Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Oct, 2025

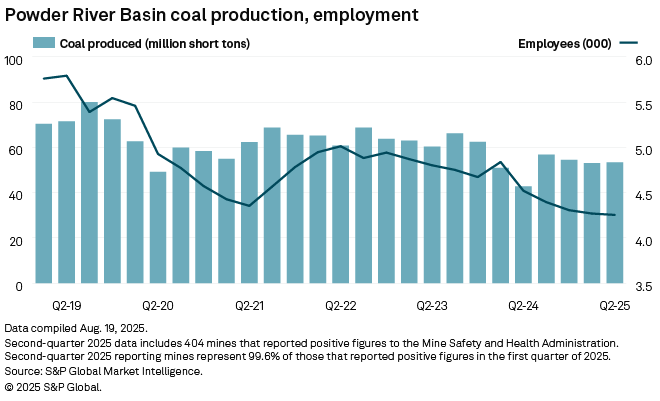

| A train delivers coal from the Powder River Basin, where producers largely produce thermal coal. Output volumes have dropped since US coal-fired power generation peaked. Source: Alan J. Nash. |

This story is the second in a two-part series on a major antitrust case that could shake up the coal industry. Read Part 1 here.

An antitrust complaint filed in 2024 by 11 Republican-led states alleges that BlackRock Inc., Vanguard Group Inc. and State Street Corp. colluded to reduce coal production by incentivizing large, publicly traded US coal miners to "operate as a cartel," but US coal production appears to have been constrained by broader economic and logistical forces.

The case drew criticism from several prominent conservative figures who warned that it could ultimately harm the coal sector by forcing a large-scale divestment or laying the groundwork for other lawsuits targeting the coal companies themselves instead. In a complaint filed with the US District Court for the Eastern District of Texas, the states said investors successfully pressured coal company management to reduce output and raise prices from 2019 through 2022. However, the complaint skips over various challenges facing the industry during the period: a regulatory push toward renewable energy, a lack of train transport, and caution among management about overextending their companies' resources.

"I think what the attorney general is broadly saying is, we want to protect American energy dominance, but this isn't the right way to get there. Coal has been declining in its use, and its production has been declining for 20 years," Thomas Aiello, senior director of government affairs for National Taxpayers Union, a conservative-leaning group that has publicly criticized the lawsuit, told Platts in an interview. "I'm not saying that government is off the hook here, but we need to look at it holistically about what the true driving forces are behind the decline in coal and the rise of energy prices."

Platts is part of S&P Global Commodity Insights.

The case highlights significant regulatory risks for asset managers implementing environmental, social and governance strategies while raising questions about the boundaries of shareholder engagement.

Complaint simplifies market narrative

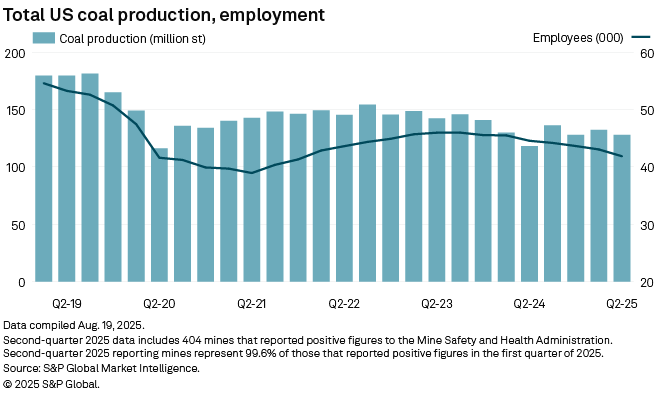

US annual coal production peaked in 2008 at 1.17 billion short tons, according to US Energy Information Administration data. Production has since mostly declined, with an occasional bounce upward. While a sharp decline in production started after the third quarter of 2019, total US coal production increased for much of the period described in the lawsuit. After another decline that started in mid-2022, producers again increased output in the first half of 2025, and Commodity Insights expects the US to produce 533 million short tons for the year.

In their initial complaint, the 11 states largely ignored the complex range of market, regulatory and investment factors in favor of a simpler allegation that the asset managers pushed coal executives to reduce production at the expense of consumers, regardless of demand.

"Defendants have immense influence over these companies on their own, but collectively defendants possess a power to coerce management that is all but irresistible," the complaint states. The defendants leveraged their shareholder status to "engage with management behind closed doors and bring about a policy of reducing coal production."

Judge Jeremy Kernodle, a Trump appointee, said his Aug. 1 decision to allow the case to proceed was a "close call" as the states' attorneys general do not have any direct evidence of conspiracy. The judge said that while "perhaps" coal production was already on a downward trajectory regardless of the asset managers' actions, such "weighty economics questions" are for another stage of the case.

