Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — May 15, 2025

The enterprise technology landscape is seeing a divide between organizations that use generative AI effectively and those struggling with it. Businesses exploring agentic AI face challenges like legacy system integration and governance issues. Implementing AI requires high-quality data, leading to privacy and ethical concerns. Investments in cybersecurity, such as Google's acquisition of Wiz, emphasize the need for strong security measures. Macroeconomic factors like trade policies influence technology spending decisions, highlighting the importance of strategic AI and digital transformation to stay competitive. This report rounds up the latest developments curated for IT-decision-makers.

The enterprise technology landscape is increasingly polarized, with a growing divide between organizations that effectively harness generative AI and those that struggle to achieve meaningful returns. As businesses navigate the complexities of agentic AI — a transformative force in IT — the potential for autonomous decision-making and task execution is becoming apparent. Use cases span various domains, from customer support to financial systems and supply chain management, yet challenges such as integration with legacy systems and governance issues remain prevalent. The need for high-quality data further complicates implementation, raising concerns around privacy and ethical considerations.

Moreover, the urgency for robust cybersecurity measures is underscored by significant investments, evidenced by Google's record-setting acquisition of Wiz. As sectors such as manufacturing embrace digitalization to enhance efficiency and address labor shortages, the focus on AI and data platforms intensifies. However, macroeconomic factors, including shifting trade policies, introduce uncertainty that impacts technology spending decisions. As organizations seek to balance innovation with trust and accountability, the strategic integration of agentic AI and digital transformation initiatives will be crucial for maintaining competitive advantage in an ever-evolving landscape.

AI in focus

There is an increasing disparity between organizations that are and those that are struggling to maximize returns. Businesses are navigating a shifting enterprise IT landscape transformed by agentic AI. For such a nascent set of technologies, agentic AI is capturing an extraordinary level of interest among enterprises, with almost unanimous support for exploring a variety of use cases. Agentic AI and agentic process automation are expected to revolutionize business and IT operations by enabling autonomous decision-making and task execution.

For instance, AI agents in customer support can handle complex multidimensional inquiries 24/7, while autonomous financial systems can optimize cash flow management, fraud detection and credit risk assessments. Similarly, supply chain automation powered by agentic AI can help ensure real-time inventory adjustments and delivery optimization. However, challenges persist. Integration into legacy systems can be complex, and ensuring transparency in AI-driven decisions raises governance concerns. Dependence on high-quality data also introduces vulnerabilities, particularly with privacy and security. Ethical considerations, such as job displacement and algorithmic bias, require careful oversight. While agentic AI offers significant promise, achieving its full potential demands that organizations balance innovation with trust, accountability, and dynamic real-time data and systems integration. These technologies are poised to reshape businesses' operational efficiency, which demands strategic agility and robust data strategies.

"Cloud migration is very high and artificial intelligence. Those are the top two initiatives… There's two big wings of [AI]. One is analysis of the pool of data that they work with. The other is applying AI, the use of AI to gain efficiency in various roles throughout the company."

– Consumer retail products and services.

Source: 451 Research's Voice of the Enterprise in-depth interview, February 2025.

Google buys Wiz for $32B in cash

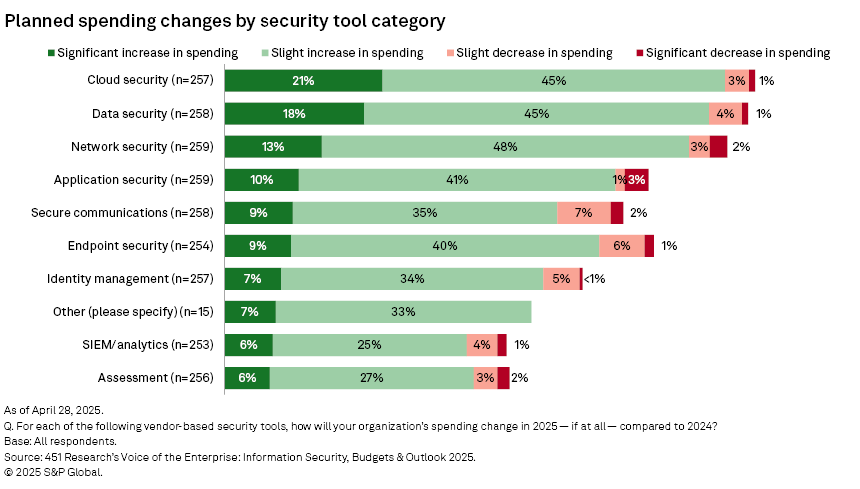

With so much of IT gravitating toward the cloud, it is imperative for any company seeking a leadership stake in cybersecurity to have a solid play in that direction. For example, in the largest information security deal to date, Google (Alphabet Inc.) acquired cloud security specialist Wiz Inc. for $32 billion in cash. This is particularly relevant as nearly all surveyed enterprises (92%) plan to increase information security spending in 2025, with a projected 27% average increase, versus only 5% expecting a budget decrease. Among those increasing budgets, 57% expect an increase in the 1%-25% range, with the lower end representing maintenance spending; simply maintaining security posture year over year requires some increased spending. About a third (35%) are well north of that range, reflecting project-level spending to enhance information security capabilities.

