Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Jan, 2021

By Tom Jacobs and KRIS ELAINE FIGURACION

Catastrophe losses related to the COVID-19 pandemic, the pricing environment and investment income should be among the items U.S. property and casualty companies will highlight when they report fourth-quarter 2020 earnings.

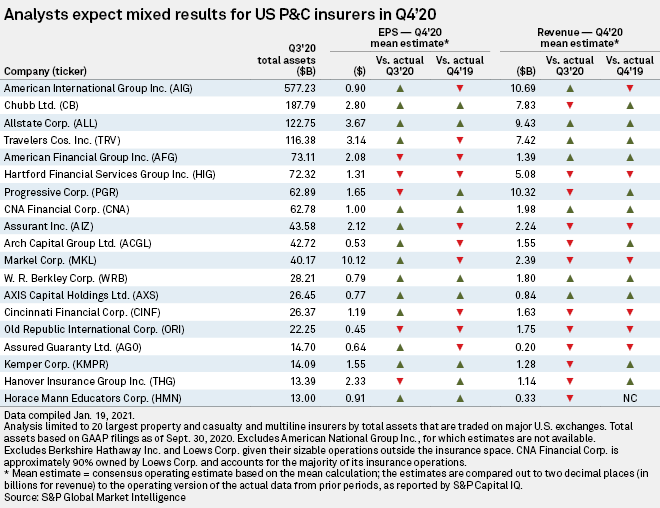

Eleven of the 20 largest P&C insurers are expected to record year-over-year revenue increases, but 12 of those 20 are projected to report a sequential revenue decline, according to an S&P Global Market Intelligence analysis of sell-side forecasts.

The analysis also shows that EPS for nine companies is expected to rise year over year; EPS is projected to rise for 14 compared to the third quarter of 2020.

The analysis was limited to the 20 largest P&C and multiline insurers by total assets that are traded on major U.S. exchanges. Total assets were based on GAAP filings as of Sept. 30, 2020. The analysis excludes American National Group Inc., for which estimates were not available.

Insurers' COVID-related loss estimates that previously looked conservative now need to be "trued up," according to Keefe Bruyette and Woods analyst Meyer Shields. He pointed to AXIS Capital Holdings Ltd. announcing that it is expecting $125 million in fourth-quarter 2020 pretax losses related to the pandemic after an "extensive review" of exposures and the dismissal of insurers' appeals in the U.K.'s business interruption insurance test case.

"I think taking another swing at COVID losses will be a broader trend, and that should be most pronounced in the reinsurance group," Shields said in an interview.

Piper Sandler analyst Paul Newsome in a note said he expects pandemic-related charges to come in less than what was reported last quarter. He said those charges will probably be ignored by investors, provided that they do not "materially" reduce book values or harm balance sheets.

Newsome said investors should expect to see reports on accelerated commercial market pricing that will give them confidence in a "full-blown hard market." Given the fact that commercial line prices have continued to accelerate, Newsome expects further margin expansion on the heels of the previous quarter's results.

The catalyst for that acceleration in pricing, according to Shields, has been the continued low interest-rate environment, which has led to reinvestment rates falling below insurers' book yields.

"There's a little bit of optimism, or at least theoretical optimism in terms of the direction of interest rates," he said, "But, right now, not enough to change the direction of pricing."