Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan 23, 2025

By Iuri Struta

| Artificial intelligence and attractive cash flows are driving investments in datacenters, especially in the Asia-Pacific region. Source: funky-data/iStock via Getty Images Plus. |

Asia-Pacific's datacenter market is driving record investment, attracting acquirers willing to pay substantial premiums for the assets amid increasing interest.

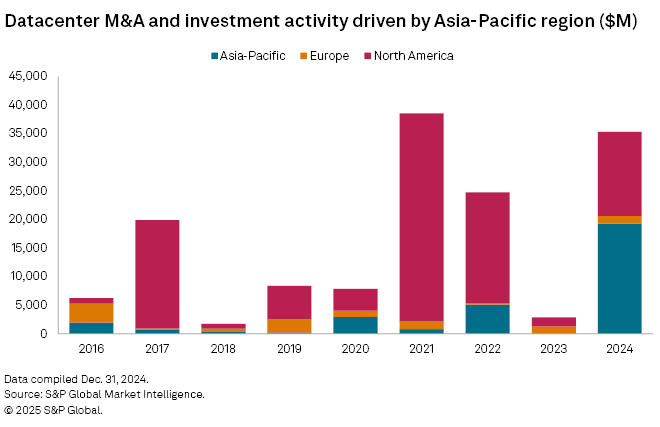

Four of the 10 largest deals during the year were in APAC, making it the region with the highest total deal value, a crown held by North America in the previous three years when the COVID-19 pandemic prompted an influx of technology spending.

The combination of increased interest among buyers and decreased supply led investors to both look overseas and pay higher premiums.

"The wave of consolidation in the 2010s in North America left the datacenter space largely played out," said Joseph Radecki, managing director and head of TMT Investment Banking at KPMG Corporate Finance. Unlike in the recent past, consolidators are increasingly looking at buying smaller datacenters because they cannot build fast enough, Radecki added.

Intense dealmaking in North America was compounded by longer private equity holding periods, leaving a scarcity of well-priced domestic targets.

"PE firms in North America have been picking up datacenter operators and are hanging on to them," said Dan Thompson, a research analyst at 451 Research. "There are a few newer companies that can get picked off by PE companies."

Biggest deal

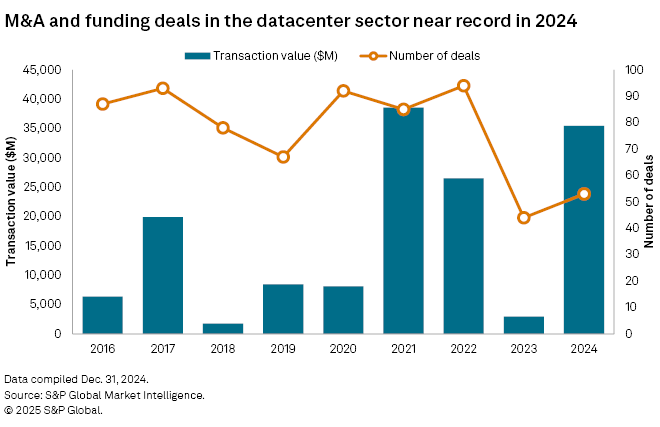

Total datacenter transaction value — including both M&A and investment rounds — exceeded $34.44 billion in 2024, nearing the $38.54 billion record set in 2021, S&P Global Market Intelligence data shows.

Blackstone Inc. and Canada Pension Plan Investment Board's $16.13 billion acquisition of AirTrunk Operating Pty Ltd. was the year's largest deal. AirTrunk is the largest data center platform in the Asia-Pacific region, with holdings in Australia, Japan, Malaysia, Hong Kong and Singapore. It has more than 800MW of capacity committed to customers and owns land that can support over 1GW of future growth across the region.

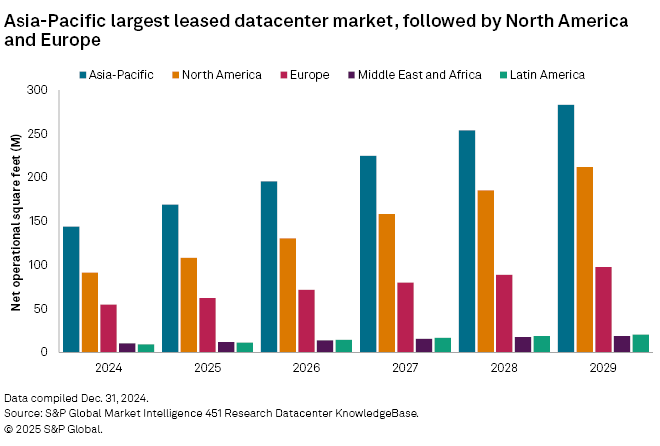

The AirTrunk deal exemplifies several key trends in the space. First, the Asia-Pacific region has the largest number of operational square feet in the datacenter market and is set to keep growing.

"In South Asia and Southeast Asia, for instance, we anticipate that datacenter capacity will increase at a CAGR [compounded annual growth rate] of 10%-25% over the next few years, spurring investments and funding opportunities," S&P Global Ratings analyst Pierre Georges said in a recent note.

Tenants matter

The tenants also make operators like AirTrunk attractive. Microsoft Corp. is one of the wholesale-focused provider's tenants in locations including Hong Kong and Johor, according to 451 Research analyst Soon Chen Kang. It is believed that Alphabet Inc. and Amazon.com Inc.'s Amazon Web Services are on the tenant list, Kang said.

Hyperscalers like Microsoft, Alphabet, Amazon and Meta Platforms Inc. are building their own datacenters and leasing capacity from third parties to both share upfront costs and be closer to end users. Companies with hyperscalers as customers typically command higher premiums than those without. These clients are often seen to derisk a deal or investment.

The second largest transaction in 2024 was a $9 billion investment in Vantage Data Centers Management Company LLC by Silver Lake Technology Management LLC and DigitalBridge Group Inc., designed to support hyperscalers in meeting growing cloud and AI demand.

"The datacenter providers that grow at a rapid rate are the ones that are servicing the hyperscalers," Thomspon said.

Resilient asset class

"Datacenters were previously seen as an alternative investment, but now, they are a resilient asset class, with long-term cash flow from US tech companies," said Matthew Harris, CFO at datacenter operator Kao Data. "There is certainly a lot of capital that is looked to be allocated in the sector."

Hyperscalers are increasing capital expenditures, with plans to spend over $1 trillion in the next four years, potentially more, S&P Global Market Intelligence estimates, as they race to build AI capacity. Most of this investment is directed toward new datacenters focused on AI workloads.

Microsoft said it planned to spend $80 billion on datacenters that can handle AI workloads in 2025, nearly double the capex in 2024.

Datacenter capacity was previously concentrated in major metropolitan areas, but now more datacenters are being built in remote locations as AI training workloads do not require proximity to end users.

Government attitudes toward datacenters have also evolved. The rise of AI has prompted some previously hesitant jurisdictions to prioritize datacenter projects in a race to attract AI technologies. In the UK, the governing Labour Party pledged to expedite the planning permitting process.

Singapore, which banned new datacenter developments from 2019 to 2022, unexpectedly allocated more power for datacenter expansion in 2024. Countries are now eager to become AI hubs. The Middle East is expected to experience the highest growth in leased datacenters, led by Saudi Arabia, Israel and the United Arab Emirates.

"With AI, you're starting to get a sense of countries not wanting to be left behind. It brought authorities back to the negotiating table," Thompson said.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Wireless Investor is a regular feature from S&P Global Market Intelligence Kagan.