Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Jun, 2021

|

A truck drives out of the New Cobar gold and copper mine in Australia. Metals and mining companies are increasingly pledging to reduce greenhouse gas emissions as investor pressure mounts. |

The roster of metals and mining companies targeting net-zero emissions by 2050 is growing as the sector positions itself for a prime role in the clean energy transition.

.

|

Seven of the 10 largest metals and mining companies by market capitalization committed to reaching net-zero emissions or carbon neutrality by 2050 or earlier, a new S&P Global Market Intelligence analysis found. Many of the largest mining companies divested coal assets if they still have them. At the same time, they are highlighting the role mined materials will play in industries crucial to reducing greenhouse gas emissions, including the renewable energy, battery storage and automotive sectors.

Market Intelligence researched 30 of the world's largest metals and mining companies by market capitalization and identified 19 with an intention to reach net-zero emissions by 2050 or earlier or that already claim carbon neutrality. While the rank and makeup have shifted somewhat, a greater share of the industry's largest companies has now laid out emissions goals since S&P last assessed net-zero emissions goals in December 2020.

The four largest global mining companies by market capitalization — BHP Group, Rio Tinto Group, Vale SA and Anglo American PLC — all committed to eliminating or offsetting greenhouse gas emissions by 2050 or sooner.

Ambitious targets becoming 'new normal'

Verónica Martinez, leader of the International Council on Mining and Metals' Innovation for Cleaner Safer Vehicles program's work on climate change, said miners are under more pressure to scrutinize their emissions sources and are now rolling out climate pledges with more clarity on what is achievable.

"[W]ith building investor pressure, the COVID-19 'build back better and greener' agenda, and ever more frequent climate-related events, there is no doubt that it will become the 'new normal' for the mining sector to set ambitious targets, both in terms of mitigation and adaptation," Martinez said in an interview. "Also, as a sector that produces critical minerals for the energy transition, there are rising expectations from downstream consumers, and society at large, that these minerals will be responsibly mined."

Earlier this year, multinational consulting firm Deloitte said that "getting serious about decarbonization" was a top 2021 trend among mining and metals companies due to external pressure to reduce emissions and a stronger business case for replacing diesel engines and electrifying mine operations. Companies are not only making net-zero commitments but also moving forward with plans to meet those goals, the firm wrote.

Andrew Swart, the global mining and metals leader at Deloitte, said investors are ramping up the pressure on mining companies to take strong actions on climate, pushing them to set aggressive targets. Swart also said consumers are demanding to know if the products were produced in a sustainable and humane way, noting the increasing distinction between "a brown versus a green mineral."

New pledges to net-zero

Toronto-based miner Barrick Gold Corp. was the largest company to join the list of miners with a net-zero target since the previous analysis. The company announced at the beginning of 2020 that it aimed for emissions reductions of 10% by 2030 against a 2018 baseline. However, in April, the company set an updated target of 30% over the same period while shooting for a longer-term goal of net-zero emissions by 2050.

British multinational miner Antofagasta PLC, which has a significant presence in Chile, was another major miner to introduce a 2050 net-zero emissions goal in recent months. The company noted that its target was in line with the Chilean government's planned date for hitting net-zero emissions.

"If technologies are developed over the coming years that allow us to achieve this goal sooner, we will quickly adopt them," said Antofagasta Chairman Jean-Paul Luksic during a May 12 annual meeting.

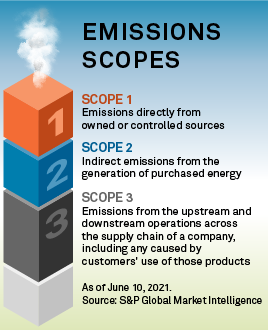

Sibanye Stillwater Ltd. publicly committed to achieving net-zero emissions by 2040 at its recent annual results presentation in February. A representative for South Africa-based Impala Platinum Holdings Ltd. said the company is committed to achieving carbon neutrality by 2050 and is studying interim targets for Scope 1 and Scope 2 emissions based on a 2019 base year for 2030. India-based Hindustan Zinc Ltd. said it aligns with its parent company, Vedanta Resources Ltd., in aiding the country to reach its climate commitments and to substantially decarbonize by 2050.

Newcrest Mining Ltd. announced in May that it would target net-zero Scope 1 and Scope 2 carbon emissions by 2050 while working across its value chain to reduce Scope 3 emissions. Newcrest Managing Director and CEO Sandeep Biswas said in a statement announcing the target that the company is seeing a "rapid evolution of a range of new technologies that will help reduce emissions going forward."

|

The International Energy Agency recently called on countries to end investments in fossil fuels while also pointing to a growing need for critical minerals such as copper, cobalt, manganese and some rare earth metals as the world transitions to a lower-emissions future. The IEA expects revenues from such minerals to outpace coal "well before 2030," the agency said, noting substantial opportunities for mining companies.

Miners who understand those climate-related opportunities and make quicker progress on implementing mitigation and adaptation measures could be seen more favorably by investors and customers, Martinez said.

Many companies that have not set 2050 targets are still aiming to reduce emissions.

Russian gold producer PJSC Polyus set a previous target of reducing carbon intensity by 15% in 2020 versus 2015 but hit that goal in 2018. However, Alex Čaičics, head of environmental, social and governance communications at Polyus, noted that the company picked the low-hanging fruit and future goals will be more challenging.

"In principle, we would be able to declare a 2050 net-zero goal like everyone does, but we feel that such practice is not quite helpful if not supported by shorter-term [greenhouse gas] reduction targets," Čaičics said in an interview, noting the life-of-mine of the company's existing production assets will end before 2050. "In 2050, most likely nobody [within] the current top management will be responsible for actually delivering on promises set now."