Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Nov 14, 2024

During the 5G Americas Analyst Forum in Dallas on October 24, technical experts from AT&T Inc., T-Mobile US Inc. and Telefónica SA, along with various vendors and system integrators, discussed the opportunities and challenges in the 5G market, namely the migration to 5G Advanced, 6G and the looming spectrum crisis.

➤ T-Mobile's launch of the RedCap USB-C dongle showcases advancements in 5G SA technology designed for internet of things devices, while major carriers like AT&T and Verizon are deploying SA networks to enhance service capabilities and prepare for future 6G developments.

➤ The successful deployment of 6G will depend on securing terahertz spectrum, with the urgency for additional mid-band spectrum growing as the Federal Communications Commission's authority to auction new bands has lapsed, complicating the landscape for operators.

➤ The wireless industry is advocating for changes to spectrum sharing rules, particularly in the 3.5 GHz Citizens Broadband Radio Service (CBRS) band, to enhance network capabilities, while also lobbying for the relocation of existing spectrum to facilitate better access for new technologies.

5G is gaining mass adoption worldwide, setting the stage for more advanced use cases. Connections worldwide number more than two billion. However, the evolution of 5G technology continues to progress slowly, mainly because the shift from early non-stand-alone (NSA) to stand-alone (SA) networks has been gradual. SA architecture enables more transformative innovations such as network slicing, private networks and wide-area IoT applications because the core becomes decoupled from legacy 4G systems.

Some executives at the forum argued that the 5G standard had too much flexibility because it has allowed operators to launch a service based on 4G architecture, which simply turned networks into ones that could offer faster broadband speeds. The real transformation comes with SA and the move to 5G Advanced through Release 17 and 18, which are now complete. 5G Advanced introduces additional 5G capabilities, transitioning from coverage-centric to service- and capacity-centric models. 5G Advanced aims to build on enhanced mobile broadband (eMBB) by introducing features such as Ultra-Reliable Low Latency Communications (URLLC) and massive IoT-enhanced location positioning.

The problem is that carriers have been busy spending on coverage and have been reticent to spend more on network capabilities that do not have significant customer demand yet. These services include advanced network slicing, massive IoT and precise location.

According to Kagan's most recent 5G Tracker, out of the total 290 operators that have launched 5G in 106 markets, at least 69 operators in 40 markets worldwide had activated 5G SA networks as of June 30. Operators in major 5G markets such as the US and mainland China have transitioned to 5G SA, but other markets have yet to follow the trend.

T-Mobile launched what it called the world's first SA network in 2020 but is just now tapping into the network's capabilities meaningfully. Smartphones supporting SA are now plentiful, and major carriers around the world, including AT&T and Verizon Communications Inc. in the US, have deployed SA, giving the technology scale.

Recently T-Mobile US introduced the TCL Linkport IK511, a 5G RedCap USB-C dongle. RedCap (5G Reduced Capability) is a 5G SA technology designed for supporting IoT devices more cost-effectively, with extended battery life and reduced energy usage via more precise location capabilities. QUALCOMM Inc. introduced the Snapdragon X35 5G modem-RF system for RedCap at the beginning of 2024.

Rob Soni, vice president of radio access network (RAN) technology with AT&T, indicated that RedCap should allow the carrier to migrate IoT devices from LTE and eventually sunset its LTE network. While RedCap targets low-end devices suitable for sensors and wearables, it also supports up to 220 Mbps, making it viable for devices like laptops and smartwatches. Operators are also eyeing RedCap devices capable of running on fixed wireless access (FWA), giving them another revenue stream by hosting laptops and in-home connected devices.

Operators are expected to begin 6G deployments in 2029. Rather than being another rip-and-replace wireless standard, 6G is envisioned to build on existing 5G architecture. For instance, the artificial intelligence features introduced in the next releases of the 5G standard will be a foundation for 6G's AI-native environment. Technological enhancements will include support for sensing and other advanced applications using terahertz spectrum bands. The extensive use of edge computing is expected to reduce network latency, while quantum networking will be written into the standard to secure data and voice communications.

