Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 21 Oct, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Despite the continued challenges posed by the coronavirus delta variant and global supply-chain difficulties, the top 12 global investment banks posted their highest combined first-half revenue in a decade. January-June revenue from equity and debt underwriting, mergers & acquisitions (M&A) deal advisory, and origination services grew 38% year-over-year, to $33.8 billion.

M&A has been a bright spot for global investment banks. The second quarter was the third consecutive quarter in which total announced M&A value surpassed $1 trillion, according to S&P Global Market's Intelligence. Among the reasons for this, analysts say, are the technological transformation away from carbon emissions, an abundance of “dry powder” investment in private equity, and the popularity of special purpose acquisition companies (SPACs).

Beyond advising on M&A deals, banks have also been active in pursuing acquisitions, notably in the fintech space. Following a recent acquisition spree, JPMorgan Chase CFO Jeremy Barnum indicated continuing interest in acquiring integrated and holistic services for consumers. "Acquisitions are very much a thing that we're considering," Barnum said on a media call on third-quarter results.

For some banks, M&A activity is replacing a previous focus on insurance as a means to achieve revenue diversification and cross-selling opportunities.

"The insurance business in general is kind of a slow growth industry, so in order to make meaningful strides in that area, acquisition has to be part of your model, and it definitely is for us," Brian Skinner, president and CEO of Towne Financial Services Group said in an interview with S&P Global Market Intelligence.

European banks have also seen a wave of consolidation. According to S&P Global Market Intelligence, there have already been more mergers and acquisitions in the European banking sector this year than there was in all of 2019. Thirty-nine deals had either been announced or closed so far this year.

Today is Thursday, October 21, 2021, and here is today’s essential intelligence.

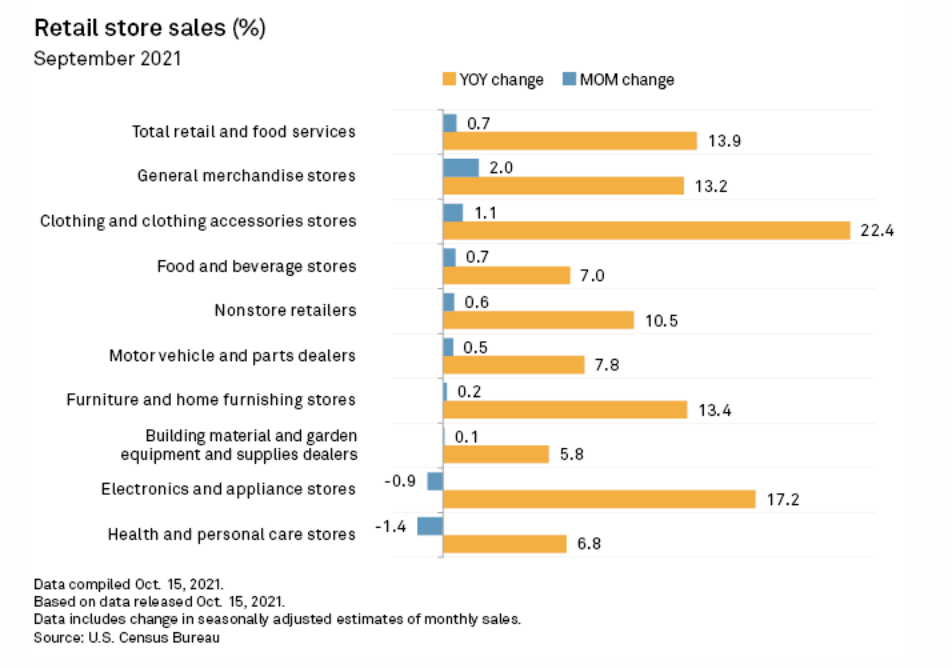

Retail Market: Supply Issues May Haunt Holidays After Sales Rise In September

Ongoing supply chain issues may hamper consumers' ability to spend during the upcoming holiday shopping season after better-than-expected retail sales in September, economists said.

