Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Aug, 2023

By Karin Rives

| Indiana state Rep. Ethan Manning discusses revisions to his anti-ESG bill shortly before the legislation passed along party lines on April 24. Source: Indiana General Assembly. |

This article is the first in a two-part series on a multistate effort to eliminate environmental, social and governance considerations from public investments.

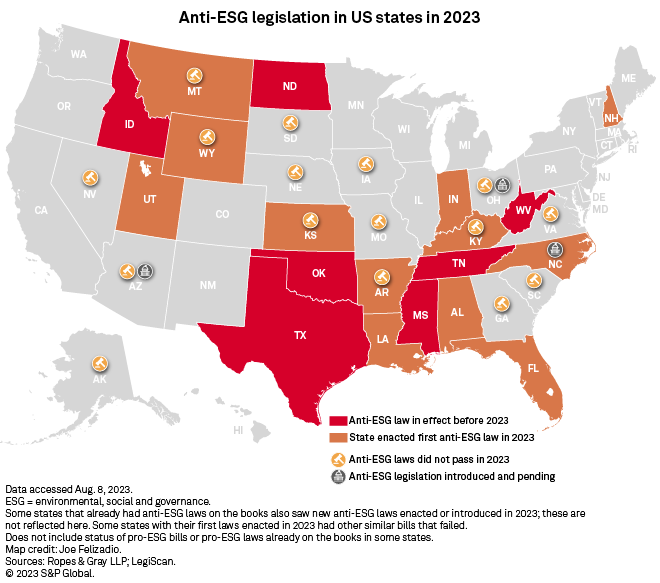

Republican lawmakers in 12 states successfully pushed anti-environmental, social and governance legislation across the finish line for the first time in 2023. Nineteen states now have one or more such laws on the books, data from bill-tracking site LegiScan shows.

A campaign to exclude ESG risk assessments from public investments pushes on, but its economic impact on state pension fund beneficiaries remains uncertain. What is clear, observers said, is that companies must now navigate ambiguity in rules and vastly different mandates from one state to another.

Though many of the anti-ESG bills were revised and weakened as they moved through the legislative process, the new laws are already having a chilling effect on investors, corporate attorneys said.

"The biggest enemy when you're trying to manage money is uncertainty," Joshua Lichtenstein, a partner with the law firm Ropes & Gray, said in an interview. "When we have unquantifiable risks like not knowing the way that a new rule is going to be interpreted, that makes it so much harder to actually carry out the business of investing capital."

During the 2023 legislative session, at least 25 anti-ESG bills were enacted in states where Republicans control the legislature, with Utah alone passing five of those bills, according to a website Lichtenstein's team maintains to track such bills. A few bills are still pending.

Weeks of negotiations

Many anti-ESG bills that made it to a governor's desk had gone through weeks of negotiations as lawmakers grappled with potential economic impacts and opposition from the banking industry and state pension systems.

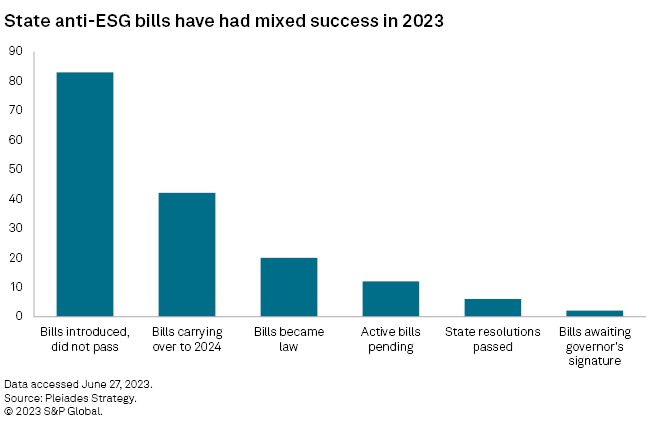

All but four of the bills that passed in 2023 underwent significant revisions, according to analysis by the policy research and strategy firm Pleiades Strategy. In most cases, the analysis found, amendments weakened mandates for pensions and state agencies or offered escape clauses that gave them flexibility.