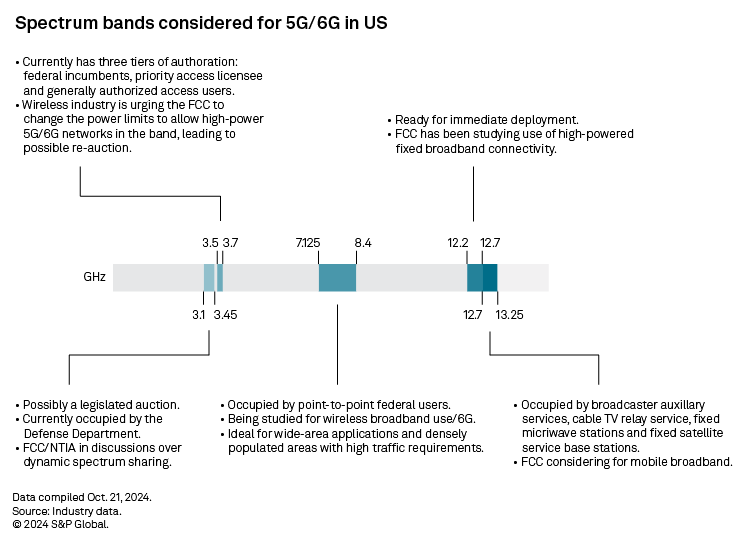

Spectrum allocation and availability will be the biggest hurdle to 6G. The standard needs internationally allocated terahertz bands. The 7.125 GHz-8.4 GHz spectrum is vital for 6G to succeed in the Americas, enabling wide-area coverage for mobile broadband. This spectrum range is currently the only one in the US and Canada aligned with WRC-27 Agenda Item 1.7. Achieving a globally harmonized band is essential to leverage economies of scale, which can lower costs and enhance affordability.

In the meantime, both carriers and their systems vendors say the need for additional mid-band spectrum is becoming increasingly dire. The US spectrum pipeline currently has no bands ripe for auction in the near term. Moreover, Congress allowed the Federal Communications Commission's authority to auction spectrum to lapse in March 2023.

Most of the mid-band spectrum for consideration is encumbered by the Department of Defense or commercial operators in the CBRS band. The wireless industry sees the 3.1 GHz to 3.45 GHz band as an important band for 5G as it is adjacent to the recently auctioned 3.45 GHz band and is aligned with spectrum allocations globally, resulting in better economies of scale for equipment-makers and a wider contiguous band for operators.

It is doubtful that the commercial wireless industry will get everything it wants regarding the 3.1 GHz to 3.45 GHz band. Both the FCC and National Telecommunications and Information Administration view spectrum sharing as a necessity, but the two could create concessions allowing some of the spectrum to come with exclusive use. No doubt lawmakers and the executive branch also understand the billions of dollars that could be generated for the US Treasury from exclusive-use spectrum auctions.

The wireless industry opposes a spectrum-sharing scenario like the one implemented in the nearby 3.5 GHz CBRS band. The industry argues that the spectrum's usefulness has been stymied by power limits to avoid interference. Carriers are lobbying the FCC to change the power limits in the band to accommodate their higher-powered networks.

In August, the FCC issued a Notice of Proposed Rulemaking that could revise the agency's CBRS rules. The crux of the proposed changes would better protect incumbent federal users and improve the rules for both Priority Access License holders and General Authorized Access users. Comments were due Oct. 7 and Reply Comments must be filed with the FCC by Nov. 5.

AT&T publicly indicated it is urging federal regulators to move existing CBRS spectrum users to a different part of the 3 GHz band. It suggested that the FCC could do so by conducting an incentive auction to relocate current users..

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Wireless Investor is a regular feature from S&P Global Market Intelligence Kagan.