—Read the full article from S&P Global Market Intelligence

Infrastructure Post-COVID-19: Funding Canadian Provinces' Rising Health Care Spending Budgets

COVID-19 has provided a catalyst for renewed health care infrastructure spending by Canadian provinces. Given provinces' need for balancing priorities, the public-private partnership (P3) model could play a more important role in delivering increased investments in health care.

—Read the full report from S&P Global Ratings

Canadian Health Care P3s: Robust Performance And Risk Mitigation Outweigh Challenges

S&P Global Ratings rates 30 Canadian public-private partnership (P3) projects, including 11 health care P3s with construction and operations and/or maintenance risk, totaling ~C$ 3.7 billion of debt.

—Read the full report from S&P Global Ratings

Cost Benefit For ESG Loans In Europe Yet To Emerge

The European leveraged loan market has not yet seen a pricing differential between transactions that include a margin ratchet linked to environmental, social, and governance-related criteria and those that do not, according to LCD data.

—Read the full article from S&P Global Market Intelligence

LCD Monthly Newsletter: September 2021

Backed by 20+ years of exclusive data, Leveraged Commentary & Data (LCD) brings you the latest news and research on the leveraged finance markets. This is a monthly newsletter that brings you select LCD news, trend stories, and data snapshots.

—Read the full article from S&P Global Market Intelligence

S&P Global Clean Energy Index: A Path Toward Greater Transparency

In April 2021, the S&P Global Clean Energy Index underwent changes to reduce constituent concentration, ease liquidity limitations, and improve index replication. The total number of constituents rose, and the weighting scheme was modified.

—Read the full article from S&P Dow Jones Indices

Volatility Returned In Q3 2021 With Latin American Equities Posting Mixed Results Amid Political And Economic Uncertainty

Latin American equities had a rough Q3 2021, as the S&P Latin America BMI fell 14.7% in USD terms, driven by a steep drop in Brazilian equities and the U.S. dollar strengthening against local currencies. This weak result offset sizable gains from earlier in 2021, leaving the regional benchmark with a 7% loss YTD.

—Read the full article from S&P Dow Jones Indices

Watch: Root And Branch - October 2021: Latest CLO News And ESG Scoring Of It's Assets

In this month’s Root & Branch Nina and Chris discuss the latest CLO from Partners, which includes internal ESG scoring of its assets, the Amedes deal, and why the ESG margin ratchet was taken out of the deal, plus the latest research on the pricing differential for loans with and without an ESG margin ratchet.

—Watch the full video from S&P Global Ratings

Global Islamic Benchmarks Near Flat in Q3 2021, Narrowly Trailed Conventional Benchmarks YTD

Global equities retreated, declining 1% during Q3 2021, as measured by the S&P Global BMI. Shariah-compliant benchmarks, including the S&P Global BMI Shariah and Dow Jones Islamic Market (DJIM) World Index, declined similarly, each losing 0.8% during the period.

