Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 21 Jun, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

‘S’ Factor In The Spotlight

The ‘S’ in environmental, social, and governance (ESG) considerations has—in the aftermath of the coronavirus crisis in 2020, the death of George Floyd in 2021, and current geopolitical shocks—shaped some companies’ strategies, some investors’ activities, and some policymakers’ decisions. A focus on stakeholder capitalism, gender and racial diversity, income inequality, human rights abuses, and companies' broader role in society is intensifying.

Despite increasing disclosure efforts, board quotas, and diversity, equity, and inclusion initiatives, inequalities remain.

“Instead of thinking about categories, and then asking your employees to report based on those categories that you predefine, the best approach might be to start from our employee base, to start to have an understanding of how your employees identify, and to try and build on from that to categorize people in a way that enables you to track your performance regarding your DEI goals,” Marie Froehlicher, an ESG analyst at S&P Global, told S&P Global Market Intelligence’s Next In Tech podcast this month. “We see companies starting to report more and more on intersectionalities, especially when it comes to gender and race or ethnicity, [but] a little bit less when it comes to LGBTQI+ identity because for the moment, generally, companies are not really reporting on that indicator at all.”

S&P 500 companies last year welcomed their most diverse class of new directors to their boards, according to the 2021 U.S. Spencer Stuart Board Index. Black or African-American directors accounted for 33% of the new representation, followed by women at 30%.

"We know that diverse workforces and inclusive cultures are more likely to exceed financial targets," Miriam Lewis, the chief inclusion officer at the Iowa-headquartered insurance company Principal Financial Group, told S&P Global Market Intelligence last month. Such companies are also "more likely to have [a] high performing organization with more innovation, more agility and ... [to] achieve better business outcomes.”

But as companies grapple with their diversity data and disclosure, Black employees still hold just 5.3% of management positions in American companies despite accounting for 10.7% of the U.S. workforce, according to the S&P Global Corporate Sustainability Assessment. Black and Latinx households are more likely than white households to lack access to a laptop or other connected device at home, facing an economic disadvantage, according to S&P Global Market Intelligence. Impending regulation threatens to create another digital divide dismantling equitable access to the cryptocurrency market, where Black Americans own more decentralized assets than white investors.

