Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 30, 2025

By Mehak Kamboj and Riya Jain

Circle Internet Group Inc. (NYSE: CRCL), the fintech company behind the USDC and EURC stablecoins, has gained 123% since its early-June debut on the New York Stock Exchange. The stock, which was listed on June 5, had risen to $185 as of July 28.

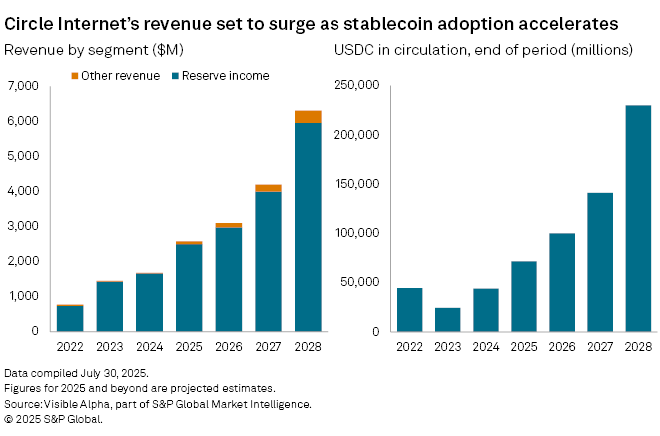

Most of Circle's revenue comes from interest earned on the reserves backing its stablecoins. These reserves, which for USDC are held largely in US Treasuries and cash, provide one-for-one backing for every unit of USDC in circulation. Reserve income accounted for almost all of the company's $1.7 billion in revenue reported in 2024. Visible Alpha consensus shows analysts expect that figure to rise to $2.6 billion in 2025, of which $2.5 billion will come from reserve income.

Stablecoins are a niche but growing corner of crypto markets. After USDC in circulation fell from 44,531 million to 43,957 million between 2022 and 2024, it is forecast to surge to 229,842 million coins by 2028, up from an estimated 71,477 million in 2025.

Policymakers in major markets, including the US and EU, are formalizing legal frameworks for stablecoins. These developments could reassure risk-averse users and broaden the appeal of reserve-backed digital currencies.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Products & Offerings

Segment