Once the court reaches that stage, it will likely hear several reasons why production volumes continued to decline. BlackRock started to make that case in a Sept. 15 filing.

"As this case is now moving to discovery, BlackRock looks forward to presenting a full picture of the coal industry as the evidence will show that BlackRock did not cause coal companies to lower production, let alone coordinate with Vanguard and State Street to do so," BlackRock wrote.

Coal consumption in the United States has declined since at least 2008 due to lower demand, in part due to the widespread availability of cheap natural gas and expanding renewable energy resources.

Rail, labor shortages limit market reaction

A substantial factor not mentioned in the complaint is that while producers wanted to increase production in response to higher prices, distribution was hamstrung by a "meltdown" in US rail service. Railroads were struggling, especially in 2021 and 2022, with a shortfall in workers just as coal orders were piling up.

"Rail performance has been extremely disappointing as we worked through the quarter," John Drexler, COO of Arch Resources Inc., said on an April 2022 earnings call. Arch reported at the time that the company had sold above its guidance range but that 5% to 10% of its output had to be pushed out to later years due to rail issues.

At an April 2022 conference organized by the National Coal Transportation Association, a survey revealed that 92% of member companies indicated that deficiencies in rail service had affected their coal transportation. Additionally, 64% of those respondents reported that these issues led to changes in their operating plans during the latter half of 2021.

The "Energy Evolution" podcast from S&P Global Commodity Insights explores the shifting energy landscape. In the episode above, co-hosts Taylor Kuykendall and Eklavya Gupte explore the latest trends in coal in the United States. Subscribe on Apple Podcasts and Spotify.

"While coal is an inexpensive, efficient energy and infrastructure resource right here at home, mining companies are facing enormous difficulties getting coal to the consumer," Katie Mills, counsel for the National Mining Association trade group, wrote in testimony to the Surface Transportation Board in April 2022.

"The backlog projections are so dire that coal producers need more than 100% of shipments to not only cover for existing contracts, but to make up for what was not picked up by rail," Mills wrote. "The issue is not the number of cars on trains, it is that the trains often do not show up at all."

Mills said one unnamed coal producer reported that only 30% of its trains showed up earlier in 2022 and that the company was two months behind in filling customers' orders.

Coal companies were also finding it difficult to attract the miners needed to dig more coal. Faced with a sudden increase in demand for coal in early 2021, Joseph Craft, chairman, president and CEO of Alliance Resource Partners LP, warned that widespread negative sentiment about coal was complicating efforts to hire new workers.

"It's tough finding people who want to enter the coal business right now, in large part because of all the news headlines, I believe," Craft said on a July 2021 earnings call. Even with demand rising, Craft cautioned at the time that utilities might tap into their on-site inventories instead of turning to new coal orders.

Burned before, coal producers show restraint

The complaint also fails to capture the sentiment regarding coal's future in the US during the 2019–2022 period. Most forecasts projected

That led many producers to focus more on share buybacks, a pivot to metallurgical coal or other strategies to avoid the risk of having more coal capacity online than needed.

The rising prices mentioned in the complaint were largely viewed as being driven by anomalous events. For example, Russia's invasion of Ukraine in February 2022 triggered a spike in US thermal coal exports due to Europe's tight energy supply and low natural gas reserves.

While many companies were eager to take advantage of new demand and higher prices, they were also hesitant to overreact.

Increasing coal production often means extensive planning, permitting and investment. Much of the nation's coal is sold on fixed contracts to generators, but utilities have been hesitant in the past to extend long-term contracts to producers. Reacting hastily to rising prices by increasing production may have exposed coal companies to stranded investments.

In addition, much of the US coal sector and its leadership were only a few years past a wave of corporate bankruptcy reorganizations that was partly due to large debts incurred to expand production based on demand outlooks that never materialized. That includes some of the entities mentioned in the suit. Looming coal plant retirements, still on the books, also created an air of caution around long-term investment in coal plants and related infrastructure. In response, many coal companies pivoted from high-volume thermal coal operations in favor of operations that could tap into higher-margin, but more volatile, metallurgical coal markets.

Companies such as Arch Resources had outlined plans to wind down operations in the western US to focus on metallurgical coal assets. However, when prices began to rise as coal demand increased, these miners were willing to increase production. But they limited increases to avoid risking investment losses if the market turned due to economic or political factors.

"We'll do what we have to do to feed [our existing thermal coal mines] and keep them going. But any thought of increasing production beyond what we have the ability to do with the equipment on hand is completely out the door. I just — I can't see it," Arch President and CEO Paul Lang said on an April 2022 earnings call. "It's not what our shareholders want. And I don't think it's a good investment for us. Frankly, there are just better options out there."

In a Sept. 16 order, the court set Oct. 19, 2026, as the date for jury selection and trial.

The US District Court case is Texas v. BlackRock (6:24-cv-00437).