Today is Tuesday, June 21, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

Global PMI: What To Watch In The Flash PMIs For June

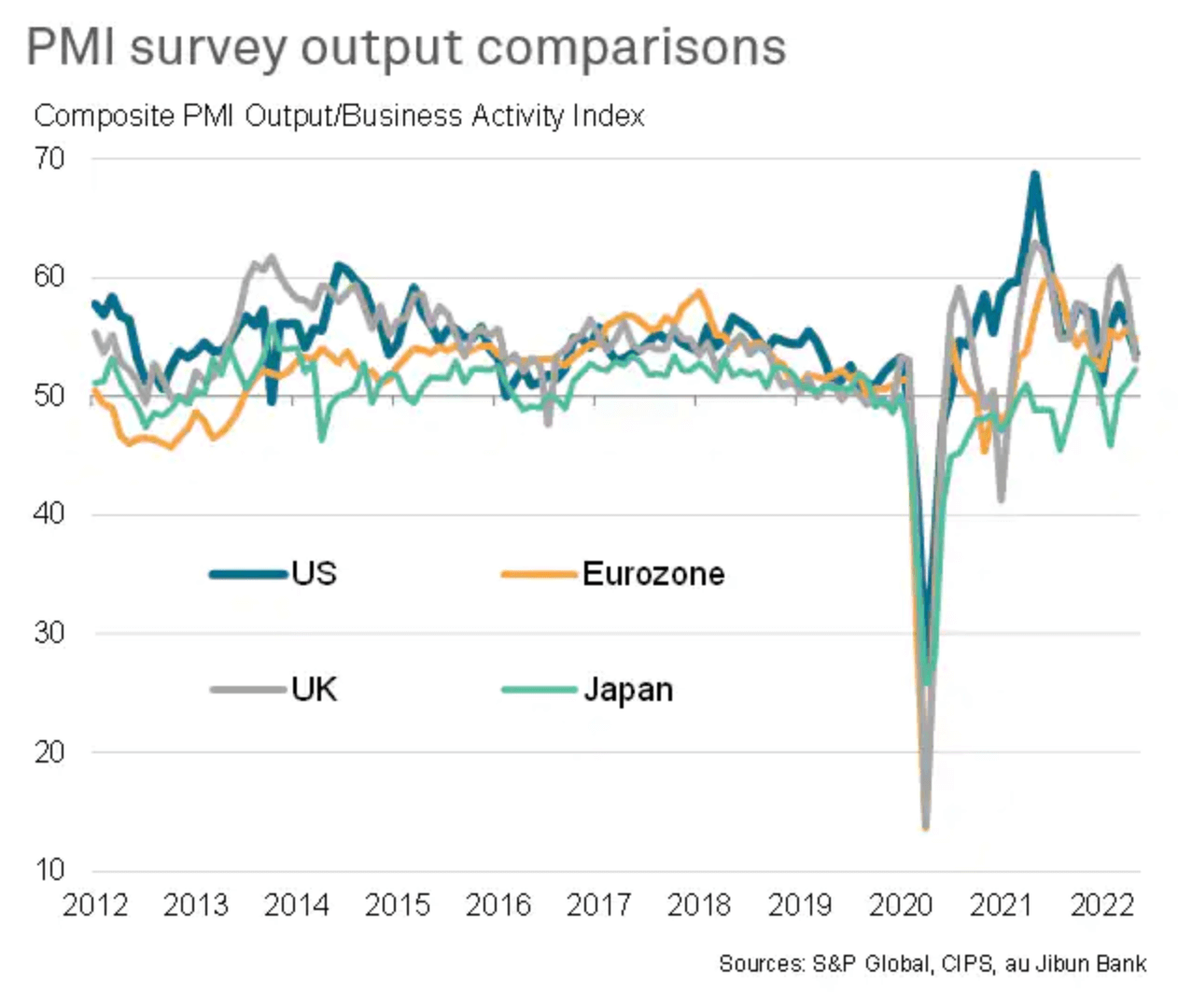

The upcoming June flash PMI data for the U.S., U.K., Eurozone, and Japan will be eagerly assessed for clues as to the persistence of elevated inflation rates and the resilience of economic growth in the face of current headwinds. May's PMI data indicated that, if mainland China is excluded, global growth retained encouraging resilience. Although losing some momentum, the global PMI's output index excluding China remained indicative of annualized GDP of around 3.5%.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Monetary Tightening To Test Australian RMBS

The resilience of Australia's RMBS sector is about to be tested. Borrowers already saddled with large household debt and high exposure to variable rates have a fresh burden: monetary tightening. Borrowers' sensitivity to rising interest rates varies across the Australian structured finance sector. In this analysis, S&P Global Ratings looks at the fundamental credit attributes of borrower cohorts, average loan balances, fixed-rate exposures, leverage levels, and historical drivers of arrears movements to provide some insights on the Australian RMBS sector's likely resilience to rising interest rates.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

