Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 7 Feb, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Rough Road Ahead for Chemical Industry

On the heels of a turbulent year, clear skies may not be on the horizon yet for the chemical market. As the risk of a mild recession gains momentum, experts are predicting a rough ride for the industry, at least in the first half of 2023.

The chemical industry plays an integral role in the modern world, converting raw materials into countless products used in everyday life, including household goods, fertilizers and pharmaceuticals. Like most sectors, the chemical market was not immune to the challenges posed by the chain reaction of events over the past three years, from the COVID-19 pandemic that caused supply chain disruptions to the war in Ukraine that triggered an energy crisis.

In 2023, recession concerns, high inflation and rising freight costs add to the uncertainties facing the chemical industry. Although logistical issues that plagued chemicals in the past couple of years are improving, concerns such as the chassis shortage in the U.S. and a lack of trucks in Europe continue. Supply will remain tight for upstream products, petrochemicals and their feedstocks due to the Russia-Ukraine crisis. However, the easing of China’s zero-COVID policy is likely to spark demand recovery, increased competition and a supply glut as more products come out of the country.

In the petrochemical arena, polymers and olefins are projected to see weak demand and oversupply in the first six months of the year, affecting the downstream market of aromatics. Petrochemical gasoline blendstocks may remain in demand and face limited supply, market sources said. Demand for butadiene could pick up globally, driven by the potential for higher prices and export opportunities from Europe to the U.S. alongside limited outflows from Asia.

Weak demand, high costs and global overcapacity in the petrochemical segment could also lead to short-term shutdowns in 2023, especially in Europe, according to Tony Potter, S&P Global Commodity Insights' global vice president of specialty chemicals. "In the longer term, some permanent shutdowns are needed in Europe, given the European [petrochemical] industry’s lack of competitiveness and ongoing oversupply," Potter said.

In the Middle East, the petrochemical outlook for the first half is much more positive. Although the rate of production growth will likely slow in 2023, Middle Eastern petrochemical companies will continue to benefit from relatively cheap feedstock and the region's proximity to key markets. The companies anticipate a demand turn-up toward the end of the year, Chemical Week Markets Editor Mark Thomas said on a recent episode of S&P Global Commodity Insights' “Chemical Week” podcast.

"Recession fears in 2023 are real," but petrochemical companies in the Middle East already “see a way out of it," Thomas said, adding that oil companies in the region, such as Saudi Arabia’s Aramco, are accelerating investments in crude oil-to-chemical projects.

In the event of a recession, S&P Global Ratings analysts expect petrochemical companies to see weaker earnings and credit metrics in Europe, the Middle East and Africa, as well as in North America. Speculative-grade chemical issuers in EMEA are deemed to be at greater risk of negative ratings actions, while their counterparts in North America are likely to face refinancing risk, which could translate into downward ratings pressure.

The energy transition, or the move away from fossil fuels to renewable sources, is creating new challenges and opportunities for the petrochemical sector. Petrochemicals, which are mainly derived from crude oil and other fossil fuels, account for about 25% of crude oil demand globally, Thomas said. This makes the sector a major direct emitter of carbon. Petrochemical producers will need to manage carbon resources while reducing the environmental footprint of their operations, according to Anne-Sophie Bescond, petrochemical research and analysis associate director at S&P Global Commodity Insights.

With more than 50% of base chemicals ultimately used in plastic production, recycling plastics will help recapture carbon content and lower the need for fresh feedstocks upstream. This and other plastic circularity solutions will be crucial in helping the world reach its net-zero carbon emissions targets, Bescond said.

Today is Tuesday, February 7, 2023, and here is today’s essential intelligence.

Written by Pam Rosacia.

