Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Mar, 2021

By Chris Rogers

Sportswear-maker Puma SE reported fourth-quarter 2020 revenues that grew 2.8% year over year on a reported basis, with improved profit margins that included "good inventory management." Growth in apparel outstripped footwear, which is somewhat unsurprising given the ongoing impact of the coronavirus pandemic on apparel consumption patterns, as outlined in Panjiva's research of Feb. 23.

Panjiva's data shows U.S. seaborne imports linked to the company fell 34.1% year over year in the fourth quarter of 2020, including a 25.6% drop in footwear and a 3.9% slide in apparel. That likely reflects the inventory management the company has referred to. There are signs of an improvement at the start of 2021, with imports of footwear down just 1.8% year over year in January while apparel imports surged 122.2%.

Puma said it has managed its supplier relations in a way that has "enabled [it] to avoid nearly any disruptions in the delivery of products to [its] retail partners and consumers around the world." Importantly, the company has "canceled less than 1% of orders" and "paid out suppliers the costs for orders [it] canceled." That follows instances, particularly in Bangladesh, of orders being canceled at late notice or completed orders not being accepted or paid for. It should be noted that Puma was not subject to such accusations.

While no mention is made of the impact of higher logistics costs, the company "made good progress with the upgrade of [its] logistics network," with the opening of new distribution centers in North America and globally.

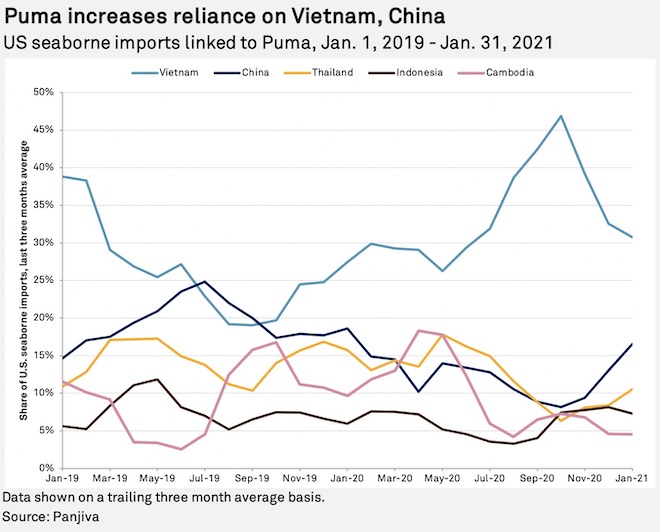

Puma's supplier mix has somehow shifted, though, during the past year. The proportion of U.S. seaborne imports linked to the company from Vietnam increased 30.7% of the total in the fourth quarter of 2020 from 24.8% a year earlier. That appears to have been offset by a drop in shipments from Thailand to 10.5% from 16.9%. Those from Cambodia fell to 4.6% from 10.8%. Puma's imports from Indonesia and South Korea also increased, potentially reflecting product as well as sourcing-in-product choices.

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.