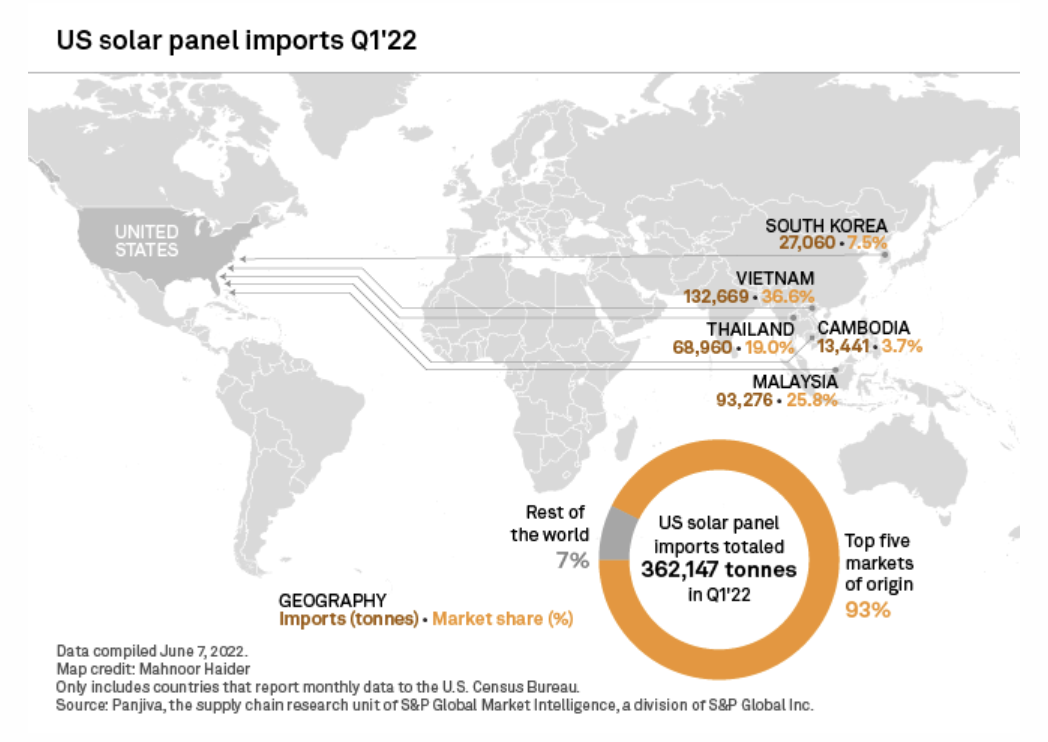

Solar Market Braces For New U.S. Trade Restriction On China

Almost two years after America's solar industry started trying to insulate itself from alleged labor abuses in China, companies are about to find out if their supply chains can withstand a new U.S. trade ban. U.S. Customs and Border Protection, or CBP, on June 21 will begin enforcing the Uyghur Forced Labor Prevention Act, which outlaws products made in China's Xinjiang region unless importers can prove goods were not produced with forced labor.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