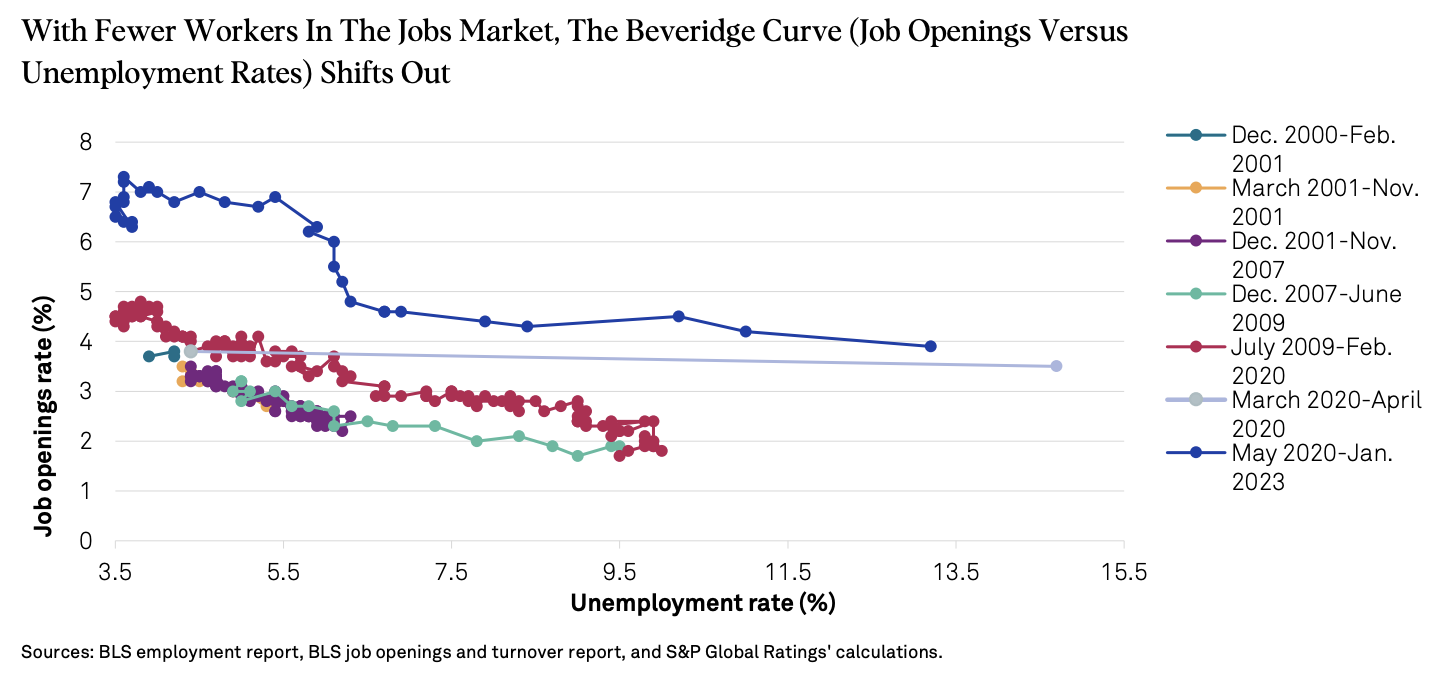

Economic Research: January Jobs Report: So Much For Moderation

January payrolls surged by 517,000, according to the Bureau of Labor Statistics, more than twice the 185,000 expected by markets. Gains were broad-based. Despite consecutive rate hikes from the Federal Reserve, the job gains were stronger than the average monthly gains of 401,000 last year. While weather distortions are partly to blame, it’s not just January. Gains for the prior two months were revised up. The labor market appears to be even stronger than earlier thought, which seems to confirm Fed Chair Jerome Powell's view that “we have a long way to go” in stabilizing inflation.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Good Things Come In Threes: Muni Bonds Appear Ripe For 2023

With one month down in 2023, let’s track the performance of municipal bonds so far: as of Jan. 31, 2023, the yield for the S&P National AMT-Free Municipal Bond Index was at roughly 3% (3.02% to be exact). The total return was up about 3% for January (2.87% to be exact), putting a dent in last year’s sell-off to provide a one-year return of “only” -3% (-2.97%). With rates rising, new opportunities are being uncovered and investors are seeking new ways to access the municipal bond market.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