—Read the full article from S&P Dow Jones Indices

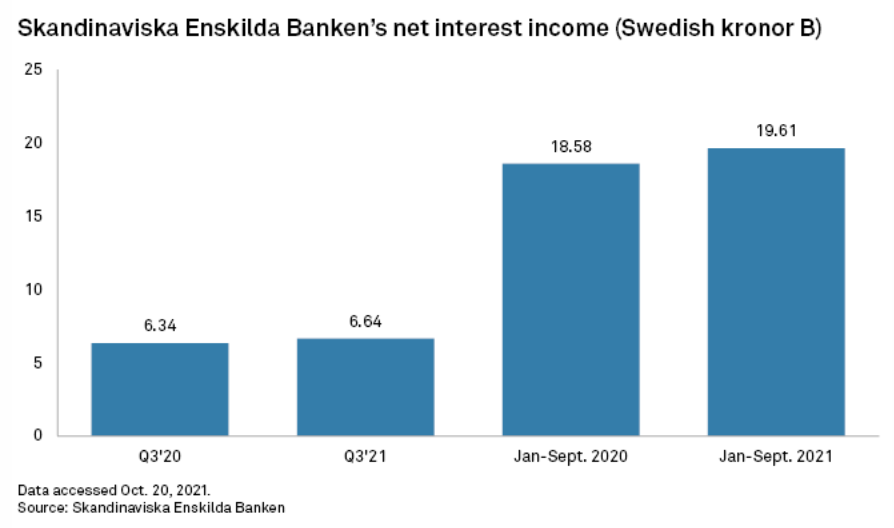

Swedish Bank SEB To Bulk Up Advisory Business

Swedish bank Skandinaviska Enskilda Banken AB (publ) is aiming to invest in its advisory business as it expands its corporate and investment bank, according to CEO Johan Torgeby.

—Read the full article from S&P Global Market Intelligence

China's Property Woes, Sagging Growth In Southeast Asia Pose Risks To Banks

Banks in some Asia-Pacific countries face downside risks as a shaky Chinese property sector and slower economic growth in Southeast Asia threaten the stabilizing outlook for lenders, according to S&P Global Ratings.

—Read the full article from S&P Global Market Intelligence

The Future Of Banking: Growing Digitalization Of Brazil's Financial System Will Foster Efficiency And Intensify Competition

The Brazilian banking sector has been evolving rapidly, not only through the digitalization of existing banks, but also through the emergence of several digital-born banks, payment institutions, and financial technology companies (fintechs).

—Read the full report from S&P Global Ratings

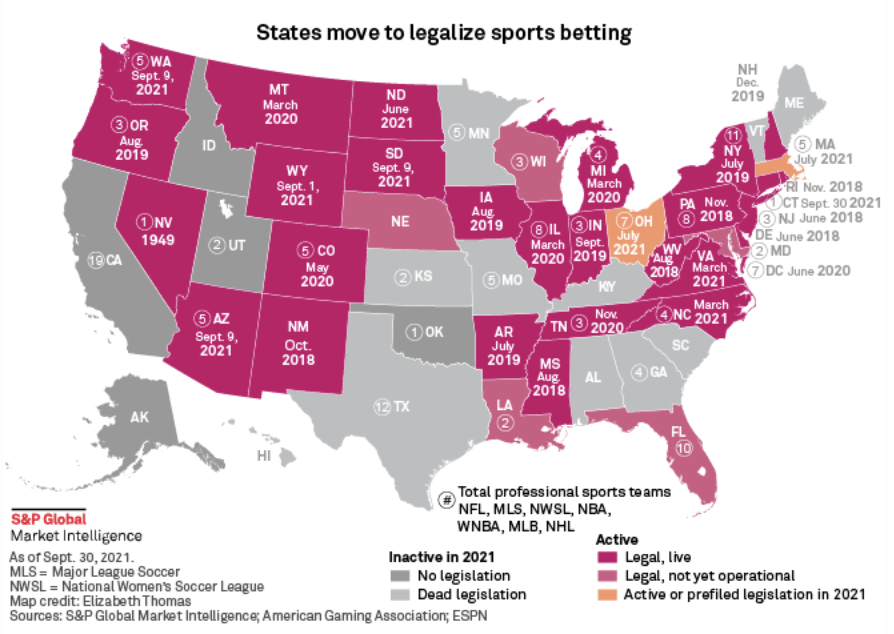

Online Wagering, Engaged Fans Key To Sports Betting Growth

An estimated 45.2 million Americans are forecast to place a wager on the NFL in some fashion during this season, up 36.2% from the 2020-21 campaign, according to a study conducted for the American Gaming Association, or AGA.

—Read the full article from S&P Global Market Intelligence

$22.6B Mexican Lithium Mine Bogs Down In Drug Cartel, Tech Risks

In 2015, the discovery of a massive lithium deposit south of the U.S. border led electric vehicle giant Tesla Inc. to announce a deal with Canadian miner Bacanora Lithium PLC. The automaker agreed to buy an undisclosed amount of lithium chemicals for its Nevada Gigafactory from Bacanora's proposed mine in the state of Sonora in northwest Mexico, creating the potential for a new branch of the North American battery supply chain.

