Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Oct, 2025

By Iuri Struta

Venture capital funding for generative AI companies is on track to more than double 2024's figures as the rush to invest in the sector goes into overdrive.

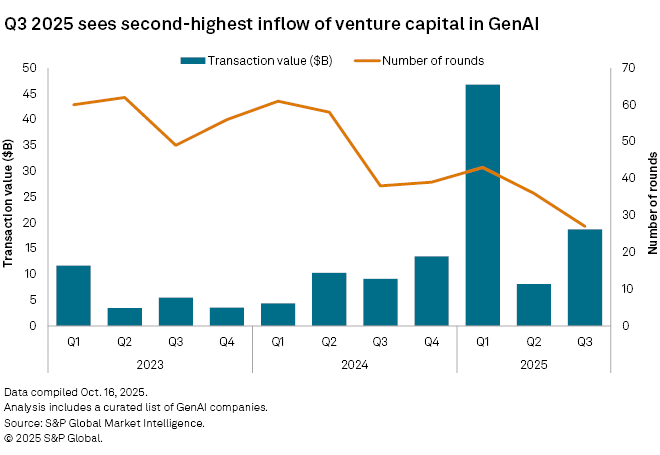

In the first three quarters of 2025, investors poured $73.60 billion into GenAI application startups, including large foundation model providers such as OpenAI LLC and Anthropic PBC, according to an analysis by S&P Global Market Intelligence. The third quarter alone saw nearly $19 billion in investment, the second-highest quarterly figure on record, surpassed only by the first quarter of this year when a massive $40 billion funding round for OpenAI inflated the total. In 2024, investment in GenAI companies totaled $37.23 billion.

"The deals are getting more expensive, and valuations have skyrocketed," Advika Jalan, head of research at early-stage venture capital firm MMC Ventures Ltd., told Market Intelligence. "Sometimes, there isn't even a product, there is just a team, but they won't be raising anything less than $20 million."

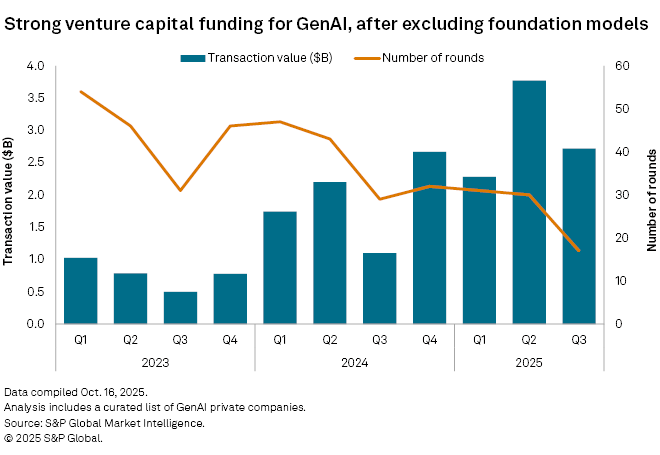

Excluding foundation model providers, which typically command the bulk of VC, venture capitalists invested $2.72 billion in other GenAI startups in the third quarter, the second-highest tally after the June quarter. Between January and September this year, $8.77 billion was invested in companies outside the foundation model space, surpassing the $7.70 billion reported for all of 2024 and the $3.06 billion recorded in 2023.

For VC firms, due diligence on whether a company has true AI capabilities has become key.

"As the wave of capital progresses, we are seeing investors asking questions around durability. Are these companies doing something durable?" Ashish Patel, managing director in Houlihan Lokey's capital solutions group, said in an interview. "We are at the part of the cycle where investors are becoming more discerning."

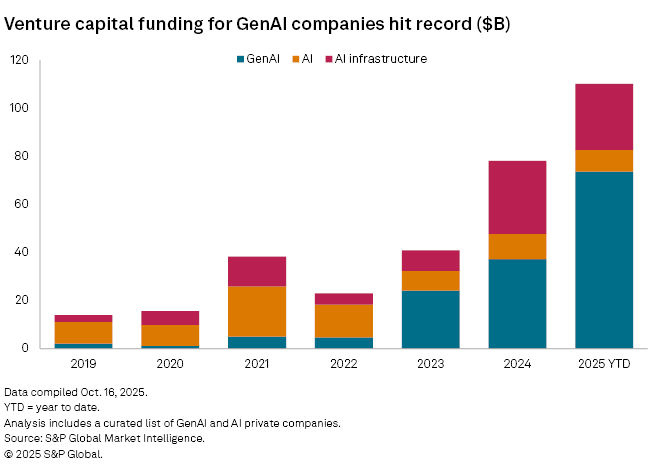

In the AI infrastructure layer — which includes companies providing AI development platforms, data management services, semiconductors and cloud infrastructure — investors deployed $27.47 billion in the first three quarters of 2025. While this figure is about $3 billion shy of the 2024 total, it will likely surpass last year's final figure of $30.31 billion by year-end.