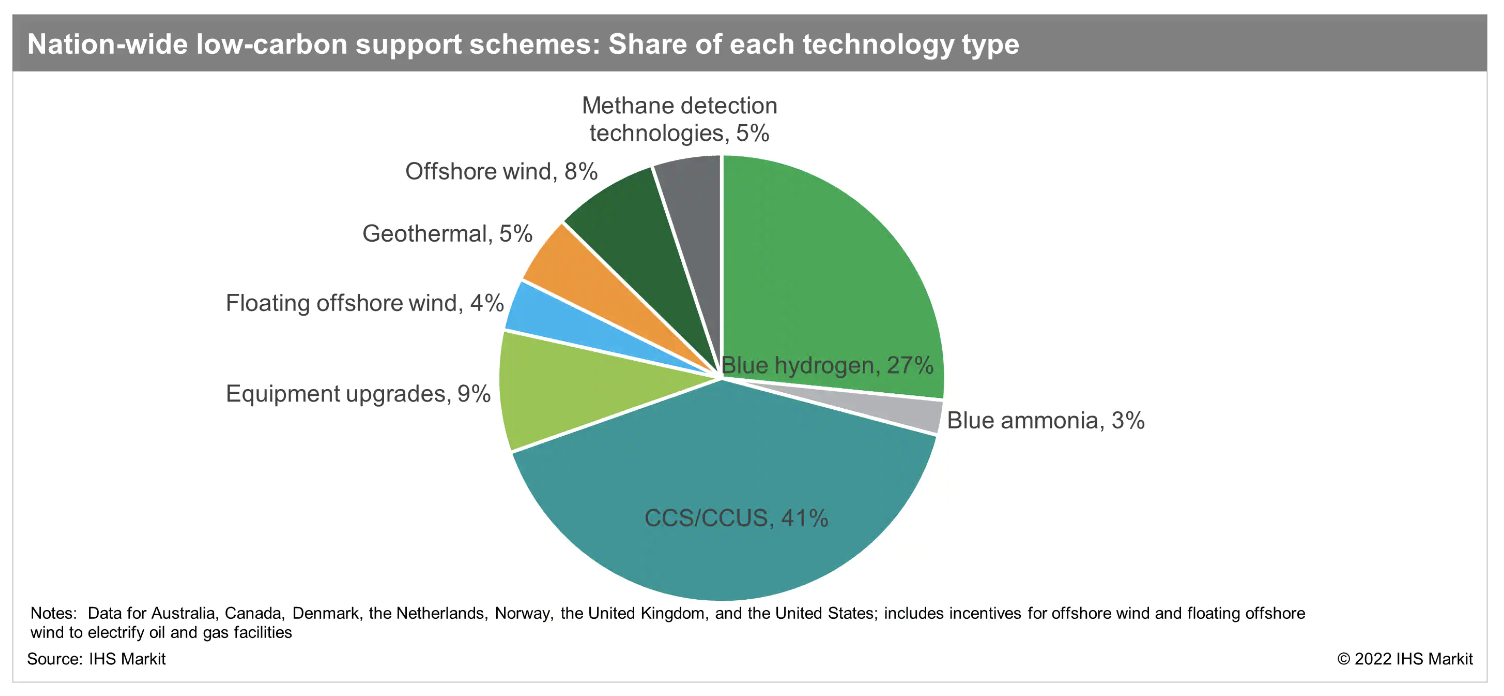

Governments Increasingly Adopt Incentive Schemes To Encourage Decarbonization Of The Oil And Gas Industry

Oil and gas producing countries across the world are rolling out policies and regulations to boost investment in emission-reduction technologies and decarbonization of the of the upstream sector. In recent years, seven diversified producers—Australia, Canada, Denmark, Norway, the Netherlands, the United Kingdom, and the United States—have led global efforts in establishing regulatory frameworks to facilitate the energy transition in the oil and gas industry.

