Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Sep, 2017 | 12:45

Highlights

Have the intended policy measures cured China's "zombie" steelmakers of their overcapacity, and what does Beijing's medicine mean for iron ore demand?

It has been about 30 months since China's Ministry of Industry and Information Technology published its paper on the outlook for China's steel industry, "The Operation of the Steel Industry in 2014 and the Outlook for 2015." This was a position paper on China's "new normal" and implications for the environment. But have the intended measures cured the "zombie" enterprises of their condition? What does Beijing's medicine mean for demand?

Since then, the upper echelons of the Chinese government have intensified the rhetoric around China's official environmental stance, with Premier Li Keqiang saying "for those 'zombie enterprises' with absolute overcapacity, we must ruthlessly bring down the knife." The government then went further and announced a 50-day decrease in the number of working days for domestic coal miners to 276 days a year — this has been relaxed, and increasingly ambitious targets for the amount of steelmaking capacity the government wants to shutter.

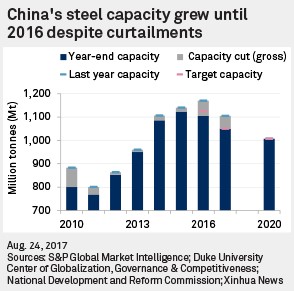

More broadly, China set out to close 45 million tonnes of steel capacity and 250 Mt of coal capacity in 2016. These national targets were not synchronized with the provincial governments, which, once aware of the steel capacity cuts' importance to Beijing, increased the ambition of their own targeted closures. Li announced June 28 that China had eliminated more than 65 million tonnes per year of steel production capacity during 2017.

The palliative measures seemed to be working, and Beijing pressed further. In March, Li announced that China would eliminate 50 Mt/y of steel capacity and 150 Mt/y of coal capacity in 2017. In May, the National Development and Reform Commission, or NDRC, announced that China had already eliminated 31.7 Mt of steel capacity, or 63.4%, of the 50-Mt target. Progress was reportedly slightly less impressive for coal capacity eliminations but seemingly still on track; 69.0 Mt of coal capacity was announced as closed. In mid-July, the NDRC issued a document announcing that China had shuttered 42.4 Mt of capacity by late-May. China seems well on its way to achieving its targeted reduction by the end of 2017.

To make sure the government's actions are working, an inspection team is reportedly destined for Tangshan to verify the closure of mills. The government has also sent notices to steel producers in Hebei, Shanxi, Shandong, and Henan to demand that they halve their output from November through February. The government is looking to weed out hidden zombie enterprises and see proof that its capacity-reduction program is being implemented this winter.

62% iron prices at four-month highs

Prices have increased steadily over the past month. The Platts IODEX recorded a five-month high of US$79.35/dmt CFR on August 18, which reflects robust demand for cargos of mid- to high-grade iron ore from emissions-constrained mills in China.

Iron ore prices have come a long way from the low of US$54/t assessed on June 13, increasing 37% since this most-recent nadir. We believe that prices are now slightly higher than justified by market fundamentals. The reason for this is primarily due to the quantity of stockpiled material but also because of the inducement effect of prices above US$70/t in bringing opportunistic Chinese concentrator capacity back online. At prices between US$60/t and US$70/t, "the market is in a sweet spot" according to Vale SA's CFO. This supports our own market and industry cost assessments for 2017.

The July average of the SGX Australia Premium Coking Coal (TSI FOB) assessment was US$26.7/t below the second-quarter 2017 average of US$190.3/t. Prices have climbed to a four-month high since May 2, but have dropped back slightly to close at US$194.0/t on August 22. This was due to an environmental crackdown on domestic coal producers, which is a source of positive momentum for mid- to high-grade iron ores, as steelmakers seek to reduce their coking coal costs as a proportion of their crude steel output.

Higher grade differentials are widening

While iron ore price increases have been strong, particularly on a year-over-year basis, gains made by producers of 65% iron material have been even greater whilst 58% iron prices have gone backward. Prices, as measured by S&P Global Platts for 65% iron products, have increased 15.0% month-over-month, and 41.8% year-over-year, while 58% iron prices rose only 7.0% month over month in July and declined 2.5% year-over-year. The market's preference for mid- to high-grade products continues to leave the responsibility for clearing the market with 58% iron ores

Robust steelmaking rates marginally reduce stocks in terms of days

All these price movements continue to be driven by elevated levels of crude steel production in China. The NBS has estimated China's steel production at 74.0 Mt in July or at 2.39 Mt/day, which is only slightly below the all-time record of June's 2.44 Mt/day.

This higher crude steel production rate mitigates the downside risk to high iron ore stocks. S&P Global Market Intelligence estimates that landed stocks in China totaled 169.7 Mt, or enough to cover 40.0 days of steelmaking at the end of July. This is marginally lower than the recent peak of 40.2 days recorded in mid-May and is mainly due to increases in steel production, given that iron ore stocks have increased by 6.9 Mt from May to July.

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.

Learn more about our mining industry research and analysis.

Request a demo to gain vital insights into the commodities market.