Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Dec, 2024

By Rica Dela Cruz and Xylex Mangulabnan

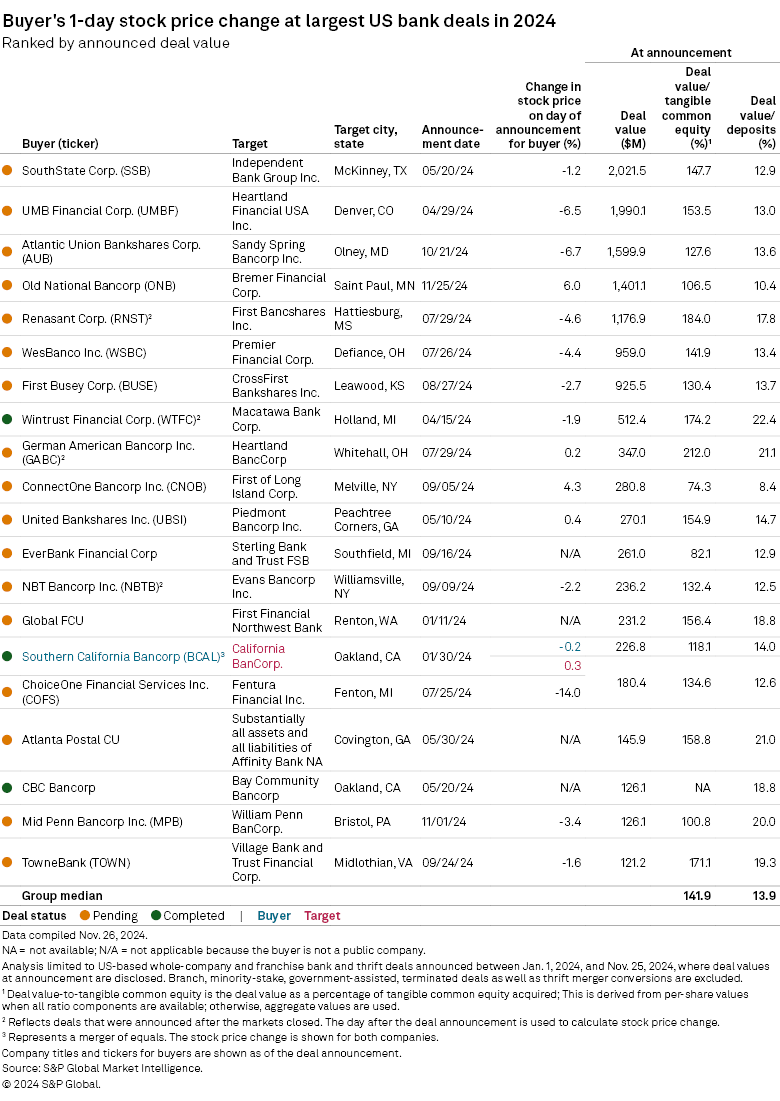

Old National Bancorp enjoyed the biggest one-day share price gain among the buyers involved in the 20 largest US bank deals so far in 2024.

Among those deals, the stock prices of the buyers and the two banks involved in a merger of equals closed down a median of 1.0% on the day of or after deal announcement, according to S&P Global Market Intelligence data. Old National Bancorp was one of the five banks that posted share price gains, with its stock closing up 6.0% on the day it announced its $1.40 billion deal to acquire Bremer Financial Corp.

The Street's reaction to the Old National-Bremer deal was due to the transaction's attractive financial metrics and strategic rationale, industry observers said. The deal's attributes include expected 2026 earnings per share accretion of approximately 22%; an internal rate of return of about 20%; and a tangible book value (TBV) dilution per share of about 10% at close, with an earnback period of two years.

"We had been talking to the market about [how] anything that we were going to do was going to require a very high hurdle rate. I think this one clears those hurdles," Old National Chief Strategy Officer and CFO John Moran IV said in an interview. "I think the financial aspects of the proposed transaction here are really, really attractive."

$1B-plus deals

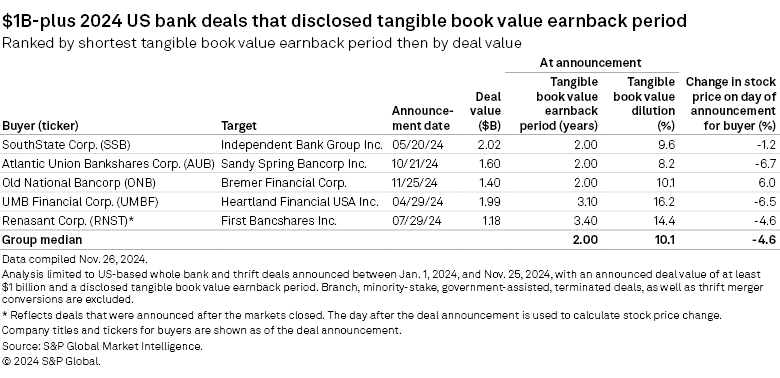

The reception that any bank buyer would get after announcing a deal depends partly on general pricing terms, which include the total purchase price and multiples to earnings and to book value. The book value earnback period holds great importance, according to James Stevens, a partner at Troutman Pepper Hamilton Sanders LLP.

"The shorter that period of time is, the more handsomely the buyer is going to get rewarded from the stock market," Stevens said in an interview.

The Old National-Bremer deal's expected TBV dilution is 10.1%, the third-highest among the five 2024 bank deals valued at more than $1 billion that disclosed that metric. However, the earnback period is the shortest — along with those of the SouthState Corp.-Independent Bank Group Inc. transaction and the Atlantic Union Bankshares Corp.-Sandy Spring Bancorp Inc. deal — at two years, according to Market Intelligence data.

While investors generally look at strategic factors and pricing terms, "it's really hard to say, with respect to specific transactions, what's causing one transaction to have a pop in the buyer stock versus another one," Stevens said.

On the days their deals were announced, SouthState's stock closed down 1.2% and Atlantic Union's stock ended the day with a 6.7% decline. UMB Financial Corp. and Renasant Corp. also faced stock price pressure after announcing deals worth more than $1 billion.

Old National's deal with Bremer was the first $1 billion-plus bank M&A transaction announced after the result of the US presidential election fueled a pop in bank stocks. The deal seems to have a positive impact on the pro forma bank's risk-reward profile in many ways, with the relatively low purchase valuation and ability to eliminate costs driving top-tier profitability in the baseline scenario, said Daryle DiLascia, a managing director at Performance Trust Capital Partners.

But in general, a one-day stock price reaction may or may not align with value creation over time, according to DiLascia.

"We've seen during the past several years how interest rates can meaningfully impact earnings and capital for banks, which can also significantly alter the M&A math for better or worse," DiLascia wrote in an email. "Looking at multiple future scenarios is required to better assess any transaction."

Robust M&A in 2025

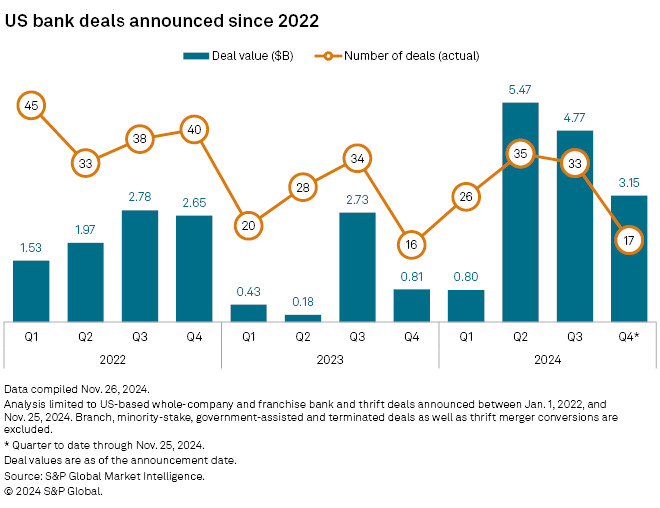

So far in 2024, the US banking industry has recorded more deals than in the prior year but fewer deals than in 2022. However, the value of the 2024 deals is higher than that of the 2022 deals. Relative to the other quarters of 2024, the fourth quarter has seen the lowest number of bank deals as of Nov. 25, at 17.

Consolidation in the banking industry has been somewhat slow as of late due to "a murky outlook in terms of interest rates and liquidity and the potential recession," Stevens said. However, with the uncertainties that affect dealmaking easing, bank M&A in 2025 will be robust, he added.