Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Feb, 2022

By Hassan Javed

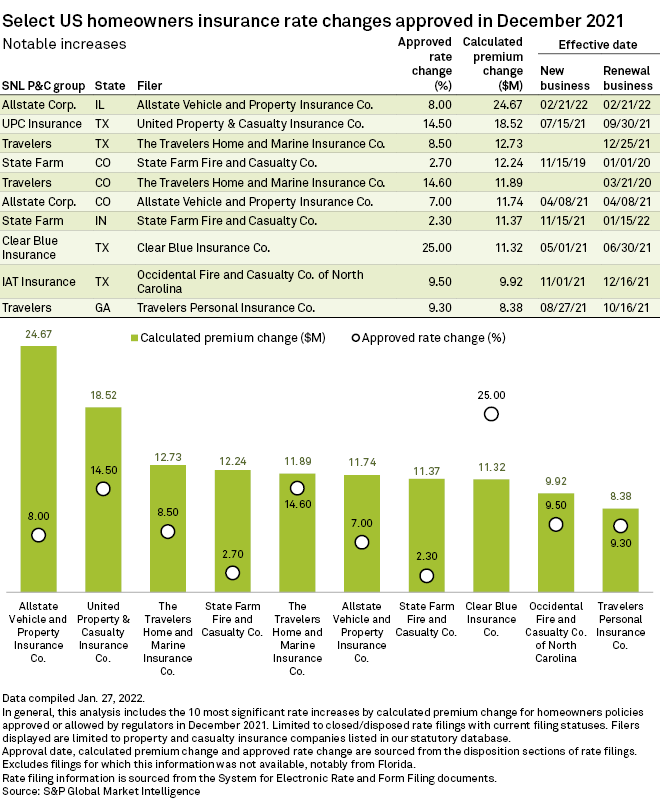

The Travelers Cos. Inc. could see the largest increase in total premiums from homeowners rate hikes approved in December 2021, according to an S&P Global Market Intelligence analysis.

Travelers, Allstate top rate hike chart

Travelers obtained regulatory approvals for 36 rate hikes, which could bolster the group's total premiums by $78.6 million. An 8.5% rate hike approved by Texas regulators may be the most significant single increase in terms of premium impact.

The Allstate Corp. also was high on the rate hike chart, thanks to an 8% rate increase approved in Illinois. That increase alone could boost the group's total premiums by nearly $24.7 million. In total, Allstate secured approvals for 11 rate increases, which could boost the group's total premiums by $51 million.

Texas regulators approved 15 rate hikes during the month, which could positively impact total premiums in the state by $71.9 million. Four of the rate hikes approved in the Lone Star State are among the top rate increases for December 2021.

USAA dominates rate cut chart

United Services Automobile Association received approval for five rate reductions in