Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

03 Mar, 2025

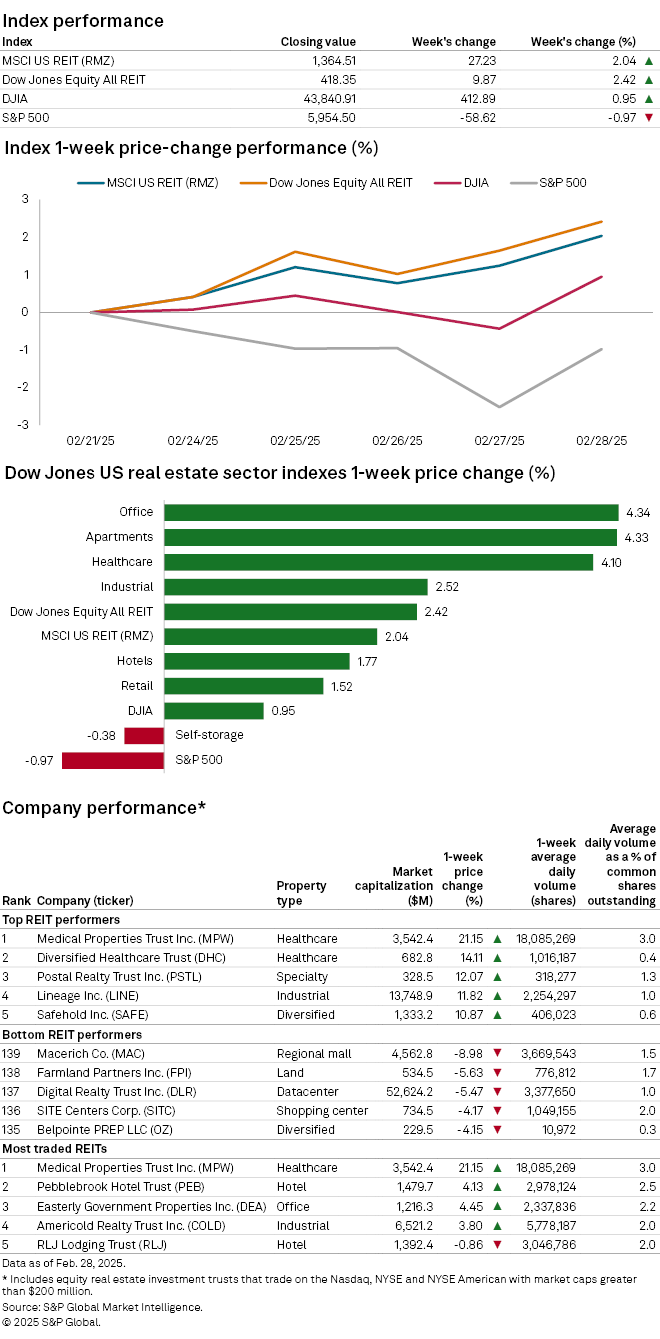

Share prices for US equity real estate investment trusts ramped up during the final week of February, outperforming the broader stock market.

The Dow Jones Equity All REIT closed the recent week up 2.42%, compared with a 0.95% increase for the Dow Jones Industrial Average and a 0.97% decline for the S&P 500.

Among the Dow Jones US real estate sector indexes, the office REIT index posted the largest share-price increase in the past week, up 4.34%. The apartment and healthcare REIT indexes followed closely behind with increases of 4.33% and 4.10%, respectively.

The self-storage sector index was the sole property sector index to close the past week in the red, down a slight 0.38%.

Healthcare REIT Medical Properties Trust Inc. logged the largest gain in share price among all US REITs with at least $200 million in market capitalization, closing the week up 21.15%. Another healthcare REIT, Diversified Healthcare Trust, followed next with share-price growth of 14.11% over the week. Postal Realty Trust Inc., which leases properties to the US Postal Service, rounded out the top three performers with an increase of 12.07%.

Conversely, regional mall REIT Macerich Co. had the largest share-price decline over the past week, down 8.98%. Farmland-focused Farmland Partners Inc. and datacenter REIT Digital Realty Trust Inc. followed next with drops of 5.63% and 5.47%, respectively.