Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Aug, 2023

Short sellers are largely holding tight to their bets against consumer discretionary stocks, wagering that persistently high inflation and interest rates will significantly hinder consumer demand.

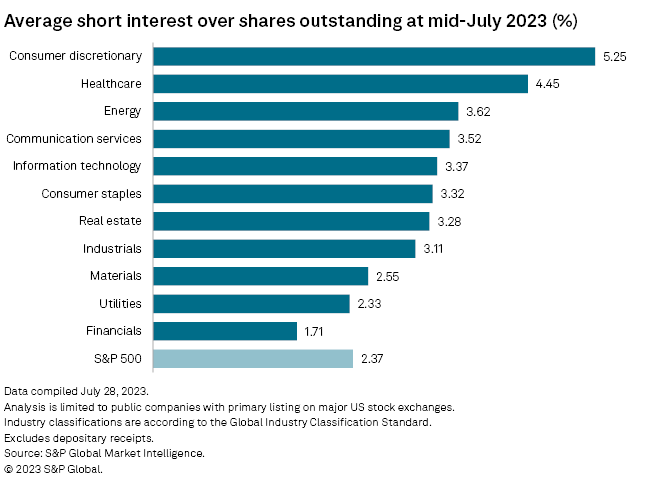

Throughout all major US stock exchanges, short interest in the consumer discretionary sector was 5.25%, the most-shorted sector by 80 basis points, followed by healthcare at 4.45%, according to the latest S&P Global Market Intelligence data. Consumer discretionary has been the most shorted US stock sector for 18 months.

Short interest measures the percentage of outstanding shares of a given company or industry held by short sellers, who seek to profit from a stock's decline by borrowing shares to sell at a high price, then repurchasing them after a drop and pocketing the difference.

S&P 500 companies

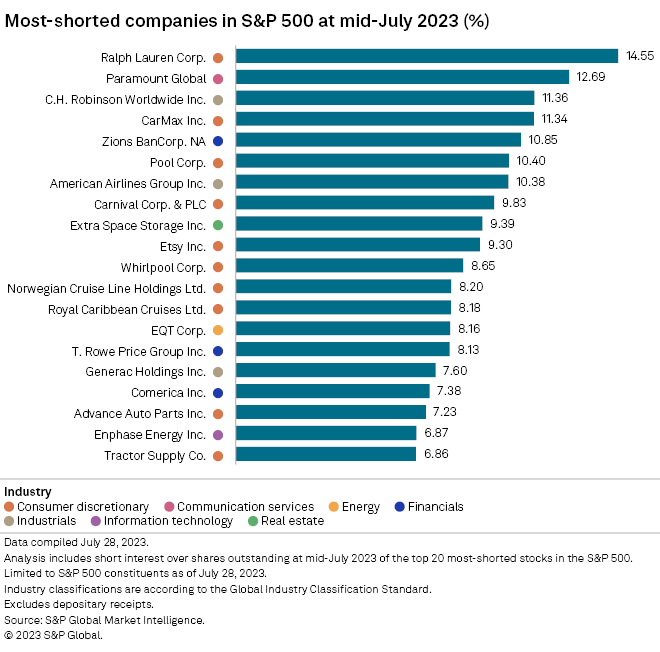

More than half of the 20 most-shorted S&P 500 companies as of mid-July were from the consumer discretionary sector.

Apparel and accessories company Ralph Lauren Corp. was the most shorted stock within the large-cap index at mid-July with 14.55% short interest. Other consumer discretionary stocks, CarMax Inc., Pool Corp., Carnival Corp. & PLC, and Etsy Inc., were among the top 10 most shorted stocks within the S&P 500 as of mid-July.

Most shorted

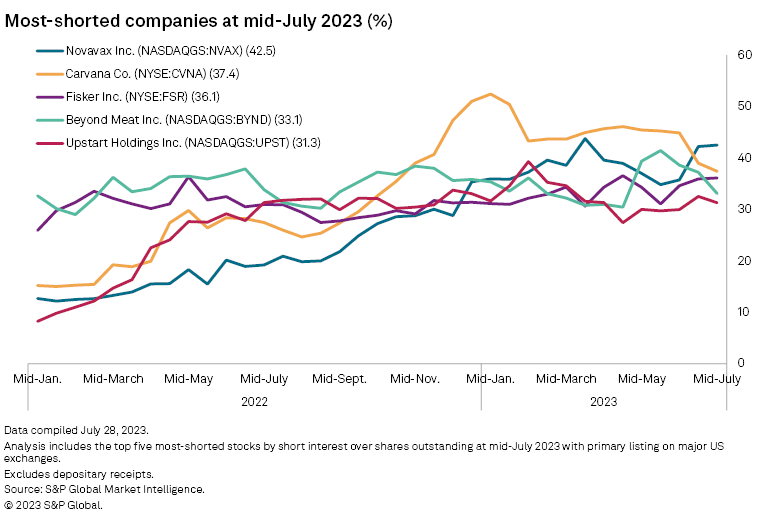

Two of the five most-shorted US stocks, Carvana Co. and Fisker Inc., as of mid-July were consumer discretionary stocks. Short interest in Carvana was 37.39% at mid-July while short interest in Fisker was 36.11%.

Novavax Inc. was the most-shorted stock across major US exchanges as of mid-July with 42.51% short interest.

Down from peak

While consumer discretionary stocks are drawing the most interest from short sellers, that level has fallen over the past year as US inflation has declined from its 2022 peak. Short interest in consumer discretionary stocks was as high as 6.5% in mid-November 2022.

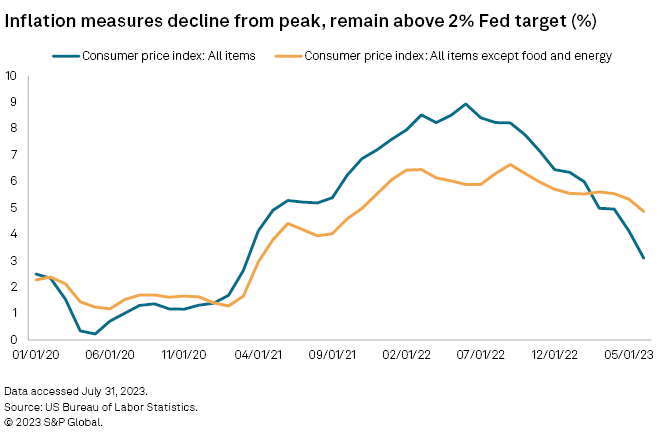

Broad consumer price rises have drastically slowed to 3.1% in June from a peak of nearly 9.0% a year earlier, according to US government data. Inflation excluding food and energy costs, a key metric for the Federal Reserve's monetary policy considerations, is proving stickier, with price gains slowing to 4.9% in June 2023 from the peak of 6.6% in September 2022.