Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Nov, 2022

By Joyce Guevarra and Annie Sabater

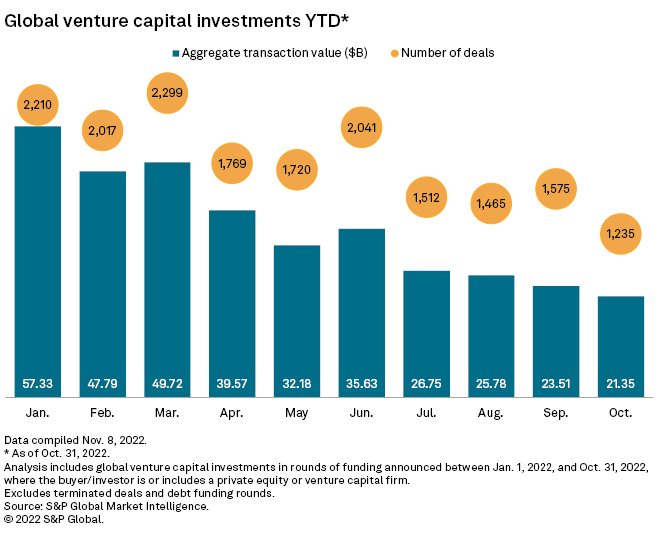

Global venture capital-backed funding rounds in total were $21.35 billion in October, the lowest monthly tally year-to-date, according to S&P Global Market Intelligence data.

A global total of 17,843 venture funding rounds representing roughly $359.60 billion have been announced from Jan. 1 to Oct. 31. Transaction value has dropped month over month since January, except from February to March, and from May to June, Market Intelligence data shows.

October comparisons

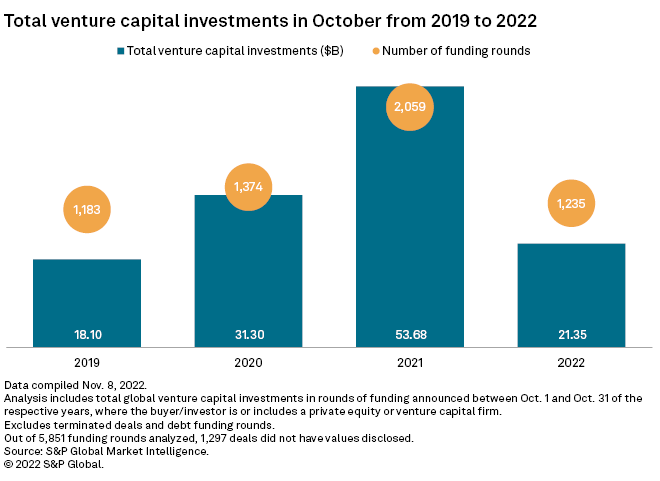

In a year-on-year comparison, deal value was down 60% from October 2021 and deal volume declined 40% to 1,235 deals, which was the lowest number of monthly transactions since January 2022.

Largest raises

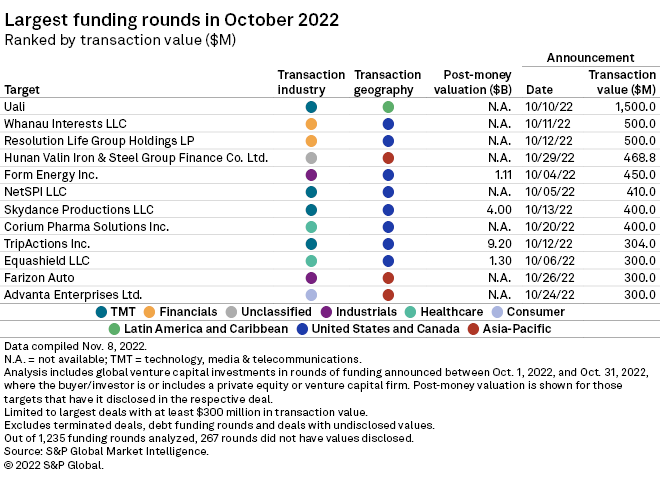

The pre-series A round of funding by Argentina-based Uali topped the global venture capital transactions list in October with $1.5 billion of secured funds. Cornwall & Isles of Scilly Investment Fund and Sistemas Globales SA participated. Uali provides IT consulting and other services.

* Download a spreadsheet of data from this story.

* Click here to set email alerts for future Data Dispatch articles.

* Click here for more private equity exclusives.

Whanau Interests LLC and Resolution Life Group Services Ltd. each received $500 million in their respective funding rounds during the month. Asset manager Whanau secured investment from funds managed by or affiliated with new investor Apollo Global Management Inc. Resolution Life Group obtained funding from The Blackstone Group Inc.

By region, the U.S. dominated the funding rounds in October, with eight American companies placing in the top 12, led by Texas-based Whanau.

Tech remains top

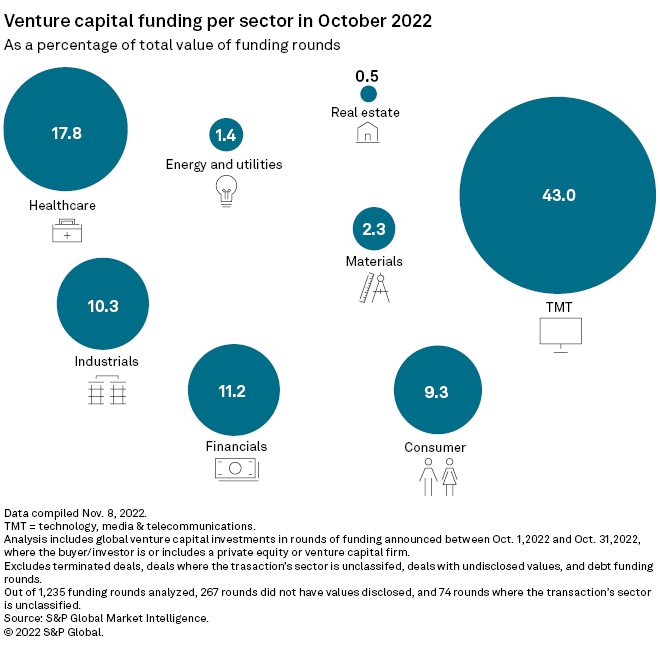

Falling valuations of technology companies and rising interest rates did not stop the technology, media and telecommunications sector from remaining the most attractive target of venture capital investors globally. The sector pulled in 43% of the total capital raised in October.