Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 Apr, 2022

By Husain Rupawala and Hassan Javed

Nationwide Mutual Group subsidiaries received approval for 15 homeowners insurance rate increases across five states in February, which stand to boost the group's aggregate premiums by $45.7 million, according to an S&P Global Market Intelligence analysis.

Nearly half of that increase, about $21.9 million, is expected to come from a single 6.98% rate hike disposed for Nationwide Mutual Insurance Co. in California. The new rates look to affect roughly 261,550 policyholders in the Golden State.

Allied Trust's Texas hike

Regulators in Texas disposed a rate increase for Allied Trust Insurance Co. that could increase its calculated written premiums by $27.4 million. That stands to be the largest premium increase from any single homeowners rate hike in February. Allied Trust wrote $104.0 million in homeowners insurance in Texas over the course of 2021, according to the latest annual statements.

Rate cuts for USAA

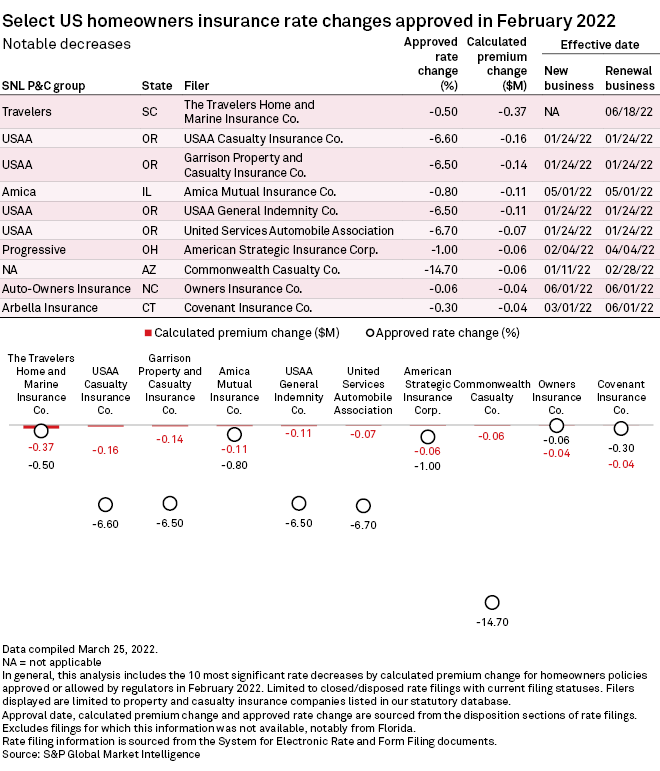

At the other end of the spectrum, rate reduction requests approved for United Services Automobile Association subsidiaries could lead to the largest cumulative premium decrease for the month of February. USAA units made eight total rate reductions in Oregon and New Mexico that, when combined, stand to reduce the group's calculated premiums by about $480,000 and $106,000 in those respective states.