Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Apr, 2022

By Michael Copley and Susan Dlin

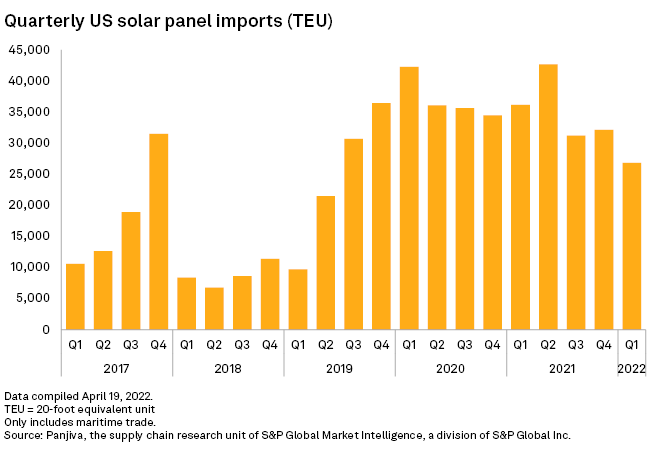

U.S. solar panel imports tumbled during the first quarter of 2022 as the industry braced for an investigation by the U.S. Commerce Department that threatens to choke off equipment supplies to project developers.

The number of shipping containers delivering solar panels to American ports during the first three months of the year was down 17% from the prior quarter and 26% from a year earlier, according to research firm Panjiva. The drop came ahead of a March 28 announcement that the Commerce Department is looking into whether solar manufacturers used factories in Southeast Asia to circumvent American tariffs on imports from China.

American solar companies have reported widespread delays or cancellations of panel shipments since the start of the investigation, which could result in tariffs being applied retroactively to past imports. Recent congestion at Chinese ports has also further disrupted global trade.

"Projects are getting delayed, force majeure is being called," Adam Hahn, a managing director at GreenFront Energy Partners LLC, said in an interview, referring to contract provisions that can excuse companies from obligations in extraordinary circumstances. "For the most part, what we've heard is that countries have just stopped shipping panels here."

The Commerce Department is focusing on manufacturers in Thailand, Vietnam, Malaysia and Cambodia, which accounted for nearly 84% of solar panel shipments delivered to the U.S. by air and sea in January and February, according to an analysis of the latest U.S. Census Bureau data.

On April 8, Northern States Power Co., a utility owned by Xcel Energy Inc., asked the Minnesota Public Utilities Commission to suspend proceedings for the company's planned Sherco Solar Project so that it can reevaluate pricing and "discuss alternatives with our potential suppliers" in light of the Commerce Department investigation.

The investigation adds to cost pressures that have been hitting the solar industry from supply chain disruptions and inflation. Before the investigation was announced, U.S. solar installations were already forecast to fall by 7% in 2022 as a result of those headwinds.

An Xcel Energy spokesperson said several solar projects in Colorado that the company has signed contracts to buy power from and which are due online by mid-2023 are in "various stages of risk at this time, and negotiations on potential solutions are ongoing."

"We have such a high demand and we have such a limited supply, particularly right now because of all of these market factors, that those contracts for projects that can move forward are going pretty fast," said Gia Clark, senior director of developer services at LevelTen Energy Inc., on an April 19 webinar.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.