In West Virginia, for example, lawmakers added a waiver to H.B. 2862, a bill barring the state's investment boards or their fund managers from casting pro-ESG shareholder votes. The final bill exempts the boards from the requirement if they cannot comply without "significantly increasing costs or limiting the quality of investment options or services available to the board."

Many anti-ESG bills introduced in 2023 also failed after chambers of commerce, banking associations and public pension officials raised concern over costs or free market principles, LegiScan data shows. This was the case with a Texas bill known as S.B. 1446, which officials said could have caused $6 billion in losses for one of the state's retirement systems over the next decade.

"We're worried that conflicts in the bill would keep us from partnering with some of the best investment managers in the world over issues such as violation of fiduciary duty and protecting competitive advantage," Amy Bishop, executive director of the $45 billion Texas County and District Retirement System, told state senators in March, after which the bill ground to a halt.

'A multiyear effort'

Lawmakers in 11 states were unable to get their anti-ESG bills to a final favorable vote or, in the case of Arizona, past the governor's desk, voting data shows.

"This has just been a loss all around," said Connor Gibson, a researcher specializing in lobbying and front groups, who co-authored a recent Pleiades Strategy report on the anti-ESG legislative season. "They definitely didn't hit a home run in any state."

Proponents of anti-ESG legislation, on the other hand, pointed to what was accomplished in just a year.

"This is a complex issue," Jonathan Williams, chief economist with the American Legislative Exchange Council (ALEC), said in an interview. "It's not surprising whatsoever that this, in many cases, was not going to get done in a 30-day state legislative session. We fully expect this to be a multiyear effort."

In 2022, ALEC published a model policy known as the State Government Employee Retirement Protection Act, which many states used to create bills prohibiting or limiting their pension funds from considering ESG-related risks and opportunities when making investments.

The sustained anti-ESG messaging by ALEC and others in 2023 likely prompted financial firms to scale back efforts to decarbonize their portfolios, a recent study concluded. The campaign also contributed to a mass exodus of insurance companies from the Net-Zero Insurance Alliance, while other businesses adjusted their messaging or practices around ESG.

"People are really rethinking the way that they engage with some of the states as a result of these laws," Lichtenstein said. "This is a topic of conversation we didn't have at this time last year."

Uncertainty and friction

In Indiana, the estimated losses from the initial version of the state's anti-ESG legislation, known as H.B. 1008, came to $6.7 billion over 10 years. The sponsor of the bill, Rep. Ethan Manning (R-Ind.), agreed to rework the language. The final bill exempted private market funds and the pension system's defined contribution plans, as well as a police pension trust, from the ESG restrictions.

The new law now allows the state's $40 billion pension to contract with asset managers with ESG policies as long as those investments yield the highest returns, which was already standard fiduciary practice. It also directs the state's treasurer to investigate service providers that have "made an ESG commitment."

Opponents of the legislation warned that the new law could still have long-ranging effects.

"This bill was watered down over time, but they still passed it," Rep. Carey Hamilton (D-Ind.), an opponent of the legislation, said in an interview. "It made Indiana less welcome to some investors, and it also creates a bureaucratic structure."

The message the state is now sending could create other costs that will be impossible to calculate, Hamilton added.

"Companies may not come here, students may not attend our universities because of the messaging we're sending out ... [that] we don't value the free market, and a far-right agenda will prevail," Hamilton said.

As did most state anti-ESG bills in 2023, the Indiana bill passed along party lines without a single Democratic vote.

In some cases, lawmakers left for summer recess with disappointments on both sides.

In Kansas, for example, a bill with an estimated $3.6 billion loss for the state pension system was reworked to prevent the $24 billion Kansas Public Employees Retirement System (KPERS) from having to divest from nearly all its current asset management firms. The final bill also dropped a provision requiring private pension funds from disavowing ESG in their assessments of investment risks and opportunities.

With the revision of H.B. 2100, "we believe that the KPERS board and our fund managers will be able to work within the new framework without any investment losses," KPERS Executive Director Alan Conroy said in an email.

The outcome of the bill ignited some dispute within the Republican caucus, state Rep. Rui Xu, a Democrat and opponent of the bill, recalled in an interview. "I think many of them didn't feel this was harsh enough," Xu said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.