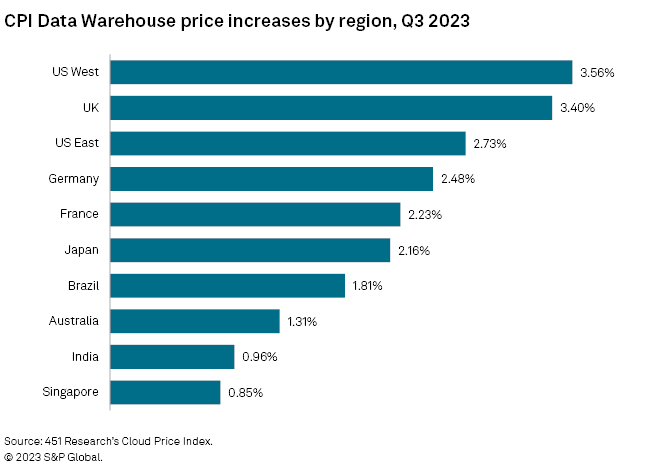

For the third quarter in a row, our Cloud Price Index benchmarks have risen marginally, continuing a slight upward trend that contrasts with the yearslong persistent declines that had been dominating the space. Unlike last quarter, which saw broad rate changes made as individual providers implemented sweeping price change strategies, the adjustments this quarter were more targeted, impacting specific service categories and cloud regions.

Our CPI uses a basket-of-goods approach to track cloud service pricing, establishing market-weighted benchmarks for compute, storage, database and other products in 10 regions around the world. In the third quarter of 2023 (July through September), many of those benchmarks increased in price. The broadest price spike was in the Data Warehouse category, which rose by 2.15% on average across all tracked regions quarter over quarter, with the largest jump (3.56%) in US West. Price hikes were seen in the Load Balancer Time and Load Balancer Data categories, with average increases of 0.51% and 0.33%, respectively.

Notable hyperscaler price changes and service additions

This past quarter highlighted the surge of interest in new generative AI services and offerings. While sweeping price changes and regional additions were few and far between, scores of new services in the generative AI space were released by all of the hyperscalers over the course of the third quarter.

Price changes

While the quarter didn't see many far-reaching price changes, there were some notable pricing announcements made by the cloud providers. In July, AWS introduced a new charge of $0.005 per IP per hour for all public IPv4 addresses, effective Feb. 1, 2024. IBM also announced in September that it would be increasing prices for IaaS and PaaS offerings effective Jan. 1, 2024.

Service additions

During the past quarter, AWS added several new services, including the general availability of AWS Entity Resolution, a machine-learning-powered service created to help organizations match and link related records stored on different applications, channels and data stores. In August, AWS unveiled its new general-purpose Amazon EC2 M7a instances, which the company says offer up to 50% higher performance compared with the older M6a instances. The new M7a instances are available in US East (Ohio), US East (Northern Virginia), US West (Oregon) and EU (Ireland), with on-demand prices 34% higher per hour than their M6a equivalents.

Meanwhile, Microsoft Corp. rolled out several new services in the third quarter, including the general availability of its Azure Container Apps dedicated plan, which allows users to run apps on dedicated workload profiles that offer more CPU and memory if needed. Google's service announcements included the general availability of its new threat-prevention tool, Attack Path Simulation, which automatically analyzes Google Cloud environments to discover possible attack pathways and prioritize security findings.

Generative AI was a hot topic across all hyperscale cloud suppliers, with each releasing new services to help support GenAI development or adding GenAI-enabled updates to their own service portfolios. At its summit in New York City in late July, AWS introduced several new GenAI services, including the general availability of Amazon Bedrock, a fully managed service that makes foundation models from various AI vendors available via an API.

Microsoft rolled out the general availability of Azure Managed Lustre, a managed file system designed specifically for high-performance computing and AI workloads on a pay-as-you-go basis. Finally, Google Cloud unveiled Vertex AI Search and Conversation, released earlier this year in preview as Enterprise Search on Generative AI App Builder and Conversational AI on Generative AI App Builder, respectively. Vertex AI Search and Conversation is an orchestration layer that combines enterprise data with generative foundation models and conversational AI/information retrieval technologies.

Regional additions

While the past quarter saw few new geographic additions to the hyperscalers' portfolios, there were some notable updates. On Aug. 1, AWS announced the general availability of the new AWS Israel (Tel Aviv) Region, operating with three availability zones under the API name il-central-1. The company also launched a new local zone in Phoenix in July.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is part of S&P Global Market Intelligence. For more about 451 Research, please contact 451ClientServices@spglobal.com.