Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 3 Feb, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

OPEC+ and the Price of Conflict

When Russia launched its invasion of Ukraine, there were reasons to believe that the war, and its impact on oil markets, would be short. As the war drags on toward its first anniversary, the Russian economy is fraying and a united West has imposed sanctions on Russian crude. While OPEC and its allies, known as OPEC+, have maintained a united front, driven largely by commercial and diplomatic alignment between Russia and Saudi Arabia, the oil producers’ alliance shows signs of strain. Announced cuts in production have not kept up with falling demand and Russia has struggled to get crude into the global market economically.

Prior to the invasion of Ukraine, Russia's fiscal breakeven oil price was $64.47 per barrel. While this was different from Saudi Arabia’s fiscal breakeven oil price of $80.38/b at the time, it was relatively simple for the two leading OPEC+ powers to align on a price that made economic sense for both of them. However, war is expensive, and Russia has few alternatives to oil revenues when it comes to funding the war. As war-related costs have increased and Russia has been hit with price caps and sanctions, the fiscal breakeven price for Russian oil has jumped to $114/b, while the Saudi breakeven price is slightly lower than before the war.

The Russians have responded to this pressure by insisting they won’t supply crude oil to any customers observing the price cap imposed by the West. However, this would necessitate a further cut in production.

OPEC+ has attempted to deal with declining crude prices by cutting production. Previous cuts were borne primarily by the Gulf producers, who had the economic capacity to reduce crude production. Saudi Arabia, Kuwait, the United Arab Emirates and Iraq imposed the deepest cuts, despite pressure from the Biden administration to increase production. Russia has managed to maintain or even increase production. However, a lot of Russian crude is flowing into storage facilities rather than the open market. An EU ban and a G-7 price cap have cut off Russia from many of its usual markets.

S&P Global Commodity Insights forecast that falling demand may be the real price cap on crude oil in 2023. An uncertain outlook from China and an anticipated recession in the first half of 2023 in the U.S. and Europe may reduce oil consumption globally. Dated Brent crude is projected to average $87/b for 2023, down from a year-ago average of about $100/b. This means profitable production for Gulf states and production at a loss for Russia.

All eyes are on Asia to see if the end of most COVID-19 restrictions in China will unleash pent-up demand and lead to a price rally. Even if predictions of a recession prove inaccurate and China bounces back strong, it is unlikely that Russian crude prices will approach the level of the other members of OPEC+.

Today is Friday, February 3, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

