Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Feb, 2021

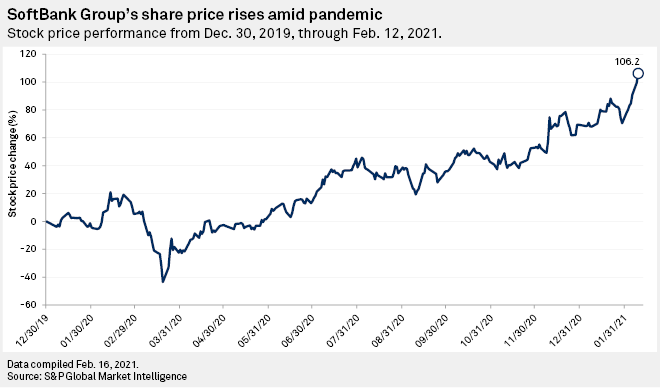

SoftBank Group Corp. is unlikely to carry out further share buybacks after a reversal of fortunes at its tech-focused fund boosted the company's share price, analysts said.

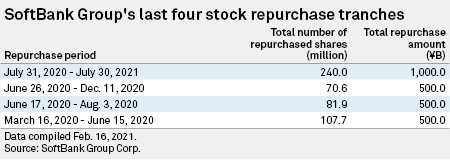

In March 2020, SoftBank announced it would repurchase over ¥2 trillion of shares in four tranches. As of January 31, 2021, ¥700 billion remained of this goal.

"Buying more of their own stock would be a poor use of [SoftBank's] cash at this time. Their stock is trading at almost 40 P/E and is really expensive this time by any measure," Hatem Dhiab, managing partner at Gerber Kawasaki Wealth and Investment Management, told S&P Global Market Intelligence.

The company's share price hit over ¥10,000, a two-decade high, on Feb. 9 on the back of an earnings update. SoftBank's quarterly report published Feb. 8 revealed its Vision Fund 1 and Vision Fund 2 investments gained ¥1.392 trillion in the quarter ended Dec. 31, 2020, compared to a loss of ¥199.68 billion in the prior-year period.

The company's ability to generate liquidity and turn Vision Fund around is down to a "historical bull market," rather than investor confidence from asset sales or share buyback programs, Kirk Boodry, analyst at Redex Holdings, said. The Masayoshi Son-led company is less likely to announce another buyback tranche in the near term given that they announced their mega buyback programs last year amid "extreme market weakness" and pressure from activist investor Elliott Management, he added.

"That is no longer the case as the [SoftBank stock] discount has narrowed dramatically since March 2020," Boodry said.

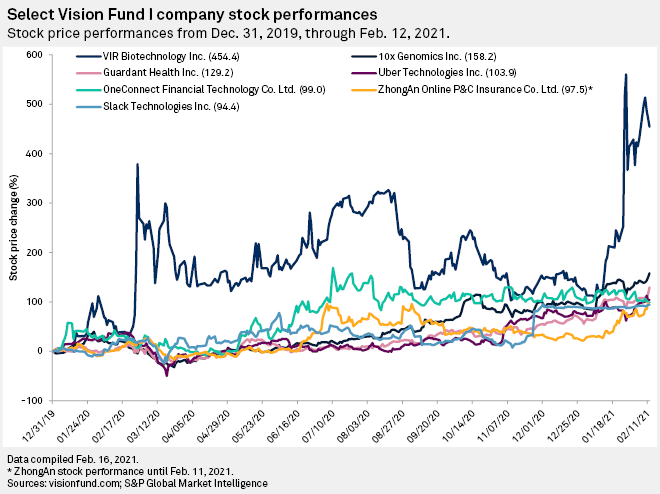

SoftBank Vision Fund 1 recorded an unrealized gain of ¥1,541.5 billion for listed portfolio companies, singling out DoorDash Inc. and Uber Technologies Inc. stocks as key performers. For unlisted portfolio companies, Vision Fund's unrealized gain totaled ¥530.6 billion.

Vision Fund-backed South Korean e-commerce company Coupang filed for an IPO in mid-February, and could be one of SoftBank's greatest bets to date.

Data from S&P Global Market Intelligence shows Vision Fund's Vir Biotechnology Inc. stock price has soared, following the announcement of an expanded deal with a major drugmaker.

Vision Fund 2 focus

In December, news reports said SoftBank could be taken private via gradual share buybacks. Rather than look at asset sales and buyback programs, SoftBank Group should look at improving its investments, particularly for its Vision Fund 2, experts said.

"I would argue that Vision Fund is barely coming back from the brink. They should hang on to their liquidity for now and focus on helping their portfolio companies succeed… [This] is going to cost them capital, especially if they are serious about Vision Fund 2," Dhiab said.

SoftBank's ability to "convince potential investors that it has improved its investment process" for its Vision Fund 2 is important, as its improved share price "does not mean too much" for the second fund, Dan Baker, analyst at Morningstar, said.

SoftBank's Vision Fund 2's 26 investments were valued at $9.3 billion, versus its purchase price of $4.3 billion. The company launched the second fund in October 2019, with the aim of raising over $100 billion. However, following the devaluation of WeWork, Son paused the company's search for external investors for Vision Fund 2 and will continue to invest its own capital.

At the end of the third quarter, Vision Fund 2's total committed capital was $10 billion, with no third-party investors.