Global Payments buys Worldpay for $24B and sells its Issuer Solutions business to FIS for $13.5B

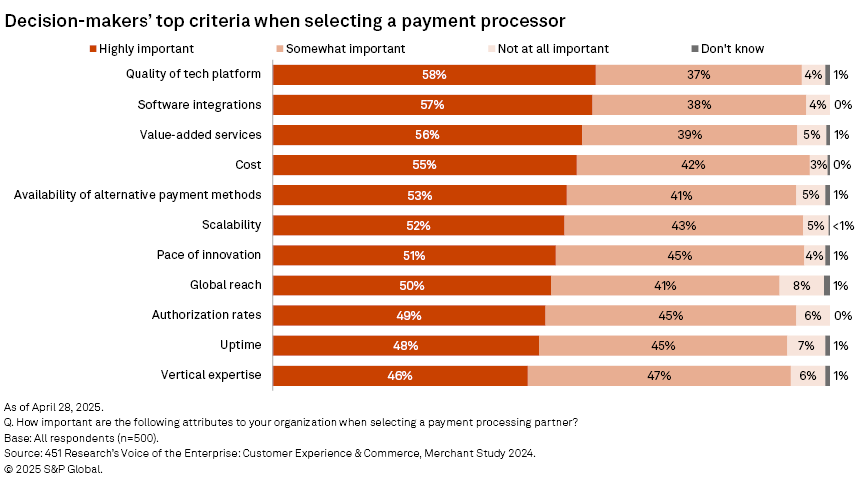

Global Payments Inc. has unveiled a pair of transactions enabling it to buy merchant processor and exit the issuer processing business. The company will buy Worldpay for an enterprise value of $24.25 billion, acquiring a 55% stake from private equity firm GTCR and the remaining 45% from Fidelity National Services Inc. Simultaneously, Global Payments is selling its Issuer Solutions business to FIS for an enterprise value of $13.5 billion. Worldpay's Payrix asset could deepen Global's payments toolset for SaaS platforms, and its e-commerce expertise enhances its omnichannel proposition for enterprises. Enterprises state that tech platform quality is the top attribute that payments and commerce technology decision-makers emphasize when selecting a payment processor, according to 451 Research's Voice of the Enterprise: Customer Experience & Commerce, Merchant Study 2024.

Key industry conference takeaways

Manufacturing goes agentic at Hannover Messe 2025

Global industrial trade conference Hannover Messe 2025 confirmed a directional shift: The industrial sector is rapidly embracing digitalization — not as an add-on but as a structural transformation to increase efficiency and reduce costs — to address the skilled labor shortage, supply chain challenges, and the need to be flexible and deliver at speed. With industrial AI, robotics and secure data ecosystems taking center stage, the event reflected the industrial sector's path toward a more autonomous, intelligent and interconnected future.

"We have quite a lot of that [IoT] stuff out in the field that monitors and controls … The control centers monitor stuff. And then if there is a problem, it actually generates a service ticket … and then dispatches that out to our operational people to do the repair. They use smart analytics to determine out of all the work jobs, which one will bring … the most value to the company."

– Energy and utilities respondent.

Source: 451 Research's Voice of the Enterprise in-depth interview, February 2025.

While digital and autonomous technologies took the spotlight, certain sectors reflected a reduced presence. Hydrogen, a key theme in previous years, was noticeably smaller in scope, suggesting a tempered near-term outlook. Similarly, green technologies, although not absent, appeared less central compared with the dominance of AI and data platforms. In contrast, quantum technologies remained well represented, with exhibitors focusing on early industrial applications such as materials simulation and optimization tasks, signaling that the field is moving steadily toward commercial relevance.

