Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 May, 2018

Technology, Media & Telecom

Highlights

The following post comes from Kagan, a research group within S&P Global Market Intelligence.

To learn more about our TMT (Technology, Media & Telecommunications) products and/or research, please request a demo.

Comcast Corp. executives had likely been waiting with bated breath for a detailed prospectus on Walt Disney Co.'s acquisition of a large swath of entertainment assets from 21st Century Fox Inc. to find out why its higher bid for Fox was rejected. The Form S-4 was filed on April 18, and in the last 24 hours, Reuters and The Wall Street Journal reported that Comcast is lining up financing to launch a hostile all-cash takeover bid for Fox.

Details are unclear on the pricing. However, the prospectus filed by Disney shows that Comcast offered stock worth $60 billion-plus, 16% higher than Disney offered. Executives at Fox, however, worried about getting the deal approved by regulators in light of the government challenge to AT&T Inc.'s acquisition of Time Warner Inc.

And after reading the proxy, management at Comcast may have concluded that an all-cash bid would be more compelling than an all-stock deal to Fox shareholders as the SEC filing highlighted that a relative value study showed Disney stock was a better bet than Comcast's.

Indeed, press reports indicate that a bid is not imminent. Rather, executives at Comcast likely have been closely watching the AT&T/Time Warner antitrust trial and are said to be waiting for a verdict before bidding on Fox. The verdict in that case is unlikely to come until next month, as U.S. District Judge Richard Leon has promised a ruling by June 12.

The transaction is likely to be approved with restrictions, and how onerous required divestitures and other concessions might be will likely weigh heavily on the minds of Comcast executives. They, too, would likely have to sell some assets in order to get government approval of an acquisition of Fox.

If Comcast makes a hostile takeover bid, Fox management will be in a pickle. The Murdoch family has super-voting stock — they vote 40% of the shares despite owning less than 20% of the equity in the company — and are said to be in favor of the Disney deal in part because they would pay less taxes in the structure arranged with Disney than they would in an all-cash offer from Comcast.

However, rejecting a much higher hostile takeover bid from Comcast could open a flurry of shareholder lawsuits, only further serving to distract management in the midst of a major restructuring of its assets.

Many investors in the company do not like the dual voting structure at Fox. In fact, 78% of the non-Murdoch-controlled votes were placed in favor of getting rid of the super-voting stock in November 2017. The Nathan Cummings Foundation, an investor in 21st Century Fox, put out a statement just prior to that shareholder vote that referred to various scandals that have plagued the company, like the U.K. phone-hacking scandal and multiple allegations of sexual harassment at FOX News Channel (US). "We have long argued that scandals like these are in large part a result of a capital structure that fosters a lack of accountability," said Laura Campos, the foundation's director of corporate and political accountability, according to Bloomberg.

There is also the possibility of a bidding war with the owner of the Magic Kingdom. Disney is preparing for the digital future with its over-the-top video services and is banking heavily on the content coming from the Fox acquisition to make this foray successful.

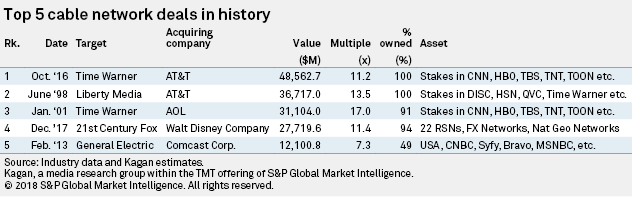

The deal, proposed by Walt Disney, was, at the time, the fourth largest cable network deal in history, and that excluded a handful of cable networks and other assets that were to remain with existing 21st Century Fox shareholders.

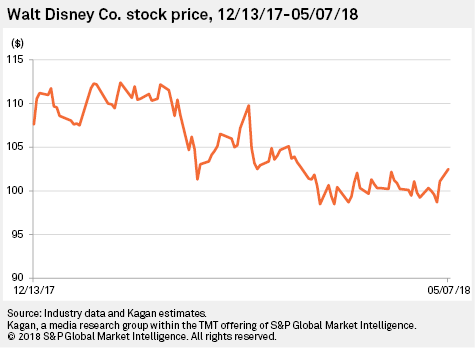

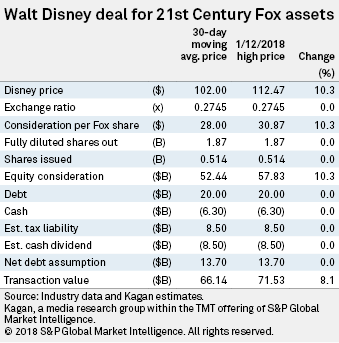

The total compensation offered for all of the 21st Century Fox assets came in at $66.14 billion at the time the transaction was announced. Shares in Disney shot up to as high as $112.47 on January 12, giving the deal a valuation of $71.53 billion, or a healthy 13.1x cash flow, versus the 11.9x multiple when the merger was originally announced.

Since then, however, Disney shares have slid back, closing on May 7 at $102.48, just a hair above the $102.00 average 30-day trailing stock price that the companies used to calculate the deal value. The stock closed on May 8 at $101.79, below the prior day's price given the news that Disney may have to fight for the assets.

Including the nearly $40 billion in assets that are to be part of the spinoff company, the entire company looks to be worth more than $100 billion. To avoid a bidding war, the two parties may want to negotiate an agreement to split the assets, with international programming assets Star TV and Sky PLC being the most valuable to Comcast.

There is also a termination fee of $1.525 billion that 21st Century Fox would have to pay to Walt Disney Co. if it backs out of the deal, although this is chump change given the size of the transaction.

Related Content: