Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Apr, 2023

By Dylan Thomas and Muhammad Hammad Asif

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

There are few data points that capture private equity's current challenges as succinctly as this one: In the first three months of 2023, there was not a single private equity-backed initial public offering.

IPOs backed by private equity first slowed to a trickle early in 2022, when a sharp decline in public markets essentially closed off that exit route. There were just 52 private equity-backed IPOs in all of 2022, down from 196 the year before.

That decline is just one symptom of a broader slowdown gripping private equity investment cycles. The lack of exits is eroding distributions to investors, which is one factor in slower fundraising across the asset class.

Exits have not disappeared, although the narrowing exit window means investments are likely to remain in private equity portfolios longer. The test for private equity is to use that extra time to create as much value as possible.

Read more about the ongoing slowdown in private equity exit activity.

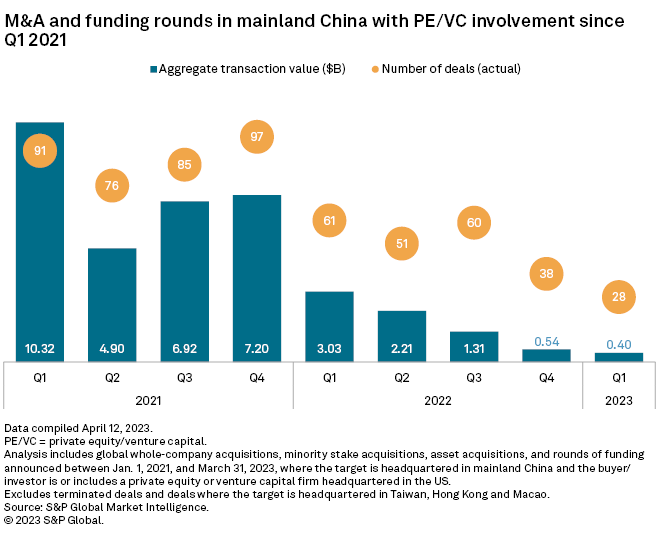

CHART OF THE WEEK: Mainland China investments by US PE firms on track for 5-year low

⮞ Investments in mainland China by US private equity and venture capital firms totaled just $400 million in the first quarter, down 87% year over year, according to S&P Global Market Intelligence data.

⮞ The slow first quarter puts US private equity investment in mainland China on track for its lowest annual total in at least five years.

⮞ Likely factors behind the declining deal activity include increased scrutiny of deals by regulators in both governments, geopolitical tensions and a lack of clarity around the impact China's strict zero-COVID strategy had on domestic manufacturing and consumption patterns.

TOP DEALS AND FUNDRAISING

– BPEA EQT, Nord Anglia Education Inc. and BPEA Private Equity Fund VIII agreed to acquire sports education institution IMG Academy Parent LLC from Endeavor Group Holdings Inc. in an all-cash deal representing an enterprise value of $1.25 billion.

– A group of investors, including KKR & Co. Inc. and AXA Venture Partners SAS, agreed to sell a majority stake in Policygenius Inc., which operates an online insurance marketplace, to Zinnia LLC. KKR will continue as an investor in the combined company after the transaction closes.

– TPG Capital LP closed fundraising for TPG Tech Adjacencies II LP and related vehicles with $3.4 billion of equity commitments.

– Ares Management Corp. launched Ares Strategic Income Fund with about $1.5 billion in initial investible capital. The fund's capital includes equity commitments of over $847 million and credit facility commitments of about $625 million.

MIDDLE-MARKET HIGHLIGHTS

– A&M Capital Europe bought a majority stake in World of Sweets and Bobby's, a UK-based supplier of confectionery, baked goods and savory snacks. Sculptor Capital Management Inc. was the seller.

– New Mountain Capital LLC will make a new majority investment in ALKU LLC, a specialty staffing firm. FFL Partners LLC, WestView Capital Partners and other shareholders are reinvesting in the business.

– Existing backer Azimuth Capital Management, through its Azimuth V Energy Evolution fund, led a series A round for H Cycle LLC, which uses organic waste to produce hydrogen. Eneos Innovation Partners LLC jointly led the round.

– Fusion Risk Management Inc., a cloud-based business continuity software solutions provider, received majority investment from Great Hill Partners LP.

FOCUS ON: APPLICATION SOFTWARE

– Elastic Path Software Inc. acquired Unstack Inc., a web development platform for e-commerce brands. The seller was El Cap Holdings Capital Partners, according to Market Intelligence data.

– TVC Capital LLC divested financial planning and analysis software developer Centage Corp. to Scaleworks Inc.

– Mainframe cloud data management software company Model9 Software will be sold to BMC Software Inc. in a transaction expected to close during the first half of 2023. Intel Capital Corp., StageOne Ventures, GlenRock Israel Ltd. and North First Ventures are the sellers, Market Intelligence data shows.

For further private equity deals, read our latest In Play report, which looks at potential private equity-backed M&A, including rumored transactions, each week.