Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Dec, 2023

Investors will get their first real indication this week of just how much the Federal Reserve expects to cut interest rates in 2024.

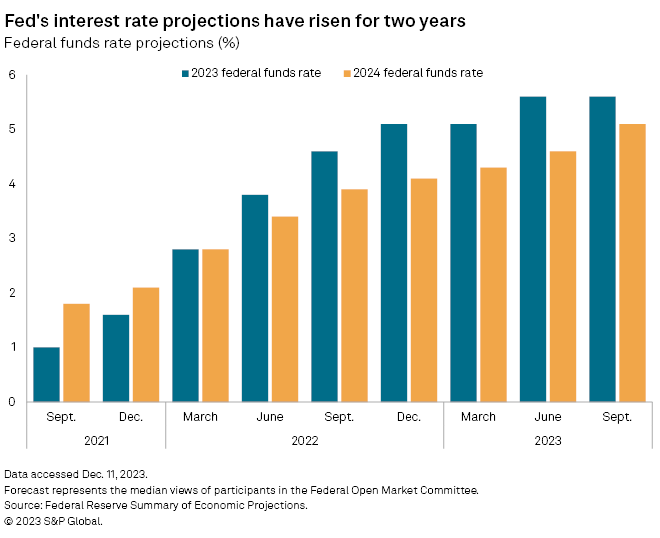

Following the close of its two-day meeting on Dec. 13, Fed officials will release their quarterly economic projections, offering their latest expectations on inflation, unemployment, GDP and rates in coming years. Projections released in September showed median expectations of one more 25-basis-point rate hike by the end of 2023, on top of the 525 basis points' worth of increases since March 2022, with cuts of about 50 basis points throughout 2024.

However, traders are betting the Fed will lower rates more and faster than that. Stocks and bonds have rallied on expectations that the central bank's efforts to combat inflation through higher rates have peaked and that meaningful cuts are coming next year. While the timing and scope of the reductions remain heavily debated, central bankers may look to tamp down rate-cut outlooks.

"The Fed will be keen to stem the pricing on rate cuts from what the market is currently pricing and look to avoid loosening financial conditions further," said Michael Hewson, chief market analyst at CMC Markets.

Expecting cuts

Nearly 75% of the futures market as of Dec. 11 was betting that the Fed would reduce the target for its benchmark federal funds rate by at least 100 basis points during 2024, according to the CME FedWatch Tool, which measures investor sentiment in the Fed funds futures market.

Nearly all of the futures market expects the Fed will keep rates steady at the December meeting; odds of a final hike this year have evaporated as data has shown inflation to be falling, according to the CME tool.

In September, projections showed that the majority of Fed voters expected the federal funds rate to end 2023 at 5.6%. A majority of those Fed officials also expected the benchmark rate to be 5.1% at the end of 2024.

Fed officials will likely keep a "relatively upbeat economic assessment" in their projections this week and could again signal the same 50 basis points' worth of cuts in 2024 to lessen speculation that significant monetary policy easing is in the near future, said James Knightley, chief international economist with ING.

"The Fed will not want to endorse the market pricing of significant rate cuts until they are confident price pressures are quashed," he said.

Holding back

Economists with Goldman Sachs this week pulled forward their forecast for the Fed's first rate cut from the fourth quarter of 2024 to the third quarter. Fed officials will again project lower ratings by 50 basis points in 2024, 125 basis points in 2025 and an additional 100 basis points in 2026, Goldman economists David Mericle and Manuel Abecasis wrote in a Dec. 10 note.

"Some [Fed officials] might pencil in more cuts than before in response to the inflation news, but others might hold back to avoid encouraging the market to price too many cuts too soon," they said.

If inflation continues to move toward the central bank's 2% target and the odds of a recession increase, the Fed could approve a rate reduction as soon as January, according to Patrick Reily, an economist and co-founder of Uplinq.

"The drive to keep the economy out of recession will likely dominate Fed actions over the next 10 months," Reily said. "Americans are sick of inflation, but if that combines with economic contraction, frustrations will certainly multiply."