Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 Aug, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Japan's Rising Inflation

Japan's "core core" inflation rate (which strips out energy and food prices) rose to 4.3% in May, the highest level since the 1980s. This increase in inflation began in 2021, triggered by higher energy and commodity prices.

Each March since 1954, large unions and employers in Japan have engaged in annual wage negotiations called “Shunto.” Despite inflation being driven largely by higher input costs, this spring’s Shunto talks resulted in significantly higher wage growth than in recent years. In addition, the inflation rate was amplified by a large depreciation of the yen against the US dollar amid the monetary policy divergence.

Global investors have focused on Japanese equity this year as the Bank of Japan (BOJ) continues its ultraloose monetary policy stance. The BOJ's policy rate has been close to zero since 2008, and less than zero (-0.1%) since 2016. Meanwhile, the Tokyo Stock Exchange has rallied this year, with the benchmark stock index topping 33,000 on June 13, its highest in more than 33 years.

In contrast to other Asian economies, Japan's merchandise exports in yen value terms were relatively resilient during the first half of 2023, increasing by 3.1% year over year (y/y) and rising by 1.5% y/y in June, according to S&P Global Market Intelligence. Exports of autos to the US were helped by the sharp depreciation of the Japanese yen, increasing by 36% y/y in the first half of 2023.

Japan's exports to the EU in this same half also showed strong growth in value terms, rising by 12.5% y/y and remaining strong in June, with an increase of 15.0% y/y. Exports to the Middle East have been buoyant, up by 35.6% y/y in the first half of 2023 and up by 30% y/y in June. However, the strong export growth to these markets was offset by weakness in Asia-Pacific markets, with Japanese exports to mainland China down by 8.6% y/y in the first half of 2023 and declining by 11% y/y in June.

In July, growth was mainly driven by the service sector as manufacturing output contracted. The latest composite output reading, covering both sectors, is broadly consistent with Japanese GDP growing at an annual rate of just under 2%.

The latest Purchasing Managers’ Index (PMI) price data suggests that any meaningful fall past the 2% mark is out of reach in the near term, foreshadowing stickier inflationary conditions in the upcoming months.

Of the four largest developed world economies, only Japan avoided a growth slowdown in July, with output growth ticking slightly higher compared to June. However, the upturn masked an ongoing decline in Japan's manufacturing economy and a slight cooling of the recent strong service sector expansion. An especially meager jobs gain in Japan was the smallest for the past six months.

The upcoming flash PMI on Aug. 23 will show if Japan’s July resilience and inflation story is set to continue or if this momentum will slow similar to other G4 developed economies.

Today is Friday, August 18, 2023, and here is today’s essential intelligence.

Written by Ken Fredman.

Inflation To Drive Treasury Market As US Borrowing Surges

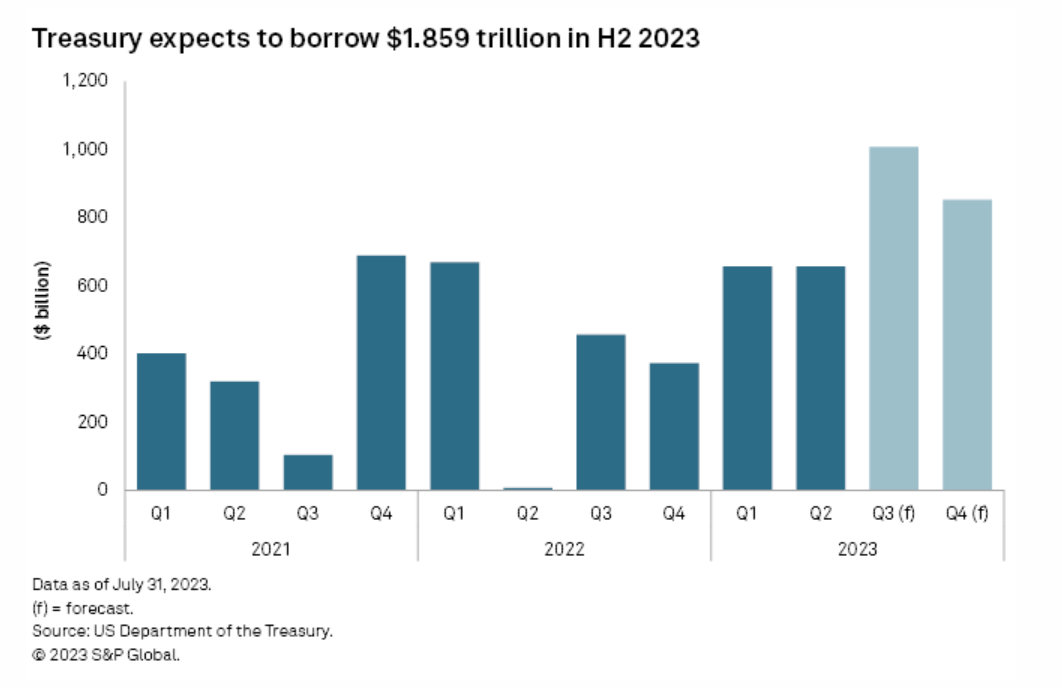

The Federal Reserve's battle with inflation will be the principal driver of yields on Treasurys even as the US government floods the market with more and more bond issuance. The Treasury plans to issue a near-record $1.859 trillion of debt in the second half of 2023, $274 billion more than previously planned in May, as it refills its coffers after running down reserves to fund operations during recent debt ceiling negotiations between Congress and the White House.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Credit FAQ: Will Country Garden's Woes Further Hobble China's Property Market?

