Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Mar, 2022

By Deza Mones

Standard Bank Group Ltd., Africa's largest lender by assets, committed to achieving net-zero carbon emissions from its portfolio of financed emissions by 2050 under its new climate strategy.

The South African

Standard Bank will also cease funding new oil-fired plants or expansion plans "except where such plants provide support services as part of an integrated renewable energy power plant."

The group said its new policy takes into account Africa's "social, economic, and environmental context" as its starting point. "A total or immediate ban on further transitional projects in Africa in order to help reduce environmental pressure in much richer regions would be a cost too far," CEO Sim Tshabalala said.

The announcement came nearly a year after the bank faced shareholder pressure to set out targets to reduce its exposure to fossil fuel assets. It also drew criticism from environmental groups in the past over its directors' links to the fossil fuel industry.

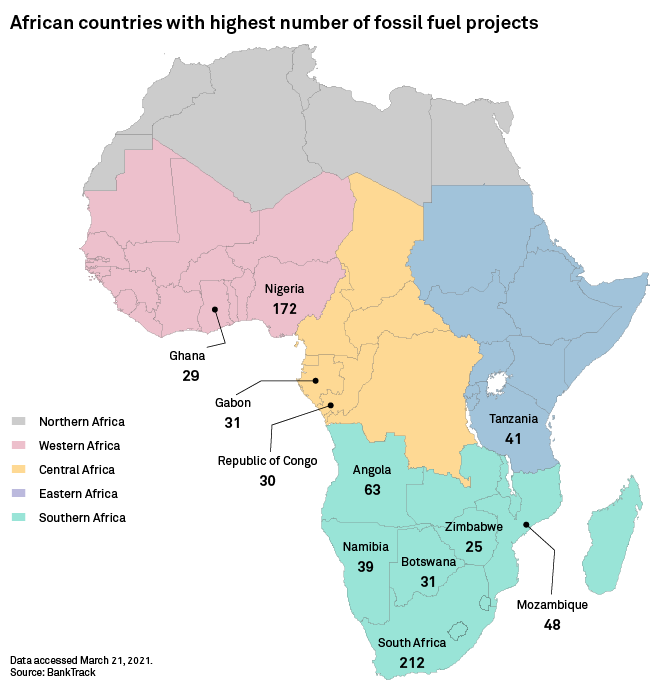

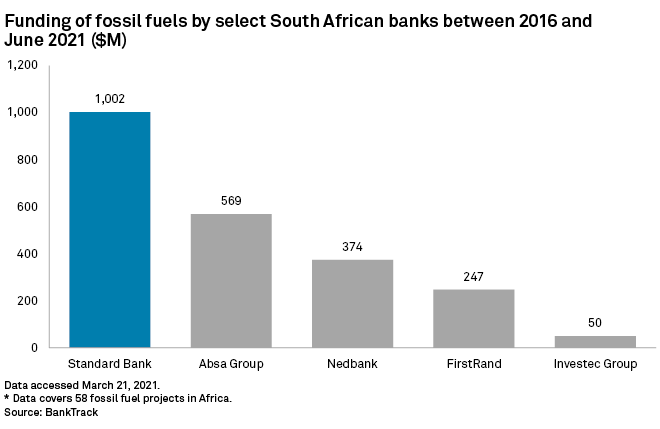

Standard Bank was among the biggest lenders to fossil fuel projects in Africa between 2016 and June 2021, according to a recent report by BankTrack, an independent organization that monitors banks' lending activities. The group ranked first among African lenders and seventh globally, having provided more than $1 billion for fossil fuel projects in the region over the period.

Standard Bank's first and latest climate-related financial disclosure published in 2020 showed that the oil and gas sector and related companies accounted for 3.78% of its loan book, while coal accounted for 0.62%. Its lending to the renewables sector accounted for 0.8%.

While the new policy includes "some steps forward," it does not prevent Standard Bank from financing the planned $3.5 billion East African Crude Oil Pipeline, or EACOP, and other projects that will expand the fossil fuel industry, said Maaike Beenes, a campaigner at BankTrack.

The decision sets Standard Bank apart from South African peers Absa Group Ltd., Nedbank Group Ltd., FirstRand Ltd.

By comparison, Nedbank has pledged to stop funding new thermal coal mines from 2025 and immediately halt direct financing to new oil and gas exploration. It also committed to cease funding coal mines in South Africa by 2025 and imposed an immediate ban on financing coal mines in other countries.

Standard Bank did not respond to a request for comment.

Other news

* The central banks of Saudi Arabia

* The Central Bank of Egypt

* Abu Dhabi

* UAE

* Israeli

* A judge in Lebanon

* Kenyan

* The Nigerian