Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Apr, 2021

Amid a steep rise in special purpose acquisition companies in Asia-Pacific, SoftBank Group Corp. is looking to use the investment vehicle to give its own fund a fighting chance when it comes to competing for tech targets.

Also known as blank-check companies, SPACs are formed to raise capital via an IPO for the purpose of acquiring an unspecified operating company.

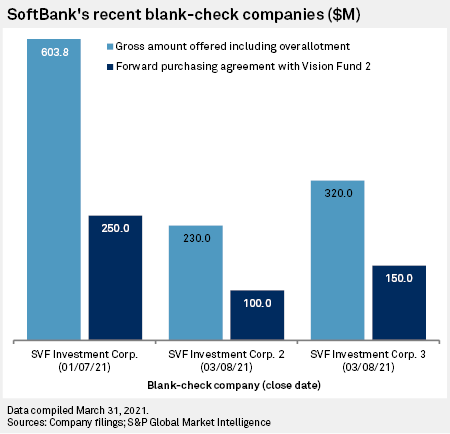

SoftBank closed its first SPAC, SVF Investment Corp. at $603.8 million in January, followed by SVF Investment Corp. 2 and SVF Investment Corp. 3 closing their respective IPOs in March. SVF Investment Corp. 2 raised gross proceeds of $230 million, and SVF Investment Corp. 3 raised $320 million.

The three SPACs give SoftBank's Vision Fund 2 greater flexibility to invest in public companies as well as a faster route to taking a company to market after absorbing it into its portfolio, experts said. This route is available via forward purchase agreements between SoftBank and its SPACs, which allow Vision Fund 2 to purchase equity in the blank-check firms.

"The ability to use Vision Fund 2 for PIPE (private investment in public equity) will allow [the fund] exposure in new companies without having to commit privately and also the agility to get out in the public market, buying themselves a lot more flexibility," Hatem Dhiab, managing partner at Gerber Kawasaki Wealth and Investment Management, said.

If Vision Fund 2 participates in a PIPE, the fund would effectively own shares in the acquired company and even warrants on the SPAC "which means they could benefit from the listing should it do well," Dhiab said.

The option to invest in public companies via a SPAC will also help SoftBank's Vision Fund compete against other private equity and venture capital firms vying for the same targets, Kirk Boodry, analyst at Redex Holdings said.

"Post COVID-19, there is a lot of money out there chasing returns and SPACs are one manifestation of that. With SPACs offering a quick path to market and usually at a high valuation, companies that might have taken Vision Fund money before may find [SPACs] attractive," Boodry said, adding that this has made it "harder for Vision Fund 2 to find new deals."

SoftBank's Vision Fund 2 has invested in 26 companies with the aim of adding 11 companies to its portfolio, Son said during his latest earnings briefing in February. So far, only three of the portfolio companies — Beike, Seer and Qualtrics — are listed.

The thriving Southeast Asia tech startup space has become a fertile ground for acquisitions for listed blank-check companies in 2021, analysts have said. This is largely due to the fact that these tech unicorns, startups and their investors have started to view the SPAC route as an efficient exit option and a faster and less costly route to the public market.

Asia-Pacific headquartered SPACs raised $2.4 billion in 2020, up from 2019's $613 million, according to S&P Global Market Intelligence data. The 2021 total could be even higher; as of Jan. 31, eight SPACs had raised a total of $1.71 billion.

Meanwhile, Vision Fund 2 has struggled to live up to expectations. The second fund, launched in October 2019, initially aimed to match the first and raise over $100 billion.

At the end of 2020's December quarter, Vision Fund 2's total committed capital was $10 billion, with no third-party investors. SoftBank CEO Masayoshi Son paused the company's search for external investors after several of the first portfolio's holdings were devalued.