—Read the article from S&P Global Commodity Insights

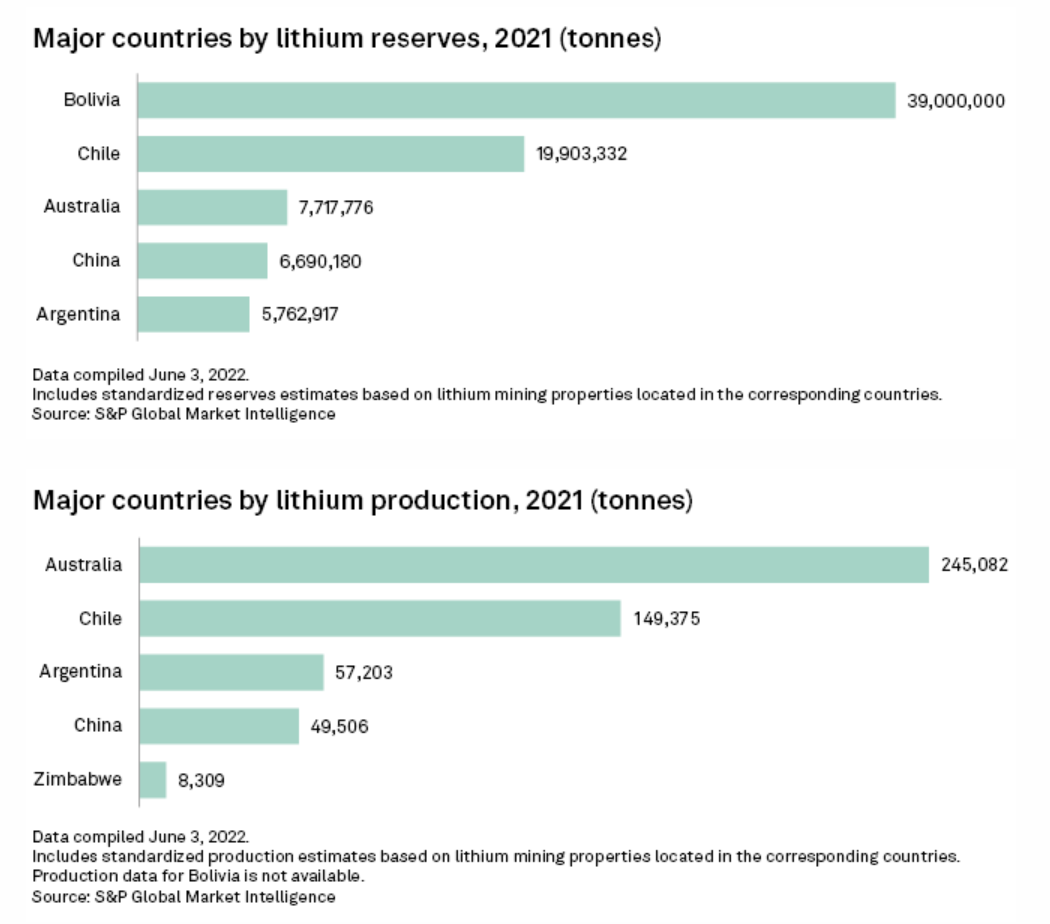

Chile At Risk Of Missing Lithium Boom Amid Political, Policy Instability

Chile may miss out on the lithium price boom if it cannot set policy to allow development of its vast reserves. With lithium prices soaring through most of 2021 and 2022, major miners have been eyeing Chile as a potential new source of the white metal. But Chile has been flailing for half a decade to create a legal framework to sell concessions to developers to extract its 19.9 million tonnes of lithium reserves, according to S&P Global Market Intelligence data, and the country has only issued a handful of permits.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

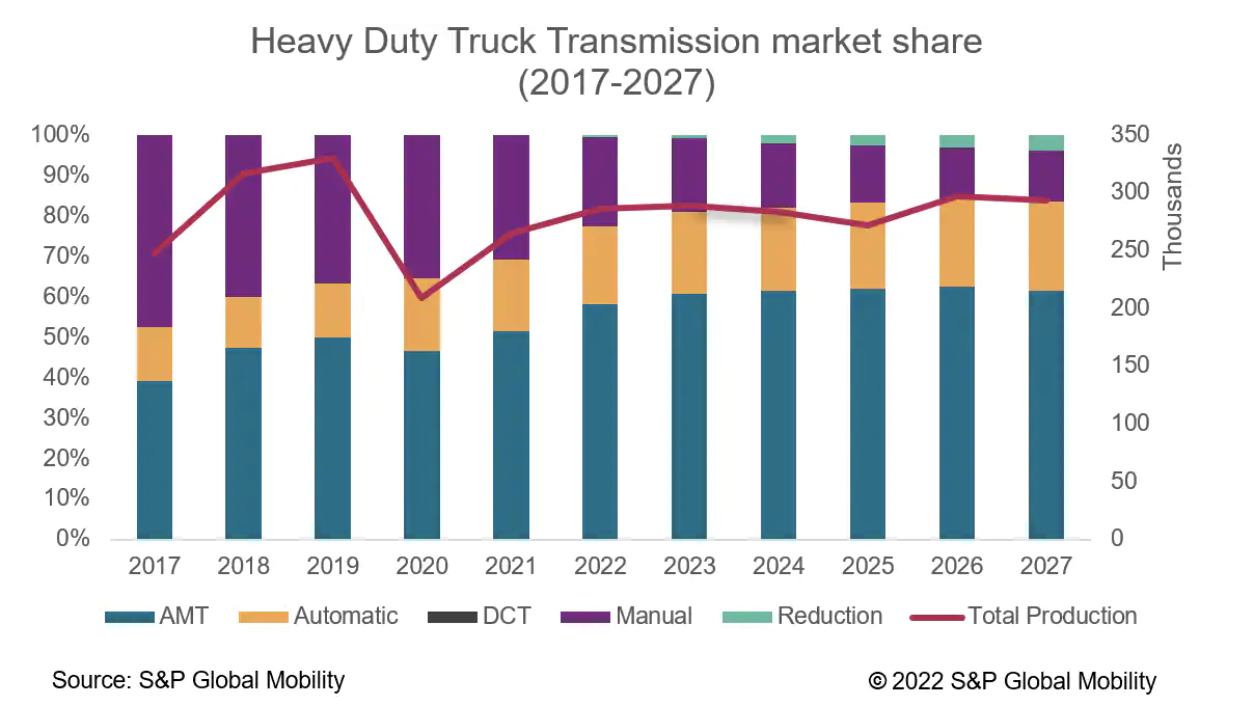

North America Truck Transmission Market

The truck transmission market in North America is gearing up (no pun intended) for a major shift towards AMT & AT. Over the last decade, advancement in software technology has led to an increase in the adoption of Automated Manual Transmissions and Automatic Transmissions. In the coming years, while manual transmissions may fall further as a share of the total, the market will see inroads from a new technology, reduction transmissions, which will support rising numbers of battery-electric trucks.

—Read the article from S&P Global Mobility