Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Oct, 2021

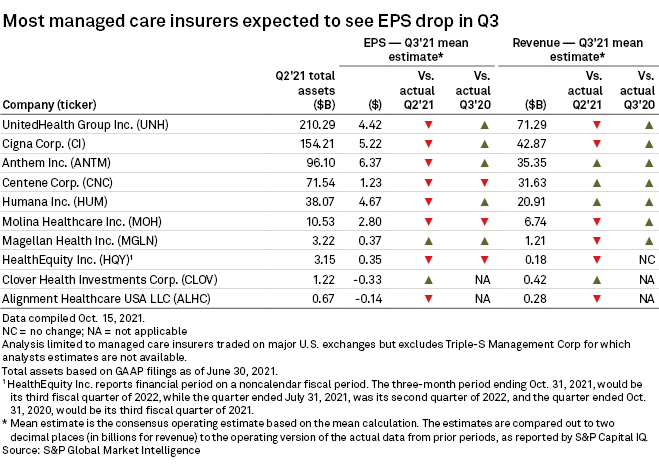

Sell-side industry analysts forecast a mixed earnings picture for the largest publicly traded managed care insurers in the U.S. amid lingering economic and pandemic-related uncertainty.

Of the 10 largest managed care insurers in the U.S., only Magellan Health Inc. and Clover Health Investments Corp. were expected to see EPS improve sequentially during the period, though half of them are seen as recording year-over-year increases, according to an S&P Global Market Intelligence analysis of sell-side analyst projections. Revenues are generally expected to improve across the board year over year; the comparison to the second quarter is less favorable.

Medical utilizations are expected to further normalize throughout the second half, with medical loss ratios trending higher, according to CFRA equity analyst Sel Hardy. Utilizations may spike further due to prior care deferrals, he added, which could result in higher acuity and higher medical costs.

Millions of Americans lost their employer-sponsored health insurance coverage in 2020 as a result of the COVID-19 pandemic and related business closures. Despite that, data from the Centers for Disease Control and Prevention showed that the number of uninsured Americans did not increase as individuals shifted to public insurance coverage through Medicaid or bought plans on the Affordable Care Act marketplace.

Labor conditions will continue to dictate the evolution of employer-sponsored health insurance and Medicaid coverage, Hardy added. The nationwide unemployment rate has fallen significantly since hitting double-digit peaks during the worst of the pandemic-related shutdowns. But the labor participation rate has not risen commensurately, and high quit rates demonstrate that there is significant churn and tightness in the labor market.

UnitedHealth Group Inc., the largest managed care insurer in the U.S. based on total assets, reported results ahead of the rest of the industry. The company logged adjusted net EPS of $4.52 in the period and saw revenues increase 11% year over year. UnitedHealth's medical care ratio for the third quarter came in at 83.0%, up from 81.9% a year earlier, mostly due to the health insurance tax being repealed.

Cigna Corp. and Anthem Inc., which round out the top three, are expected to see EPS decline sequentially to $5.22 and $6.37, respectively.