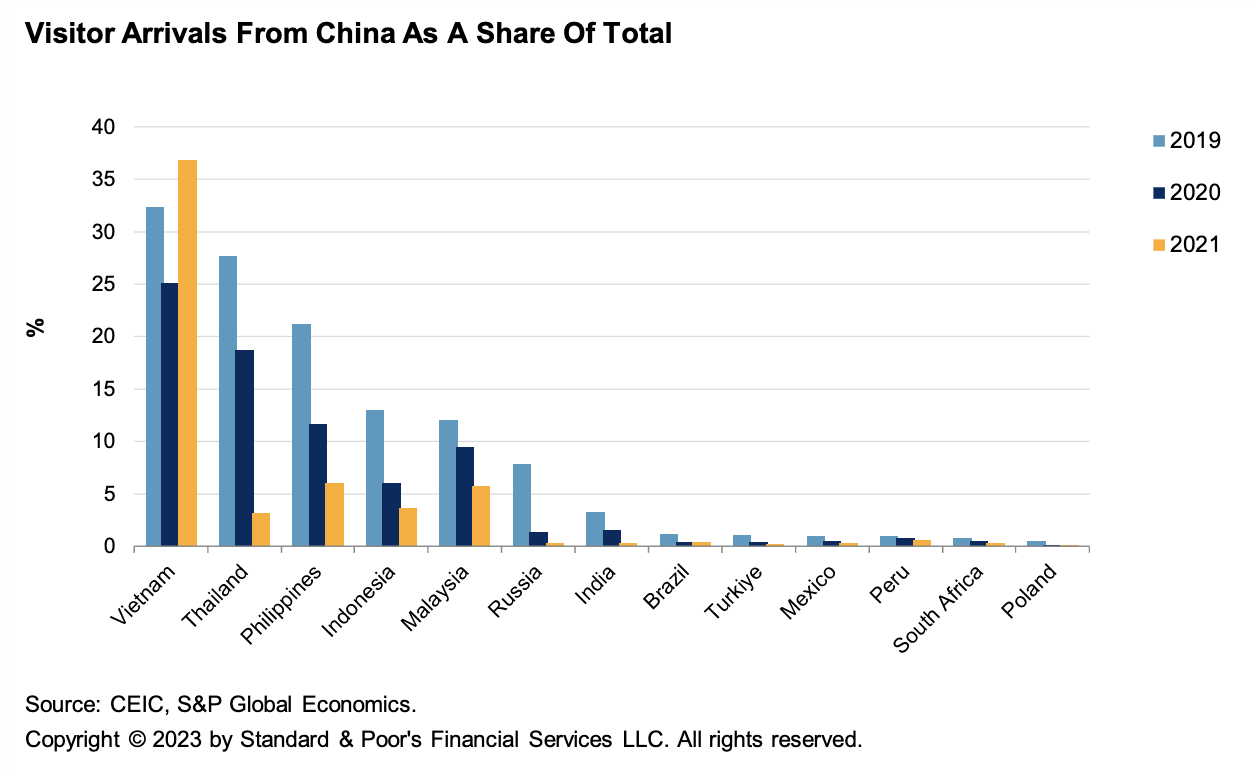

Which Emerging Markets Benefit The Most From A Reopening In China?

China has begun the rapid relaxation of zero COVID-19 policy. In S&P Global Ratings’ view, emerging markets that are exposed to China's consumption will benefit the most from this policy shift. In particular, EMs that are large recipients of Chinese tourists could benefit significantly as travel picks up after a couple years of virtually no outbound Chinese tourism. These include Thailand and Vietnam.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

U.S. Corporate Credit Outlook 2023: Profit Pressures, Refinancing Risk

Near-term profit pressures on U.S. corporate borrowers look set to intensify, as many find it more difficult to deal with still-elevated input costs and waning demand amid the prospects of a downturn in the world’s largest economy and diminished consumer purchasing power. Benchmark borrowing costs will likely go higher still, as the Federal Reserve continues its fight against inflation.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

