Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Oct, 2021

By John Atkins

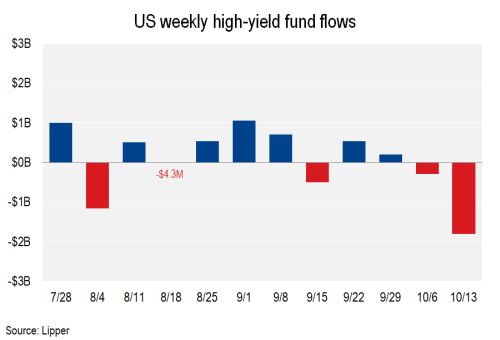

U.S. high-yield retail funds reported $1.8 billion of outflows for the week to Oct. 13, following on a $294 million outflow over the previous week, according to Lipper. The latest outflow was the largest for a single week since $2.23 billion exited the funds over the week to June 16.

The rolling four-week average was negative $341 million, versus negative $15 million through the previous week. The trend turned negative this month after that four-week rolling average held in positive territory for five straight weeks through September, capped by a positive $236 million reading for the four weeks to Sept. 29.

Investors exited U.S. high-yield exchange-traded funds, or ETFs, to the tune of $1.37 billion over the latest week, or the heaviest outflow from the category since the week to Aug. 4. Mutual funds posted outflows totaling $431 million.

Overall outflows now total $16.4 billion for the year. Last year, the funds attracted $38.3 billion of inflows, net of the heavy redemptions in March 2020 as the pandemic struck.

Assets at the weekly reporters to Lipper totaled $276.8 billion as of Oct. 13, $75.3 billion of which is at ETFs, or 27%. For that pool of assets, the change in value due to market conditions was in the red for a fourth straight week, at negative $464.5 million.

For context, the price for the broader S&P U.S. High Yield Corporate Bond Index declined 20 basis points week over week as of the Oct. 13 close, to 104.42% of par, marking a low since March. The index yield to worst reached a six-month high at 4.22%.