Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 May, 2022

Operational and financial challenges at Siemens Gamesa Renewable Energy SA continue to burden majority owner Siemens Energy AG, whose president, CEO and chairman, Christian Bruch, has described the wind-turbine maker's performance as a "disappointment."

However, during the May 11 earnings call, Bruch declined to comment on plans to review Siemens Energy's 67% shareholding in Siemens Gamesa, including a potential bid to take over the company's entire share capital.

"I can only repeat what I always said before — we're looking [at] it," the executive told analysts when asked about Siemens Gamesa's capital structure. "As soon as the situation changes, we will inform [the market] about it."

Reuters reported in January that Siemens Energy was exploring options to buy out the remaining 33% of Siemens Gamesa that it does not already own. The company had previously denied reports that it was planning a takeover bid for its subsidiary.

Siemens Gamesa issued a profit warning April 19 after recording a €304 million operating loss in its fiscal second quarter due to challenges in its onshore wind division, as well as cost inflation and delays in its supply chain.

These issues contributed to Siemens Energy recording adjusted EBIT of negative €77 million for its fiscal second quarter, compared to profit of €197 million in the prior-year period. The company now expects to achieve the low end of its guidance range for the full year.

"[Siemens Gamesa] has been a disappointment," Bruch said, adding that Siemens Energy and Siemens Gamesa — under the leadership of newly installed CEO Jochen Eickholt — are "working hard" to get the turbine-maker back on an even keel.

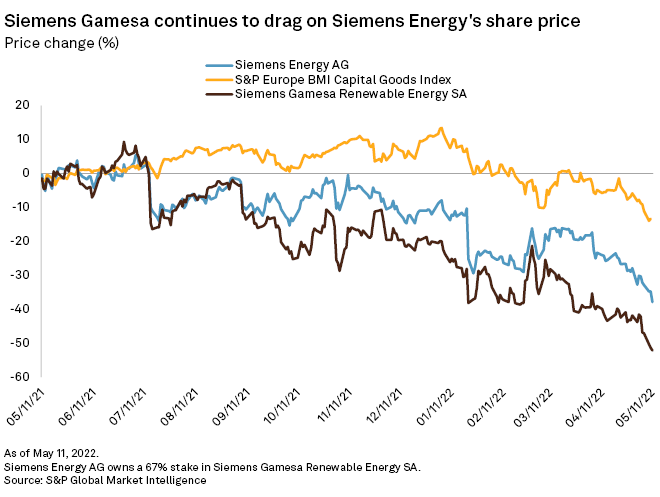

Both companies' stock prices have suffered in the last year compared to the wider market, though Bruch said this decline has been witnessed "across the board" in the wind industry.

Eickholt, who started as CEO on March 1, was previously on the board at Siemens Energy, and Bruch said the new CEO's first assessment was that Siemens Gamesa's problems are "bigger than expected."

Siemens Gamesa's issues are two-thirds internal and one-third external, according to Eickholt, who on May 5 launched a program to address roadblocks to the company's profitability.

"The good news is that Jochen has identified the root causes, that he has solved similar problems in previous roles ... and that he does not see a reason to believe that, in the long run, [Siemens Gamesa] should not be an 8% or 8%-plus margin company," Bruch said.

Siemens Gamesa achieved an EBIT margin of negative 0.9% in fiscal 2021, and its guidance range for fiscal 2022 — negative 4.0% to 1.0% — is under review. The company is targeting a margin of 8% to 10% by fiscal 2024 or fiscal 2025.

"The less good news is that it will take longer" to turn the company around, Bruch added. "If I talk to Jochen, what I hear is there's nothing that he sees that he has not seen before."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.