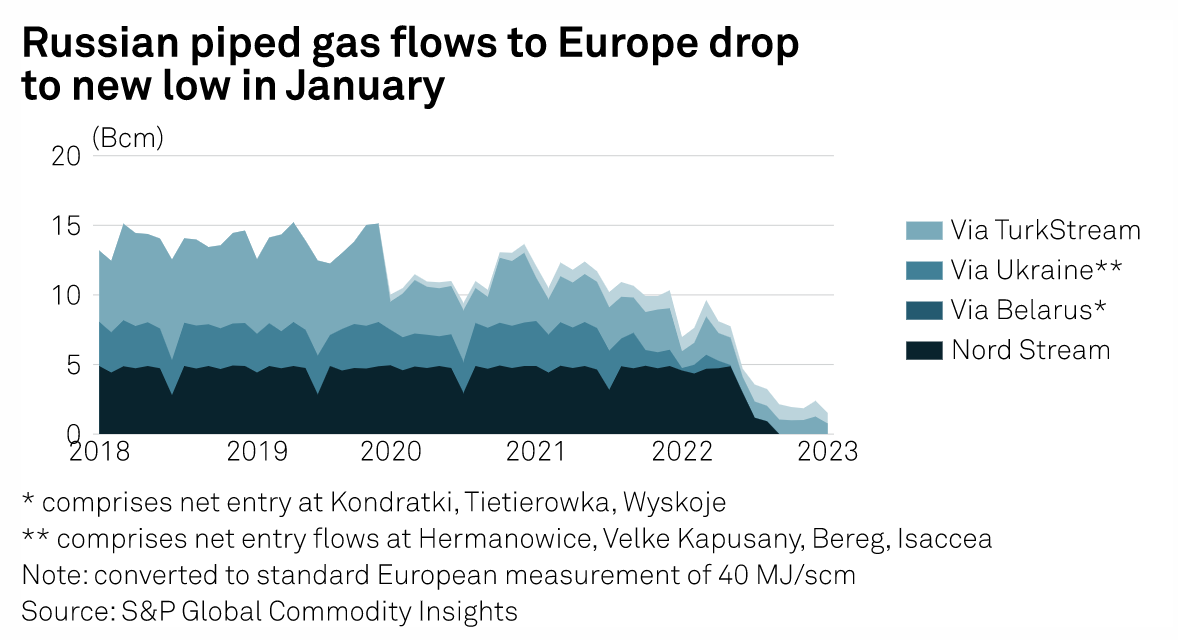

Russian Pipeline Gas Flows To Europe Drop To New Low In January

Russian gas flows to Europe fell to a new low in January of just 1.52 Bcm as deliveries via both TurkStream and Ukraine dropped, an analysis of data from S&P Global Commodity Insights showed Feb. 2. Total Russian pipeline exports to Europe in January via the two remaining major supply routes were 36% down on deliveries in December and 79% lower year on year. Russian contract prices became less competitive versus European hub prices in January as spot prices plunged, leading to a likely buyer-led reduction in imports.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

