Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Sep, 2021

By Rhema Peñaflor and Cheska Lozano

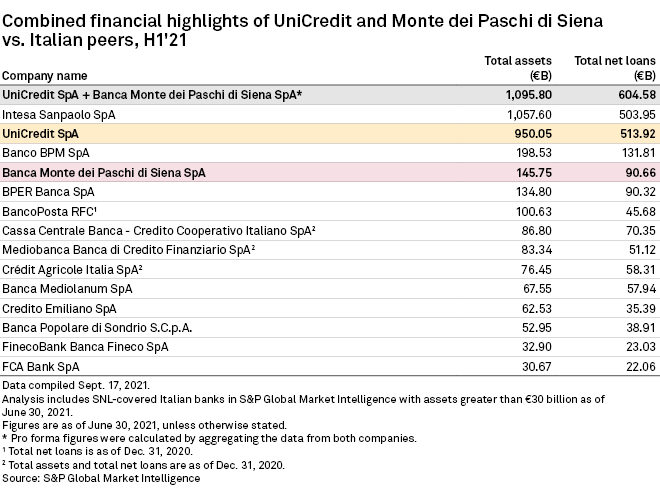

While uncertainty remains as to whether UniCredit SpA will finally agree to a much-speculated takeover of state-owned Banca Monte dei Paschi di Siena SpA, the tie-up would create Italy's biggest bank by assets, S&P Global Market Intelligence data shows.

In July, the Italian government began exclusive talks with UniCredit to dispose of its 64% stake in Monte dei Paschi, which it acquired as part of a 2017 bailout. The discussions were scheduled to end Sept. 8, but negotiations are still ongoing, Reuters reported Sept. 20.

Should a deal be struck, the combined entity's pro forma assets as of June 30 would be €1.096 trillion, surpassing that of the current largest bank in Italy, Intesa Sanpaolo SpA. The pro forma net loans of the combined entity would also be the largest among Italian lenders at more than €600 billion.

The talks included a feasibility study, whereby bad loan manager AMCO - Asset Management Co. SpA was granted access to Monte dei Paschi's data room of nonperforming and stage 2 loans. Data from Market Intelligence shows that UniCredit has managed to reduce its book of NPLs from €75.2 billion in the second quarter of 2016 to €21.5 billion in the second quarter of 2021.

Over the same period, Monte dei Paschi has cut NPLs from €45.3 billion to about €4 billion, aided most recently by the Project Hydra securitization deal that was completed in February.

At current levels, the combined entity would have in excess of 100,000 full-time employees and more than 5,000 branches, the vast majority of which are in Italy. UniCredit's branch network is more than double that of Monte dei Paschi, and it employs more than 80,000 full-time staff, while Monte dei Paschi has over 20,000 full-time staff.

The state has a deadline of 2021-end for disposing of its stake in Monte dei Paschi, but sources told Reuters that both parties remain far apart in the negotiations and that the Treasury may have trouble meeting UniCredit's conditions for a deal.