Emerging tech

FinOps in focus

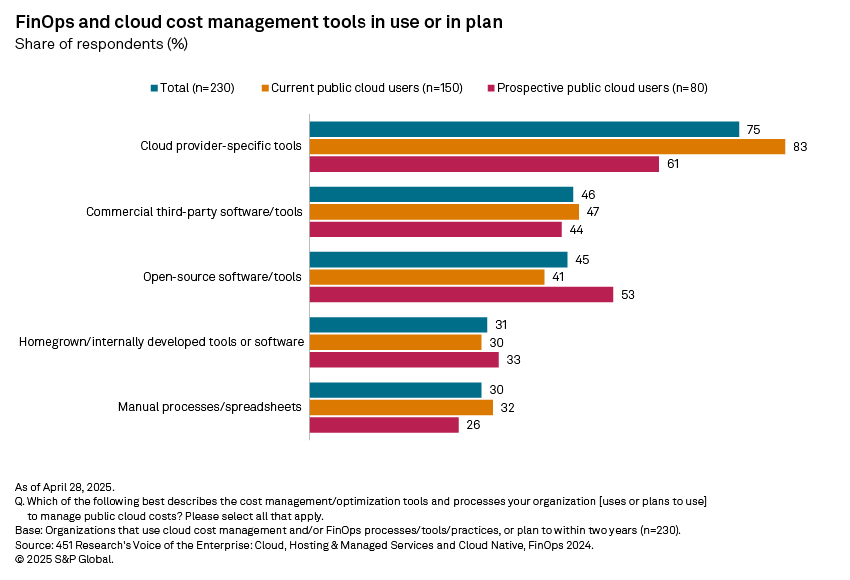

Businesses face challenges in managing public cloud expenses, focusing on budget planning, forecasting, cloud policy, governance and billing complexity. To address these issues, organizations increasingly adopt FinOps tools to enhance planning, optimize spending, improve visibility and manage resources, emphasizing disciplined spending over reducing overall costs. As the cloud spending bill rises, the imperative to optimize usage and rates becomes more important than ever to forecast spending more accurately and reduce wasted cloud spending — mostly by turning things off and planning via commitments and reservation management.

With standardization of billing metrics across providers and more granular cost observability, algorithmic, autonomous and AI-powered approaches to balancing resource usage with performance needs are assuming greater importance. Increasingly, information on public cloud infrastructure costs is augmented with spending data from additional technology domains, and labor and ecosystem costs, to deliver more holistic views for FinOps, CloudOps or IT asset management.

Hyperscale providers' own tools (e.g., Amazon.com Inc.'s Amazon Web Services Cost Explorer, Microsoft Corp.'s Azure Cost Management, Google Cloud Billing) are the predominant type of cloud cost management tool or process in use, adopted by 83% of those using IaaS/PaaS public cloud. However, nearly half of organizations also use commercial third-party cost solutions, which include tools and techniques for tagging automation, showback/chargeback, rightsizing, discount plan arbitrage, anomaly detection and Kubernetes-specific resource optimization, according to 451 Research's Voice of the Enterprise: Cloud, Hosting & Managed Services and Cloud Native, FinOps 2024.

Macroeconomic insights

Tariffs, economic fears could slow accelerating US tech demand

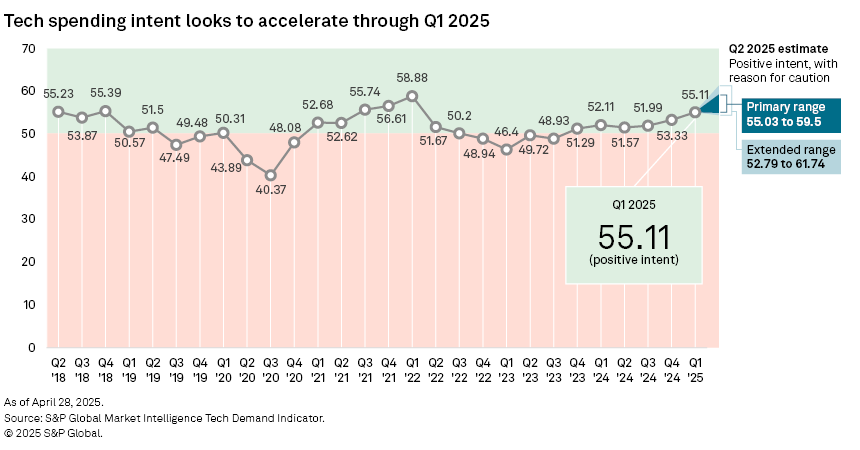

While early signals gathered during Q1 point to a further increase in spending intention during Q2, quickly changing trade policies and new tariffs introduced by the US government in early April led to significant swings in stock markets and introduced a major new influence on future sentiment that the Q1 Tech Demand Indicator results did not entirely account for. Trade policies and the broader economic disruption have a complex relationship with IT spending, affecting both cost and demand in multiple ways. It is also important to consider that a positive Tech Demand Indicator score, while it represents a likelihood of increased technology spending, does not necessarily reflect a positive attitude toward that spending.

