Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Nov, 2021

By John Atkins

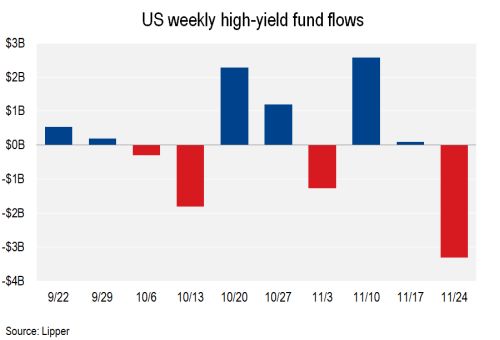

Amid heightened rate volatility, U.S. high-yield retail funds reported $3.315 billion of outflows for the week to Nov. 24, following back-to-back inflows over the previous two weeks, according to Lipper. The outflows were the largest since an outflow of more than $5.3 billion for the week to March 10 this year.

The hefty redemption level drove the four-week rolling average into the red at negative $477 million — the deepest negative reading since the period to Aug. 4, 2021 — from positive $649 million through Nov. 17.

The latest redemptions reflected outflows of $913 million from mutual funds, and just over $2.4 billion from U.S. high-yield exchange-traded funds. For the year-to-date, overall net outflows total $14.8 billion through Nov. 24, including outflows of $12.95 billion from mutual funds, and $1.82 billion from ETFs. In 2020, the funds attracted a net $38.3 billion of inflows for the full year.

Assets at the weekly reporters to Lipper totaled $277.3 billion as of Nov. 24, $77.5 billion of which are at ETFs, or 28%. For that pool of assets, the change in valuations due to market conditions was negative $2.01 billion, reflecting the steepest market-based drop since the final week of October 2020. The change due to market conditions was also in the red over the previous week, at negative $1.2 billion.

Underscoring the market shocks last week as pandemic headwinds returned with force, the price for the S&P U.S. High Yield Corporate Bond Index tumbled more than a full handle to 102.85% of par as of Friday, from 104.01 a week earlier. The latest price marked a 12-month low, a move that drove the average yield-to-worst to a 12-month high at 4.70%, from 4.34% a week earlier. The latest T+352 spread for the index increased from T+315 a week earlier, and T+293 on Nov. 9.