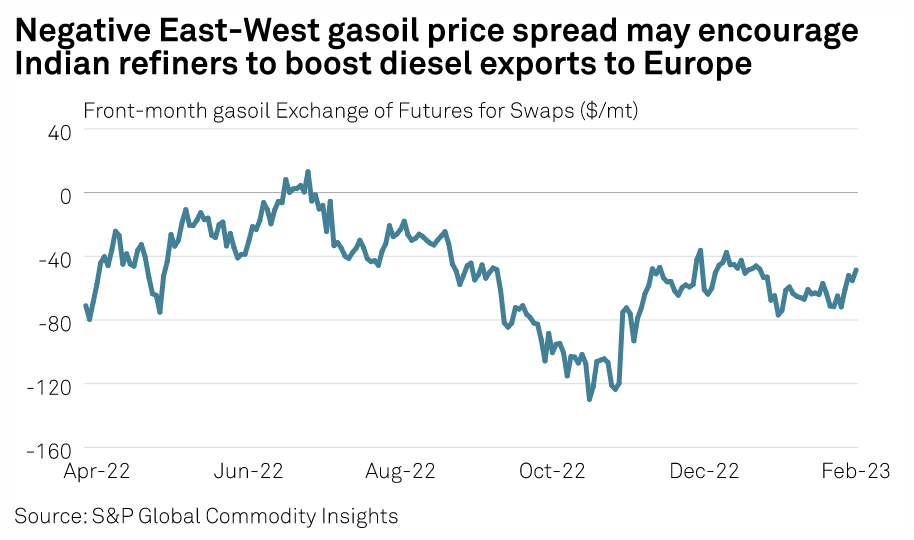

Asia Prepares For Two-Way Oil Product Flows As EU Ban, Price Cap Take Effect

Asia is preparing to see more Russian oil products flowing into the region following the EU ban that came into effect Feb. 5, while the supply squeeze in the West will create ample opportunities for Asian refiners to cater to those requirements and reap lofty margins. However, shipping costs and logistics will pose challenges as long-haul product shipments in relatively small tankers all the way from Asia to destinations in regions such as Europe may not be viable commercial options unless the arbitrage window is wide enough, analysts and trade sources told S&P Global Commodity Insights.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: How Financial Institutions Are Tackling Scope 3 Financed Emissions

In this episode of the ESG Insider podcast, hosts Lindsey Hall and Esther Whieldon are digging into the steps financial institutions are taking to reduce emissions across their value chain. They speak to Laurent Babikian from environmental nonprofit CDP and hear from Samu Slotte, the global head of sustainable finance at big Danish lender Danske Bank. And they talk with Antoni Ballabriga, the global head of responsible business at Spanish bank BBVA.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

Key Trends For India’s Power And Renewables Markets In 2023

As 2023 kicks off, India shows resilience to handle price shocks. Electricity demand in 2022 grew by 8.7% after continued recovery from COVID-19-related disruptions and intense heat waves that swept the country during a prolonged summer. On the supply side, coal generation increased by 8.7%, resulting in higher emissions. Energy security and affordability remained top priority in 2022 to navigate the energy crisis. Hence, efforts to improve domestic coal production, mandates for coal imports and an emphasis on expanding local manufacturing remained interesting developments in 2022.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Digital Marketplaces: Gaining Traction

Knowde founder and CEO Ali Amin-Javaheri joins CW editor Rob Westervelt to discuss how digital marketplaces are gaining traction in the chemical sector, overcoming the barriers and reluctance on digital adoption from suppliers and buyers, and how venture capital views the chemical sector.

—Listen and subscribe to Chemical Week, a podcast from S&P Global Commodity Insights

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy, Climate and Security

Join global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2023 for timely dialogue, shared learning and connection.

—Register for CERAWeek