Among the factors reported as having an outsize influence on businesses' technology spending decisions in Tech Demand Indicator inputs, external economic pressures remained the most common issue, cited by 52% of respondents in Q1 2025. While in previous quarters, those economic pressures were somewhat abstract, in Q1 the factors in question can be understood more specifically to include the impacts of trade policy.

10 companies to track

DeepGram: The voice AI startup recently launched Voice Agent API, a next-generation voice AI offering designed to support natural-sounding, real-time conversations between humans and machines at enterprise scale.

SmartRPA: The robotic process automation company offers real-time performance monitoring of automated workflows, as well as streamlined orchestration of workflows across diverse platforms. It also has optimization capabilities that improve processes in multivendor automation ecosystems.

Replit Inc.: Its agent allows users to provide prompts — typically text, but it also supports dictated prompts and images — which are then converted into software. It autonomously generates a plan, writes code and adds features based on these prompts, and can deploy the generated application.

Firefly: The cloud infrastructure automation startup focuses on solving enterprise cloud management challenges such as complexity, multicloud deployments and lack of skills. The company uses AI-driven remediation to drive efficiency and reduce outages, and it enables AI agents to interact with the cloud using a model context protocol server.

CloudHiro: The FinOps platform is designed to help businesses curtail their cloud expenses. It provides features for optimizing cloud spending, including automated reservation management, resource allocation and visualization for tracking cloud usage and cost allocation, plus a cloud waste detection and elimination system.

Kipu Quantum GmbH: The quantum algorithm and tool development provider bridges the gap between quantum hardware advancements and end-user applications. It is focused on building out algorithms for use on current and near-term quantum hardware to effectively reduce the time to meaningful quantum computing.

8Flow Inc.: The company's technology maps enterprise automations, priming organizations to modify or implement new agentic workflows. The startup helps organizations track, map and learn from employee workflows, providing insights to identify productivity inefficiencies and automation opportunities.

IXOPAY GmbH: The payment orchestration company provides a modular platform that has depth in both vaulting and payment orchestration. It optimizes, secures and unifies merchants' payment processing via a single API so they can store payment information securely and independently from their payment processors.

Enzai Technologies Ltd.: The company simplifies AI model governance for enterprises with a workflow-driven platform, underpinned by a model registry and controls, to assist with identification, management and compliance with an emerging roster of AI laws, regulations and standards. It uses classic machine-learning models, as well as generative AI models — large language models, small language models and reasoning models.

AgentOps: The platform is engineered to support the entire life cycle of AI agents, encompassing development, deployment and monitoring functionalities. At its core, the platform allows users to create agents that can automate tasks such as data retrieval, customer support and quality assurance.

What to watch

S&P Global Market Intelligence 451 Research provides essential insight into the pace and extent of digital transformation across the global technology landscape. 451 Research offers differentiated insight and data on adoption, innovation and disruption across the technology markets, backed by a global team of industry experts. As the enterprise technology landscape evolves, several key trends warrant close attention. First, ongoing advancements in agentic AI and its applications across various sectors will be crucial, particularly in enhancing operational efficiency and decision-making capabilities. Organizations should monitor how effectively they can integrate these technologies into existing frameworks while addressing governance and ethical concerns. Additionally, the surge in cybersecurity investments, highlighted by significant acquisitions like Google's purchase of Wiz, indicates a growing recognition of the importance of robust security measures in a cloud-centric world. Furthermore, the impact of macroeconomic factors, such as trade policies and tariffs, on technology spending will be pivotal in shaping market dynamics. Finally, the rise of FinOps tools to manage cloud costs effectively reflects a shift toward disciplined financial management in IT. Keeping an eye on these developments will be essential for organizations aiming to successfully navigate the complexities of digital transformation.

S&P Global Market Intelligence analysts Sheryl Kingstone, Oscar Abbink, Jean Atelsek, Ellie Brown, Raul Castanon-Martinez, Zach Ciampa, Liam Eagle, William Fellows, Melissa Incera, Alex Johnston, Dan Kennedy, Carl Lehmann, Jay Lyman, Chris Marsh, Jordan McKee, Michael Nocerino, Malav Parekh, Yulitza Peraza, Melanie Posey, Krishna Roy, Johan Vermij, McKayla Wooldridge contributed to this report.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is a technology research group within S&P Global Market Intelligence. For more about the group, please refer to the 451 Research overview and contact page.

Location

Products & Offerings

Segment