—Read the full article from S&P Global Market Intelligence

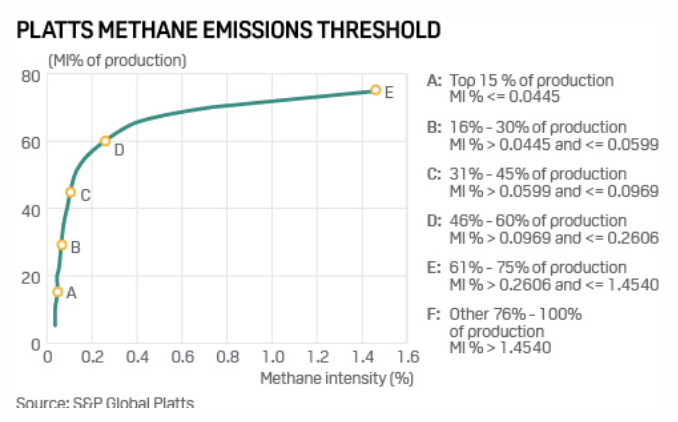

Methane Performance Certificates To Bring Price Transparency To Emission Reduction Efforts

Over the last 15 years, the global move away from coal has led to a surge in global natural gas demand. However, with that transition, it has become clearer that methane emissions from natural gas production, transportation, and end-use have exacerbated global heating.

—Read the full article from S&P Global Platts

Amazon, IKEA, 7 Other Multinationals Pledge Zero Marine Emissions By 2040

Amazon.com Inc., IKEA AB, Michelin, and six other multinational companies announced Oct. 19 that they will begin to replace maritime shipping oil with cleaner fuels with the goal of operating 100% zero-emission vessels by 2040.

—Read the full article from S&P Global Market Intelligence

Europe Retains Leading Role In Green Finance, But Other Centers Gaining – Z/Yen

Europe will need to ensure its regulatory regime is robust if it is to retain its position as the leading region for global green finance activities, according to London-based think tank Z/Yen Group.

—Read the full article from S&P Global Market Intelligence

UN Warns Global Fossil Fuel Output Targets Well Above Climate Goals

The world's governments plan to produce more than twice the amount of fossil fuels in 2030 than would be consistent with limiting global warming to 1.5 degrees C, the United Nations said Oct. 20 in a report detailing a persistent "production gap" between polices and key climate goals.