All told, venture capitalists have invested $110.17 billion across the entire GenAI and AI value chain so far this year. This amount is nearly eight times the capital invested in 2019, a period when traditional AI startups received more funding than their GenAI counterparts.

Anthropic and Mistral AI SAS, two providers of foundation models, raised the largest funding rounds in the third quarter, both completed in September.

Anthropic raised $13 billion at a post-money valuation of $183 billion. Led by Iconiq Capital LLC, the round was co-led by Fidelity Management & Research Co. LLC and Lightspeed Ventures LLC.

Mistral, meanwhile, raised €1.7 billion at an €11.7 billion post-money valuation. The series C funding round was led by semiconductor equipment manufacturer ASML Holding NV. DST Global, Andreessen Horowitz LLC, Bpifrance Investissement SAS, General Catalyst Group Management LLC, Index Ventures, Lightspeed and NVIDIA Corp. also participated in the round.

Rounding out the five largest funding rounds in the third quarter were those completed by data and AI platform Databricks Inc., cloud infrastructure provider NScale Global Holdings Ltd. and semiconductor maker Cerebras Systems Inc.

Click here to download the data in Excel format.

Data includes a market map and funding trends for the GenAI space, encompassing AI infrastructure, AI applications, GenAI applications and agentic AI applications.

|

Read more of Market Intelligence's coverage of GenAI funding trends:

|

Bubble concerns

The frenetic dealmaking and some of the circular deals between large AI players such as NVIDIA and OpenAI have raised concerns about a potential bubble. NVIDIA agreed to be a buyer of last resort for CoreWeave Inc., which provides cloud services specialized for AI workloads. Notably, NVIDIA is a CoreWeave investor, customer and supplier. NVIDIA also agreed to invest $100 billion in OpenAI, funds that will be used to buy chips from the investor.

The circular nature of financing has evoked memories of the dot-com bubble, when companies like Cisco Systems Inc. were engaging in vendor financing. Under this practice, a seller lends money to buyers to help purchase the seller's product.

Meanwhile, new unicorns in GenAI are minted almost every day. Among the companies included in Market Intelligence's analysis, the 57 unicorns in the GenAI application layer are collectively worth $1 trillion, with OpenAI and Anthropic responsible for the bulk of that amount. For context, there are 121 publicly listed companies in the US in the application and systems software sector that have a market capitalization larger than $1 billion. When including the AI infrastructure layer, the number of unicorns jumps to 105.

|

Q3 GenAI Funding: Record volumes continue as agentic AI takes center stage |

AI demand skyrocketing

Nevertheless, demand for GenAI technology does appear to be getting stronger. Some GenAI companies are reporting record revenue growth and projections, not just at the foundation model layer but also at the application layer. Anthropic has an annual revenue run rate of $7 billion and expects to triple its annualized revenue in 2026.

There is also little doubt that organizations are frenetically seeking to adopt the technology as quickly as possible.

According to S&P Global Market Intelligence 451 Research's Tech Demand Indicator, enterprise spending intent on AI technologies ranked as the second-highest spending priority in the third quarter, behind information security. Other top spending categories, such as cloud infrastructure and data and analytics tools, are linked to organizations' desire to implement AI and GenAI tools as quickly as possible.

After a period of initial investment in GenAI technologies, organizations are starting to look more closely at whether the adoption has positively affected the top and bottom lines. A recent report from the Massachusetts Institute of Technology (MIT) showed that 95% of GenAI pilots are falling short of delivering any value. MIT pointed out that the failure is linked to the faulty integration of AI rather than the quality of AI models.

As such, strong growth rates for some companies can be short-lived. "There is so much more due diligence that needs to be done," Jalan said. "Some of these [annual recurring revenue] numbers that are being presented by companies are correct, but churn can be extremely high."

