Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Apr, 2021

Oil and gas M&A deal-making in the first quarter of 2021 rebounded from year-ago levels as supermajors like Exxon Mobil Corp., Royal Dutch Shell PLC and Equinor ASA divested assets and corporate consolidation continued, according to S&P Global Market Intelligence data.

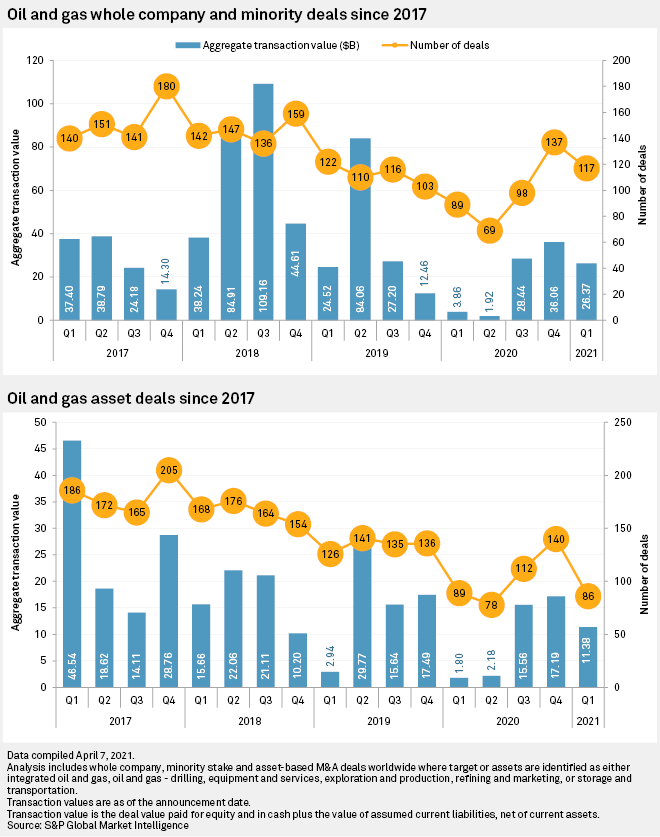

The industry announced 28 more whole-company and minority-stake deals in first-quarter 2021 than in the first quarter of 2020: 117 deals compared to 89. In the same period, the combined value of deals soared from $3.86 billion to $26.37 billion. The number of announced asset transactions fell slightly from 89 to 86, but their aggregate value climbed nearly $10 billion to $11.38 billion.

The quarter held 10 transactions valued at over a billion dollars. In March, those included an agreement by Leif Höegh & Co. AS and funds managed by Morgan Stanley Infrastructure Inc. to buy the remaining interest in Höegh LNG Holdings Ltd. for just over $2 billion and International Seaways Inc.'s $1.06 billion acquisition of fellow crude oil tanker company Diamond S Shipping Inc.

Oilfield services provider Noble Corp., which emerged from Chapter 11 bankruptcy in February, also agreed to a combination with Pacific Drilling SA for $913.8 million during the quarter.

The biggest North American asset-level transaction announced during March was shale driller Ovintiv Inc.'s $880.0 million sale of its Eagle Ford assets in Texas to Validus Energy Services LLC, which is backed by investors including private equity firm Pontem Energy Capital Management.

"After most of 2020's activity was dominated by mergers between public companies, we are seeing private equity play a more prominent role in M&A markets in 2021," Andrew Dittmar, an analyst at oil and gas market data firm Enverus, told clients April 8. "Following years of heavy investment in unconventional resources, private [exploration and production companies] were having a challenging time finding exits either through sales or IPOs and had consequently tamped back spending on new deals. Now, in December 2020 and continuing into 2021, we have seen several prominent exits plus new investments from the private side of the industry."