Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Mar, 2023

By Sanne Wass

Large Swedish lenders are among the most shorted European banking shares, according to S&P Global Market Intelligence data.

The short positions come amid fears that inflation and higher interest rates will adversely impact commercial real estate and housing in Sweden, to which the country's banks have large exposures.

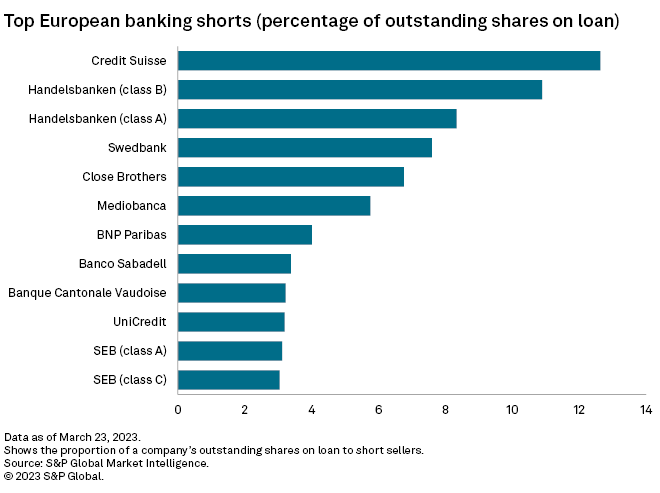

Svenska Handelsbanken AB (publ) and Swedbank AB (publ), Sweden's second- and third-largest lenders by assets, were among the three financial institutions in Europe with the highest proportion of outstanding shares on loan to short sellers on March 23. They were topped only by troubled Swiss lender Credit Suisse Group AG.

Short-selling investors profit from stock declines by borrowing shares of companies they believe are overvalued, selling them on the open market and then buying them back later at a lower price.

Commercial real estate worries

As of March 23, 10.9% of Handelsbanken's class B shares and 8.3% of its class A shares were held by short sellers, while 7.6% of Swedbank's outstanding shares were out on loan.

Skandinaviska Enskilda Banken AB (publ), or SEB, Sweden's largest bank by assets, was also among the top 10 European financial institutions with the highest proportion of shares on loan to short sellers.

Concerns over banks' exposures to commercial real estate have driven interest from short sellers in large Swedish banks, said Matt Chessum, securities finance director at S&P Global Market Intelligence.

"Scandinavian commercial real estate is currently going through an adjustment in pricing and those banks remain exposed to this sector," said Chessum.

The Swedish financial regulator, in its latest financial stability report, highlighted commercial real estate as a growing risk to the country's financial system. The sector is particularly vulnerable to rising interest rates, given its high indebtedness, and could drive significant credit losses at Swedish banks in an economic downturn, it said. Exposures to the commercial real estate sector represent between 16% and 36% of each large Swedish bank's lending to the general public, according to the regulator.

Analysts are already projecting loan loss provisions at large Nordic lenders to triple this year, with property management including commercial real estate exposures being "the main risk factor for asset quality," said Deutsche Bank analyst Kazim Andac in a March 6 note. But there could be an "upside risk to consensus," particularly for Swedish institutions, Andac said.

Handelsbanken has 30% of loans out to property management, compared with 17% for SEB and 16% for Swedbank, higher than the sector average, according to UBS analysis.

A Swedbank spokesperson told Market Intelligence that the bank's credit quality "remains strong," with largely unchanged indicators, such as late payments, during the fourth quarter. Swedbank’s exposure to real estate is in line with its strategy and risk appetite, it said.

Handelsbanken and SEB did not respond to a request for comment.

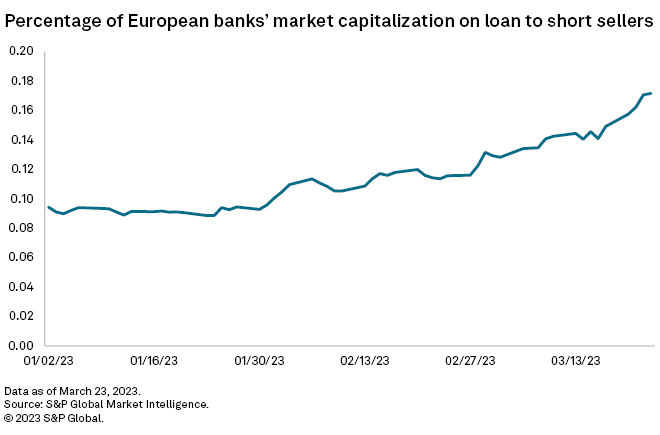

Investors have beefed up their short positions in European banks after the collapse of Silicon Valley Bank and crisis at Credit Suisse sparked contagion fears. About 0.17% of European banks' market capitalization was held by short sellers as of March 23, an 82% increase from the beginning of the year, according to Market Intelligence data.

Credit Suisse topped the list of most shorted European banking shares, with 12.6% of outstanding shares on loan to short sellers as of March 23, having reached 14.0% on March 20. The bank has gone through a period of market crises, executive turnover and financial losses, which have caused its shares to plunge more than 72% this year. On March 19, rival UBS Group AG announced it would acquire Credit Suisse in an emergency rescue orchestrated by Swiss authorities.

From March 1 to March 23, short sellers made approximately $3.1 billion in profits from shorting Credit Suisse, according to Market Intelligence data. On March 21 alone, short sellers booked $766 million in profits.

UK banking group Close Brothers Group PLC, Italy's Mediobanca Banca di Credito Finanziario SpA and French bank BNP Paribas SA were also among the top European banking shorts as of March 23.