After signs of stabilization in the first quarter of 2023, China's property market now faces another unsettling stress event. Country Garden Holdings Co. Ltd., one of China's largest and most successful private developers, has missed interest payments on two offshore bonds and suspended trading on nearly a dozen onshore bonds. In S&P Global Ratings’ view, this raises the prospect of a disorderly default and could dampen the country's slow-healing property market.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Listen: European Oil Markets After The Russian Embargo (Part 2)

For many years, Russia was Europe's main supplier of key refined oil products until Western sanctions were imposed in February 2023. Six months into the embargo on Russian refined products, markets across the continent continue to adjust. Prices appear to be rising and shipping times have lengthened as European buyers find products further afield in India, the Middle East and the US Gulf Coast. In the second of a special two-part Platts Oil Markets podcast retrospective, OPEC+ Oil News reporter Rosemary Griffin and Refined Oil Products Managers Gary Clark and Kieran Hess join Francesco Di Salvo to discuss how European oil markets have adapted to a "new normal" following one of the most consequential events in the geopolitics of oil in decades.

—Listen and subscribe to Platts Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

Planned Renewables Pave Way For Majority Carbon-Free US Generation Output

Annualizing US energy production based on currently operating and planned capacity suggests that majority carbon-free generation is on the horizon. That said, renewables have a long way to go to dislodge legacy fuels from the top spots, let alone becoming reliability contribution anchors. Complicating matters, hurdles are mounting on the US' path to net-zero, including inflation and rising costs of financing, dependence on outside markets for critical green energy materials and components and perhaps the changing climate itself.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

Ocean Mining In Focus

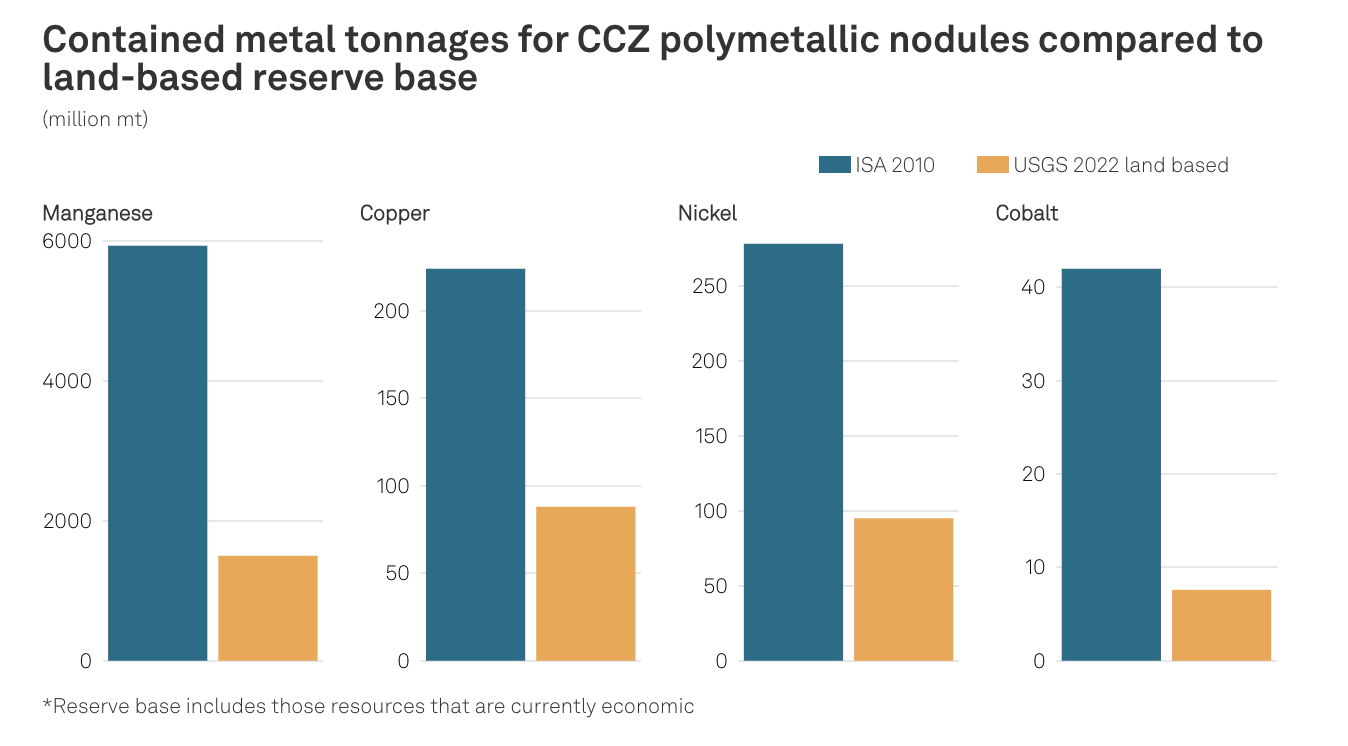

Commercial mining of the seabed has been subject to growing interest from countries and private companies in recent years after the discovery of huge undersea mineral resources containing critical metals such as copper, cobalt and nickel, which are in high demand due to the material requirements of the global energy transition.

—Read the report from S&P Global Commodity Insights

Access more insights on energy and commodities >

Watch: Streamline Your Corporate Workflow

The S&P Capital IQ Pro platform provides essential data, insights and workflow tools to help corporate professionals succeed across multiple areas. Whether you need to stay on top of global markets and industries, monitor competitor performance or benchmark against peers, Capital IQ Pro has got you covered with a single trusted source of financial, company and industry data.

—Watch the video from S&P Global Market Intelligence

Content Type

Language