Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Feb, 2023

| A container ship at a port in Hamburg, Germany. The country is among the top 10 importers of U.S. iron and steel products, which will be subject to the EU's new carbon border adjustment mechanism. Source: Getty Images Europe/Getty Images News via Getty Images |

The U.S. iron and steel industries are shrugging off the EU's latest plan for a carbon border adjustment mechanism, experts told S&P Global Commodity Insights.

Members of the European Parliament reached a provisional agreement with the European Council in December 2022 on a law to establish the new carbon fee. Under the rule, companies importing select products — including iron, steel and some items made of the two metals — will be required to buy certificates that represent the difference between the carbon price paid in the country of production and the carbon price in countries participating in the EU emissions trading system. Once finalized, the policy will go into effect in October, beginning with a transition period.

Iron and steel could have high fees,

"We're not particularly concerned about the EU [carbon border adjustment mechanism, or CBAM] ... principally because only a very small percentage of U.S. steel exports go to the EU," said Kevin Dempsey, president and CEO of the American Iron and Steel Institute, a trade organization for U.S. iron and steel makers. "I think the issue of carbon tariffs is an important one, [and] we're not advocating for a system like in the EU, but I think some of the ideas that are being discussed in the U.S. about a tariff at the border that is based on that differential between domestic industry [carbon] intensity and foreign producers' emissions intensity do have a lot of merit."

Canada, Mexico at the core

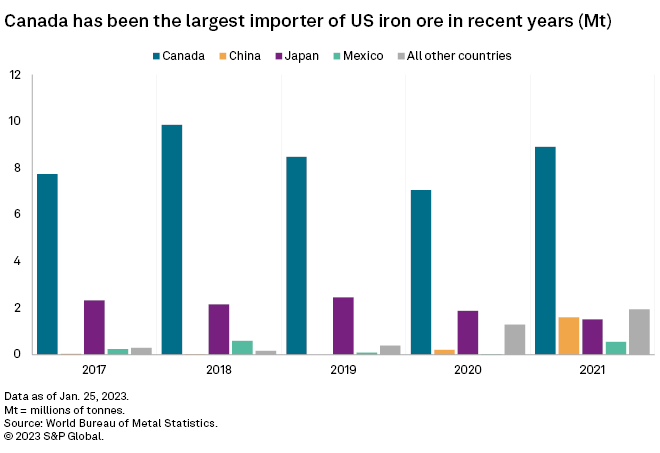

Export destinations for U.S. iron and steel products have been heavily concentrated in North America in recent years. Canada received 8.9 million tonnes, or 61.4%, of U.S. iron ore exports in 2021, according to S&P Global Market Intelligence data.

Mexico took the lead on purchases of U.S. iron, steel, and iron and steel products, receiving $11.7 billion worth, or 31.7%, of U.S. exports in that category in 2021, according to Panjiva data. Canada followed closely with $11.5 billion in imports of the same materials. Both countries' individual consumption was roughly nine times higher than that of Western Europe as a whole.

Canada and Mexico have free trade agreements with the U.S. as well as their own carbon pricing systems, reducing concerns that any EU adjustments would affect the market for U.S. products.

Climate goes beyond Europe

Despite the EU's relatively small demand for U.S. iron and steel, the border adjustment

"When it comes to particularly heavy industries like steel ... domestic policies alone in the U.S. or in the EU can only really do so much from a climate perspective; the real goal has to be global," said Noah Kaufman, a research scholar at Columbia University's School of International and Public Affairs' Center on Global Energy Policy. "If you're a policymaker in the U.S. or the EU and you want this global change, you really need to have a vision for how we are going to cooperate and leverage our joint economic and geopolitical power to try and get more of a global agreement on the decarbonization of the sector."

The U.S. Congress has not passed

"Despite an environment ripe for cooperation and collaboration on climate policy, the European Union has gone ahead with its [CBAM] on its own," Sen. Kevin Cramer, R-N.D., wrote in an opinion piece for The Wall Street Journal. Cramer is a member of the Senate Environment and Public Works Committee. "Instead, the EU should step back and work with the U.S. and other allies to develop a trade-centered approach that rewards high environmental performance and holds the world's polluters accountable."

Meanwhile, U.S. trade officials proposed forming a "club" of steel-producing countries that would pay carbon-emissions tariffs based on an emissions intensity standard to be negotiated. The U.S. Trade Representative sent a proposal describing the plan to the EU, Reuters reported Dec. 7, 2022.

"There would be an advantage of being in the club, as it would provide a lower level of carbon tariffs, while countries outside the club would pay higher tariffs," an unidentified source familiar with the plan told Reuters.

This kind of approach is one that U.S. steel producers are likely to support, Dempsey said.

"We do need to, I think, work towards a broader international consensus on the right way to approach a carbon tariff regime," Dempsey said. "I think the more flexible approach based on actual carbon intensity rather than on domestic taxes or domestic allowance prices is a better approach, and it's worth further consideration and discussions with our colleagues in Europe and in many other parts of the world."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.