—Read the full article from S&P Global Platts

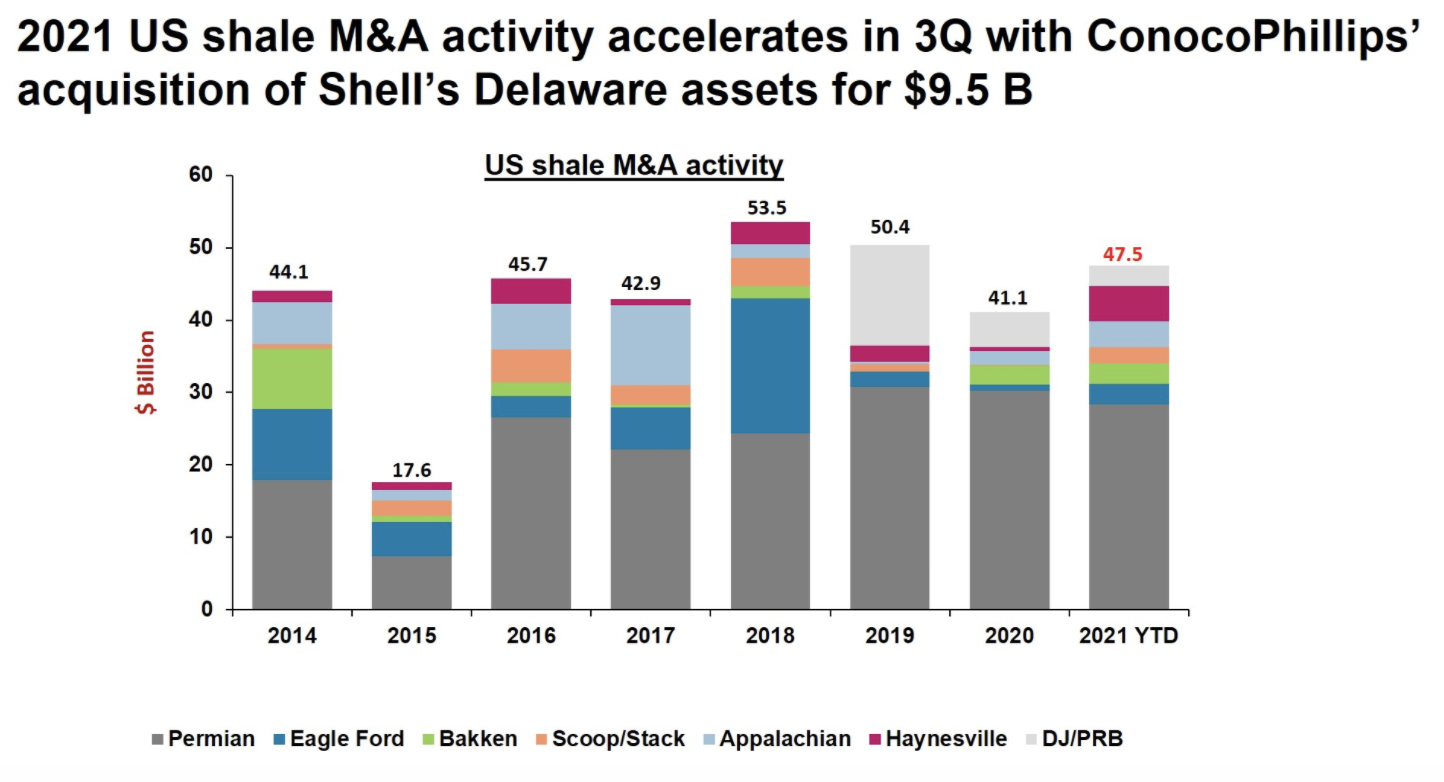

Spotlight: U.S. M&A Activity Continues To Grow In The Fourth Quarter

M&A activity has continued to increase with three deals thus far in the fourth quarter, totaling roughly $330 million. Northern Oil and Gas bought non-operated interest in 400 Bakken wells from Comstock Resources for $154 million. An undisclosed buyer purchased 22,000 net acres in the Eagle Ford from Callon Petroleum for $100 million. SilverBow Resources purchased 17,000 net acres in the Eagle Ford from two sellers for a total of $75 million.

—Read the full article from S&P Global Platts

Crude Oil Prices Turn Green On Surprise U.S. Inventory Draw

Crude oil futures turned higher midmorning Oct. 20 on the back of an unexpected draw in U.S. crude oil inventories. Total commercial crude stocks fell 430,000 barrels in the week ended Oct. 15 to 426.54 million barrels, U.S. Energy Information Administration data showed Oct. 20, putting them around 6% behind the five-year average for this time of the year.

—Read the full article from S&P Global Platts

Putin Says Rising European Gas Prices Not In Russia's Interests: Report

Russian President Vladimir Putin attributed current high price levels to a fall in coal and nuclear production in some countries, a harsh winter last year, low levels of wind generation, higher demand in Asia, and insufficient injections into underground gas storage.

—Read the full article from S&P Global Platts

India Says Rectifying Oil Demand, Supply Imbalance Crucial For Recovery

India said Oct. 20 that surging oil prices could potentially create hurdles for a post-pandemic economic recovery and urged the world's leading producers to take steps to potentially rectify the current supply and demand imbalances.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language