Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Mar, 2025

US-domiciled property and casualty insurers have surpassed $1 trillion in annual direct premiums written for the first time in the industry's history, according to an S&P Global Market Intelligence analysis of annual regulatory statements.

Aggregated direct premiums written for 2024 were $1.05 trillion, an increase of 8.0% from the prior year. Personal lines of business, which consists of homeowners, farmowners and private auto, hit $534.92 billion compared to $477.04 billion in 2023. Out of the three individual business lines, private auto recorded the largest year-over-year increase at 12.6%. Private auto direct premiums written totaled $358.77 billion in 2024.

Homeowners direct premiums written climbed 11.1% to to $169.55 billion in 2024, while farmowners premiums came to $6.60 billion.

Aggregated premiums for commercial business lines grew 4.0% to $502.35 billion in 2024. Commercial lines include of a variety of coverages such as liability or casualty, commercial auto and property, and even pet insurance. Pet insurance is now a reported stand-alone line of business in 2024; it was previously included within the inland marine business line.

The majority of commercial lines direct premiums, roughly 80%, can be consolidated into four broad buckets: liability, property, auto and workers' compensation.

The four reported liability lines — product liability, medical professional liability, commercial multi-peril (liability) and "other" liability — combined for $162.70 billion in direct premiums in 2024. "Other" liability includes numerous subtypes of insurance such as general liability, commercial excess and umbrella, errors and omissions, and cyber insurance. That line totaled $123.32 billion in direct premiums written last year

|

– Click here for S&P Global Market Intelligence's P&C reported line of business roll-ups. – Download a template to analyze the P&C insurers historical market share across all lines of business |

The combination of three commercial property lines — allied lines, fire and commercial multi-peril (non-liability) — reached $103.97 billion in direct premiums. Commercial auto and workers' compensation direct premiums written in 2024 were $70.94 billion and $55.42 billion, respectively. Workers’ compensation posted a year-over-year decline of 5.3% in 2024, while commercial auto increased by 10.2%.

Property and casualty (P&C) insurers underwrite some accident and health contracts, such as long-term care and stop-loss insurance, but that is just a fraction of the premiums the life industry writes in this space. P&C insurers' total direct premiums written within the accident and health lines were $8.63 billion in 2024 versus $8.46 billion a year earlier.

Underwriting strengthens

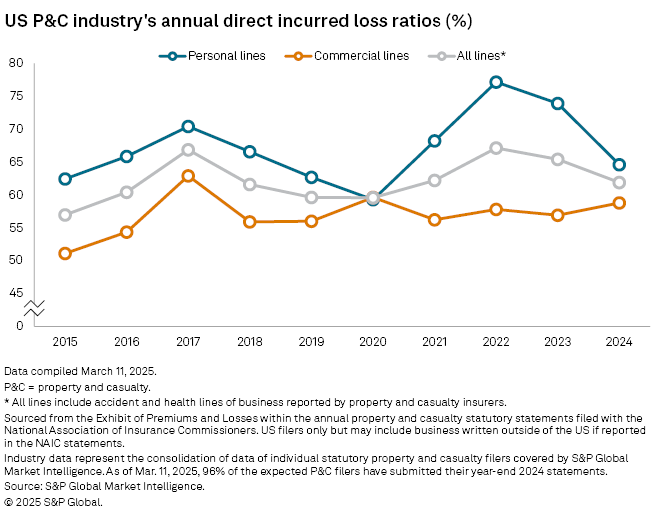

The US P&C industry's overall underwriting performance improved in 2024 but did show a weakening in the direct incurred loss ratios in several commercial lines.

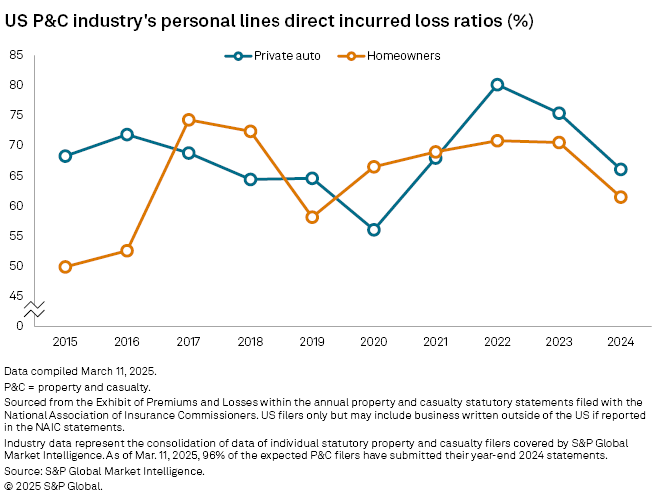

The industry's overall direct incurred loss ratio improved to 61.9% in 2024 from 65.4% the previous year. The favorable results in 2024 were driven by substantial improvement within personal business lines, which posted a 9.3 percentage point decrease from 2023. The total direct incurred loss ratio for personal business lines was 64.6% in 2024

Private auto's direct incurred loss ratio was 66.1% in 2024 compared to 75.4% in 2023. The homeowners direct loss ratio dropped 9.1 percentage points from the prior year to 61.5%.

The direct incurred loss ratio for commercial business lines rose to 58.8%, a deterioration of 1.9 percentage points year over year.

Of the individual commercial business lines that account for the largest share of direct premiums in 2024, the "other" liability reported business line recorded the largest year-over-year weakening. The business line reported a direct incurred loss ratio of 70.8% in 2024, compared to 63.0% during the prior year.

Workers' compensation was another key commercial line to see its loss ratio worsen, deteriorating 1.8 percentage points to 46.8%.

The overall loss ratio for commercial auto showed improved by 1 percentage point in 2024, with a reported direct incurred loss ratio of 72.9%. However, the commercial auto liability lines deteriorated to 77.4% in 2024 compared to 76.6% in 2023. Commercial auto physical damage improved by 7.4 percentage points in 2024 with a 57.8% direct loss ratio.