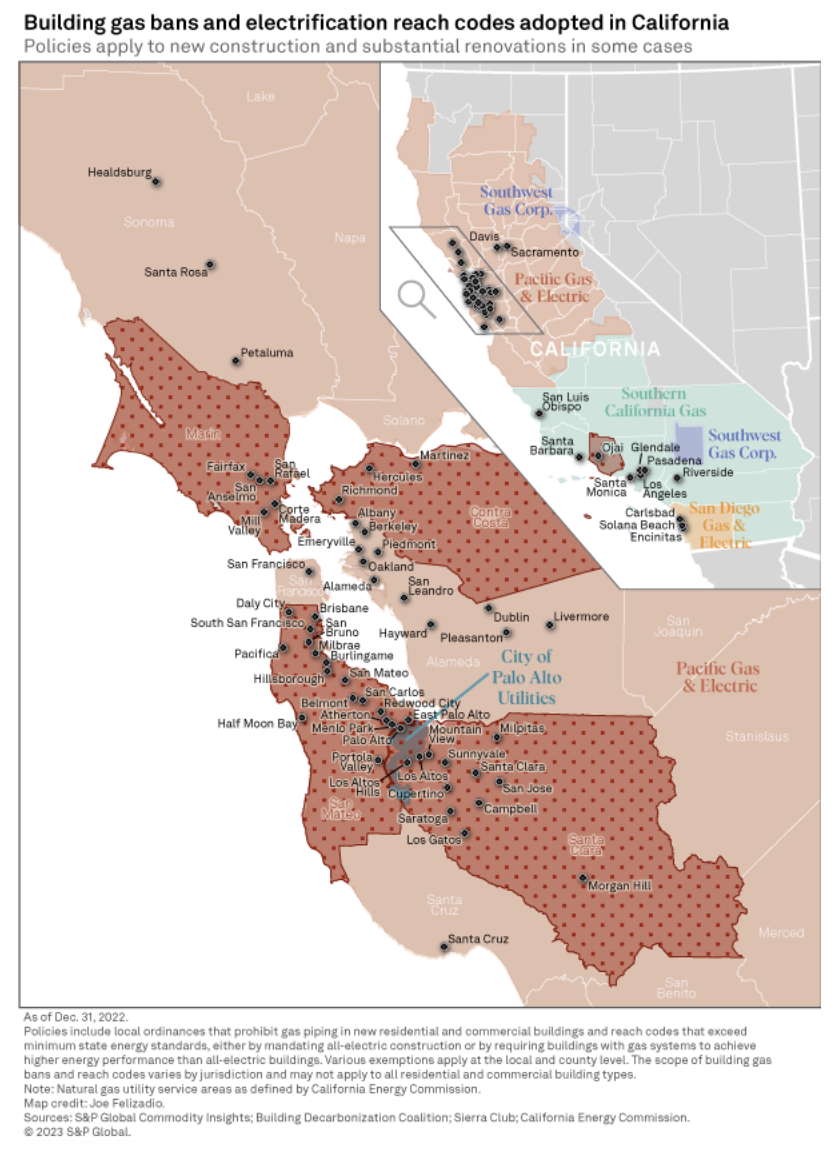

Calif. Cities Begin To Require Building Electrification Retrofits

After three years of steadily restricting natural gas use in new construction, San Francisco Bay Area communities have turned to a bigger goal: requiring existing buildings to go all-electric. A handful of towns and cities in the region have begun requiring homeowners to install electric appliances and prepare their homes for future electrification when they replace gas equipment or undertake renovations. Some communities have also set a target date for discontinuing gas service within their borders, a policy known as "end of flow."

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

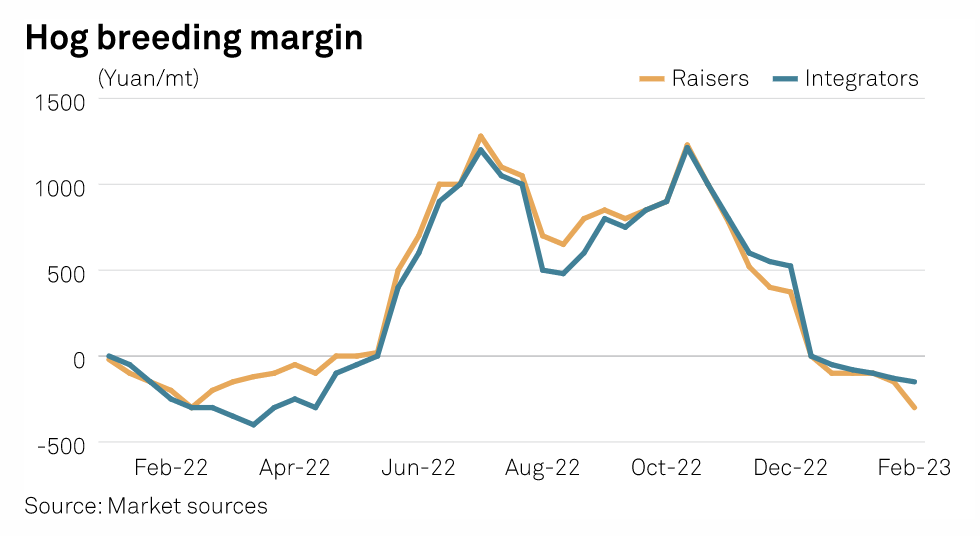

China's Sliding Hog Prices Weigh On Soybean Meal Demand For March-June

China's soybean crushers are bracing for a further fall in soybean meal demand from the feed sector from March after domestic hog prices fell for the 11th consecutive week due to excessive slaughtering and a spike in pork inventories over December and January. The hog price at slaughtering was down 17.5% month on month at Yuan 15.82/kg Feb. 1, and down 43% quarter on quarter, according to industry sources. The average hog price was Yuan 25/mt last October, before excessive restocking over October-November, an increase in slaughtering volumes and lower-than-expected demand during the Lunar New Year pressured prices lower.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 101 Data On Datacenters

Infrastructure supporting technology is often hidden from sight. Understanding fundamentals, such as where the datacenters are that house so much of what we work with every day can be a complex exercise. A source of clarity is the Datacenter Knowledgebase and analyst Stefanie Williams joins host Eric Hanselman to look at what it is and how it’s used. Capacity and resource consumption for ESG tracking are just a start.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy, Climate and Security

Join global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2023 for timely dialogue, shared learning and connection.

—Register for CERAWeek