Text and code

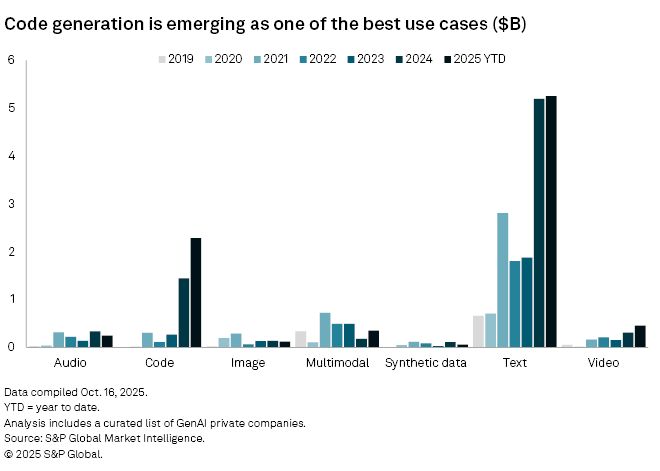

GenAI companies that generate text use cases have continued to get most funding from investors, but funding for coding use cases continues to grow. The rapid advance of coding generators like Lovable Labs Inc., Anysphere Inc. and Exafunction Inc., which typically use third-party foundation models to power their applications, shows coding as one of the key use cases where businesses see results, as programmers are more efficient.

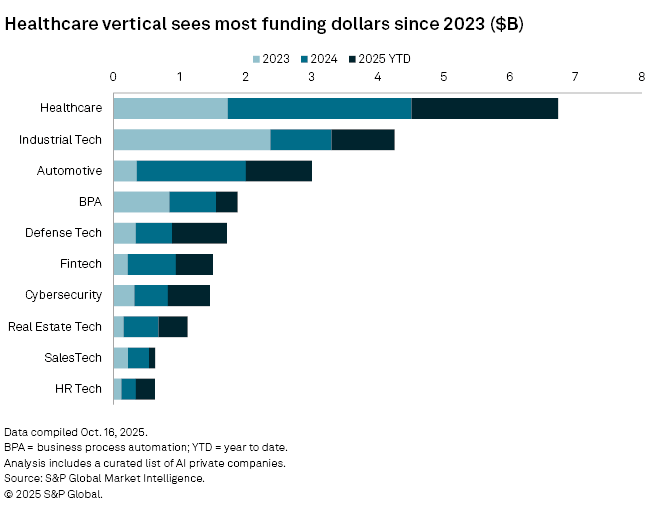

Across the AI space, some of the key verticals that saw large capital infusions from VCs include the healthcare sector, which has seen more than $6.7 billion in funding since 2023 across 254 deals, followed by the industrial and manufacturing sector and automotive, where a slew of startups developing self-driving technology using AI have been funded.

The healthcare industry, in particular, does not have clear winners in terms of attracting capital. The industry is highly fragmented, and drug discovery companies are often moonshots similar to the biotechnology sector, where many young companies fail.

Jalan notes that healthcare providers are particularly eager to experiment with AI in administrative tasks such as revenue cycle management. Clinical tasks such as wound care and medication administration are less open to AI experimentation.

Agentic AI

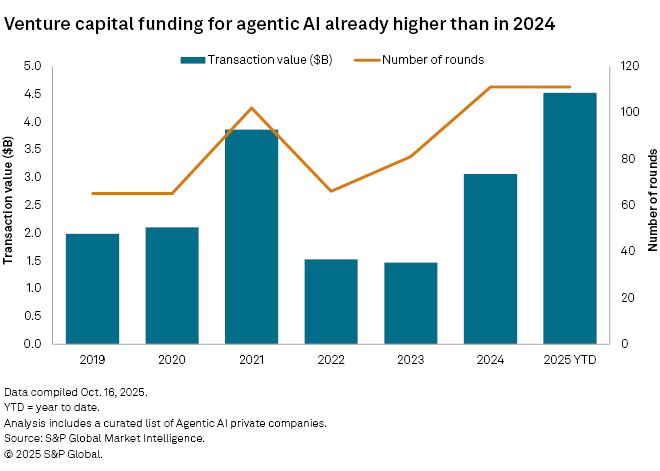

An area that has seen growing interest from investors and enterprises is agentic AI, which can be defined as an AI system that can also take action on behalf of the user rather than just generating content. Early such systems were companies in the robotic process automation sector, pioneered by companies such as UiPath Inc. and Blue Prism Group Ltd. With the emergence of GenAI, these systems can upgrade to making more complex decisions.

Most of the agents can be deployed in an enterprise context, but some of the strongest use cases so far have been in coding and programming, customer experience and workflow automation. The agentic AI space also includes some robotics companies, especially those that use AI to guide robot actions.

The largest agentic AI funding deal in the third quarter was Cognition AI Inc., a maker of coding agents that raised $400 million in a funding round led by Peter Thiel's The Founders Fund LLC at a $10.2 billion post-money valuation.

Far from peaking, the funding frenzy in GenAI shows no signs of slowing. Activity is poised to accelerate as key players — viewing the technology shift as both a critical opportunity and an existential threat — deploy capital aggressively in the battle for market share.