Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Dec, 2021

Source: Ford Motor Co. |

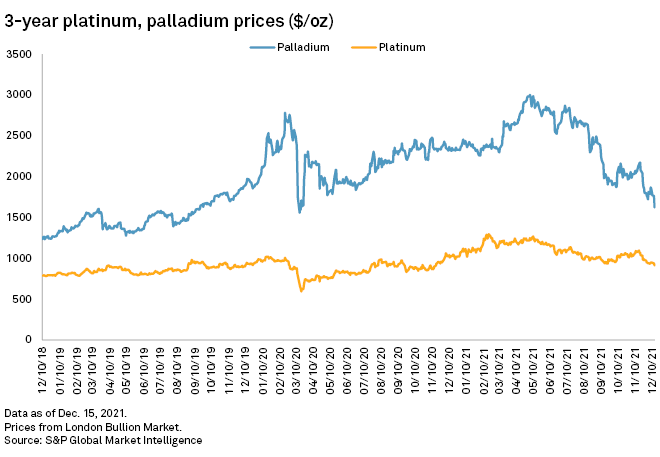

Platinum and palladium prices are set to recover next year on the back of climbing demand, as vehicle production rebounds through 2022.

The prices of both metals, key materials in exhaust-cleaning catalytic converters, plummeted in 2021 as global car and truck output slowed amid global supply chain bottlenecks, particularly for computer chips. Late in the year, supply chains started to clear, and auto production began to climb again, bringing with it an increase in demand for platinum group metals, or PGM.

Platinum, in particular, may see a big boost as a cheaper substitute for palladium. Increasing electric vehicle sales may also spell trouble for both metals in the long run.

"We do expect PGM demand to rise as the chip shortages sort themselves out," Jeffrey Christian, managing partner of precious metals consultancy CPM Group, said in an email. "We see platinum having a tighter supply and demand balance, still a surplus I believe, but much smaller. Palladium may see a larger surplus in 2022 as auto-catalysts shift to using more platinum and less palladium."

2021 was a harsh year for PGM as shortages in computer chips held back car production, even as customers clamored for new vehicles. The price of palladium collapsed from about $3,000 per ounce in early April to $1,622/oz on Dec. 14. Likewise, in mid-February platinum traded just shy of $1,300/oz, but in recent sessions it has sunk to near $900/oz. Those prices are still well above the values typical for most of the decade before a rapid run up that began in summer 2018.

"This chip shortage is prolonged, it's lasting longer and it's much deeper than we had originally anticipated," said Wilma Swarts, director of platinum group metals at research consultancy Metals Focus.

Vehicle output may end 2021 on a high note, after bottoming in the third quarter, Swarts said. In the third quarter, global vehicle production was about 17 million units, Swarts said, but it is on track to hit close to 20 million units in the fourth quarter.

Car production is set to grow 10.6% year over year to 82.7 million units, according to an Oct. 18 forecast by IHS Markit.

Platinum's advantage

In 2022, platinum may also benefit from growing vehicle output as thrifty automakers increasingly push to substitute it for pricier palladium, analysts said. Platinum is favored in diesel catalytic converters, while palladium dominates in gas-powered vehicles; but both metals can be swapped, one for the other, in diesel- and gas-powered vehicles, and this tends to happen when the price for one of the metals is relatively high.

"We now see platinum for palladium substitution in light duty auto-catalysts amounting to around 170Koz this year (on a 1:1 basis), growing to more than 330Koz over the course of 2022, with further substantial gains expected through the middle of the decade," J.P. Morgan analysts Gregory Shearer and Natasha Kaneva said in a Nov. 29 research note.

In recent years, palladium prices have soared relative to platinum, so automakers have increasingly started to put more budget-friendly platinum back into palladium-dominant catalytic converters.

"There was very little platinum, in fact none in many instances, that remained in gasoline catalysis if we think back four or five years," Swarts said. "Right now that trend has shifted."

As for palladium, the J.P. Morgan analysts said they see its price recovery as "relatively short-lived" in contrast to platinum, which will "build on gains throughout next year as medium-term fundamentals for each metal look starkly different."

The EV challenge

Rising electric vehicle sales pose a challenge for both metals. Full battery electric vehicles do not require catalytic converters, and while the metals get used in electronics, neither is used on the same scale as they are in converters. Platinum producers will be cushioned by the metals' application in jewelry, but palladium producers could get squeezed.

"The market share of ... battery electric vehicles, with no [catalytic converters], is also increasing," Swarts said. "That's particularly weighing quite heavily on palladium."

Still, Metals Focus has noted that hybrid vehicles, those combining internal combustion and battery technology, may help extend the usefulness of PGM in the automotive sector as they can use heavier loads of the pollution-scrubbing metals, especially as emission regulations tighten.

Swarts also pointed to the potential for surprises on both the demand side and the supply side next year. Demand for platinum and palladium could get a boost if vehicle production exceeds current expectations — for example, if rental companies restock more than anticipated — or new COVID-19 variants could interfere with mining.

"In 2022, you have normalization of demand and you have complete normalization of supply, with a very narrow surplus," Swarts said, referring to platinum and palladium output. "But any big events on the supply side could actually swing that to a deficit again."

IHS Markit is subject to a merger with S&P Global pending regulatory and other customary approvals.