Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jan, 2022

By Selene Balasta and Susan Dlin

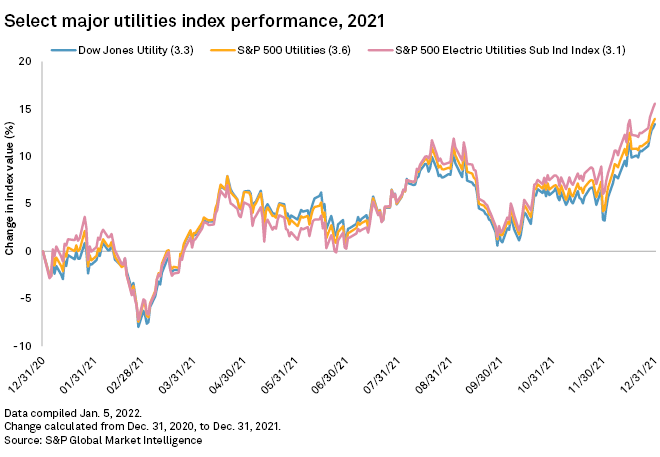

The last quarter of 2021 saw electric and multi-utility stocks rally, with indexes reaching peaks of 12.1% to 13.4%, easily the sector's best performance during the year.

At the end of December 2021, the S&P 500 Utilities Index rose 3.6%, the Dow Jones Utility Index climbed 3.3%, and the S&P 500 Electric Utilities Sub Ind Index was up 3.1%.

Top-performing stocks

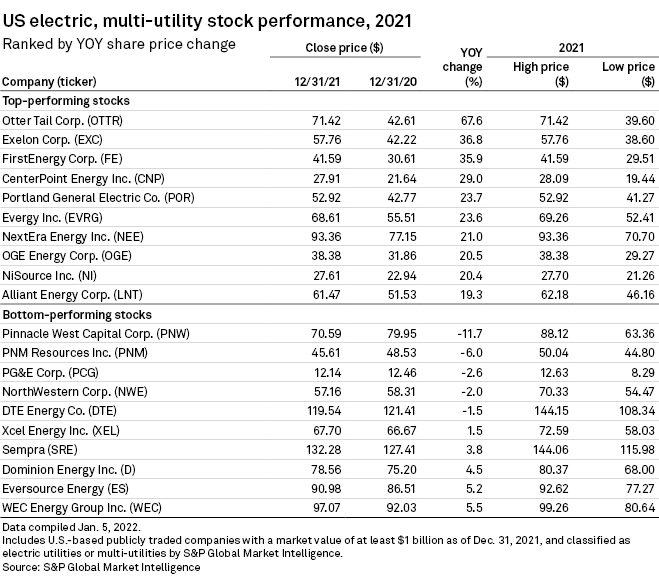

Otter Tail Corp. took the top spot, closing 2021 with a 67.6% share price increase to $71.42.

In November 2021, Otter Tail Power was authorized an electric rate increase of about $100,000 by the Minnesota Public Utilities Commission. The increase was premised upon an authorized 9.48% return on equity, which is slightly above the utility's previous ROE authorized in 2017.

Exelon Corp. saw its share price rise 36.8% to $57.76.

In September 2021, Illinois lawmakers voted to approve legislation that will allow Exelon to keep operating its two nuclear power plants in the state. Company executives expect the utility holding company and the spinoff of its competitive generation business should still see some nuclear tax credit relief even if a federal clean energy and infrastructure legislation package does not pass Congress.

FirstEnergy Corp.'s stock price was up 35.9%, closing at $41.59.

Headquartered in Akron, Ohio, FirstEnergy is regaining value and trust among various stakeholders and investors since a July 2020 corruption scandal rocked its public image. In November 2021, the company reached agreements to sell a 19.9% stake in its three regulated transmission businesses to Brookfield Super-Core Infrastructure Partners LP for $2.4 billion and issue $1 billion of common stock to Blackstone Infrastructure Partners LP.

CenterPoint Energy Inc. recorded a share price increase of 29% to end at $27.91.

During the company's third-quarter earnings call on Nov. 4, 2021, CEO David Lesar announced that CenterPoint had increased its five-year capital investment plan from $16 billion to $18 billion, and declared its intent to invest $40 billion over the next 10 years, partly with the goal of achieving net-zero emissions by 2035.

Portland General Electric Co., which saw its stock price climb 23.7% to $52.92, unveiled plans in October 2021 to "nearly triple" its clean energy supplies for customers to achieve net-zero carbon emissions by 2030, and to comply with a new Oregon law requiring the state's largest investor-owned electric utilities to nullify their greenhouse gas emissions by 2040.

Evergy Inc. posted an increase of 23.6% to close at $68.61.

Evergy on Oct. 18, 2021, issued a request for proposals for up to 1,000 MW of wind energy to supply the needs of its 1.6 million customers in Kansas and Missouri.

NextEra Energy Inc.'s stock price rose 21% to $93.36. As NextEra Energy looks ahead to 2022 deal-making, eyes are on how yieldco subsidiary NextEra Energy Partners and third parties might benefit from initiatives to buy and sell nonregulated renewable assets.

Other top-performing stocks that posted double-digit increases in 2021 are OGE Energy Corp., which rose 20.5% to $38.38; NiSource Inc., which climbed 20.4% to $27.61; and Alliant Energy Corp., which gained 19.3% to $61.47.

Bottom-performing stocks

Pinnacle West Capital Corp. logged a share price decline of 11.7% to close 2021 at $70.59.

The company plans to immediately prioritize stanching the holding company's wounded equity after the Arizona Corporation Commission dramatically reduced utility Arizona Public Service Co.'s earning and cost recovery potential, executives said.

PNM Resources Inc.'s stock price dropped 6% to $45.61.

PNM and Avangrid Inc. have extended their merger agreement to April 20, 2023, to buy more time to secure the approval of New Mexico regulators. The companies also filed a notice of appeal with the New Mexico Supreme Court regarding the New Mexico Public Regulation Commission's rejection of the merger in December 2021.

PG&E Corp. saw its share price decrease 2.6% to $12.14. PG&E Corp. executives said they are confident that beleaguered subsidiary Pacific Gas and Electric Co. will recover a $1.15 billion loss from the Dixie Fire, California's second-largest wildfire on record.

NorthWestern Corp. slid 2% to $57.16. The company, which does business as NorthWestern Energy, canceled a proposed flexible natural gas plant near its existing 88-MW Aberdeen gas plant in Brown County, S.D., citing rising construction costs due to global supply chain challenges.

DTE Energy Co., whose share price declined 1.5% to $119.54, proposed a $7 billion, five-year plan to invest in southeastern Michigan's electric distribution grid.

Among bottom-performing utility stocks that still saw positive total returns are Xcel Energy Inc., with an increase of 1.5% to $67.70; Sempra, with an increase of 3.8% to $132.28; and Dominion Energy Inc., with an increase of 4.5% to $78.56.

Eversource Energy's share price climbed 5.2% to $90.98, and WEC Energy Group Inc. saw its shares rise 5.5% to $97.07.

Looking ahead

Utilities overall will continue to underperform the broader market during the first half of 2022, according to UBS, given a "short-sighted view by the market to the rate base growth potential of the clean energy transition and the electrification of the end-use BTUs of the economy."

But analysts also acknowledged that the fate of the $1.7 trillion Build Back Better package could impact valuations of utilities if parts of the legislation pass in a stand-alone bill.