Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Nov, 2022

By Vaibhav Chakraborty and Umer Khan

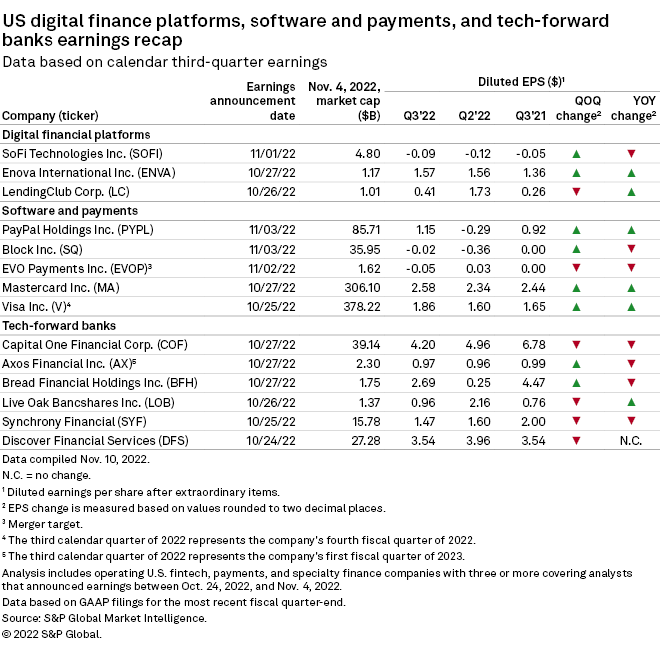

Third-quarter earnings at most of the select group of financial technology, payment processors and tech-forward banks showed mixed results in quarterly and yearly comparisons.

Most of the 14 companies posted a sequential increase in their EPS, while the rest recorded a quarter-over-quarter decline, according to S&P Global Market Intelligence data.

In terms of year-over-year change in EPS, seven companies posted a decline, six companies reported an increase, while Discover Financial Services' EPS was unchanged at $3.54 compared to the corresponding quarter of 2021.

Interest rate headwinds

Industry executives believe that the headwinds from higher interest rates, foreign exchange rate volatility and the likelihood of a recession posed risks to companies' revenues and are likely to continue in the near term.

Among digital finance platforms, San Francisco-based LendingClub Corp. posted the highest quarter-over-quarter decline with an EPS of 41 cents, down $1.32 from the second quarter. However, the digital lender's EPS was up 15 cents year over year.

"With the pace and scale of rate changes now more significant than prior expectations, the anticipated dynamic is more material," LendingClub CEO Scott Sanborn said during the latest earnings call.

* Download a template to compare a bank's financials to industry aggregate totals.

* Download a template for a comprehensive profile on a selected bank or thrift.

* View U.S. industry data for commercial banks, savings banks and savings and loan associations.

Enova International Inc. was one of the four companies to post a sequential and year-over-year increase in earnings during the third quarter. The Chicago-based company posted an EPS of $1.57, up 1 cent from the previous quarter and 21 cents from the corresponding quarter of 2021.

Although SoFi Technologies Inc. reported a loss per share in the third quarter, it improved quarter over quarter. The San Francisco-based company posted a loss of 9 cents per share, an improvement of 3 cents per share from the previous quarter. The loss slid 4 cents per share from a year ago.

Software and payment processors

Mastercard Inc., Visa Inc. and PayPal Holdings Inc. posted sequential and year-over-year increases in EPS during the quarter.

Mastercard posted an EPS of $2.58 during the quarter, up 24 cents from the linked quarter and 14 cents from a year ago. Visa reported an EPS of $1.86 in the third quarter, up 26 cents from the previous quarter and 21 cents from the corresponding quarter of 2021.

Paypal's EPS rose significantly during the quarter. The company posted third-quarter EPS of $1.15, up $1.44 from the second quarter and 23 cents year over year.

Block Inc. and EVO Payments Inc. were the two companies in the software and payment processor segment to record losses per share during the quarter. Block's loss improved sequentially, while EVO Payments' slid further into the negative territory.

Tech-forward banks

Among tech-forward banks, four companies posted a decline in their EPS sequentially during the third quarter, while two reported a quarter-over-quarter increase.

Columbus, Ohio-based Bread Financial Holdings Inc. reported the highest sequential increase in EPS. The company posted an EPS of $2.69 in the third quarter compared to 25 cents reported during the previous quarter.

Axos Financial Inc. also posted an increase in EPS during the third quarter and was at 97 cents, up one cent from the previous quarter but down 2 cents from the corresponding quarter of 2021.

Live Oak Bancshares Inc. had the highest quarter-over-quarter decline in EPS among the tech-forward banks. The Wilmington, N.C.-based company's EPS was at 96 cents during the quarter, down $1.20 from the previous quarter but up 20 cents from the corresponding quarter of 2021.